Expectations for U.S. interest rate cuts, record-breaking gold prices approaching almost $3,790 per ounce, and a weakening dollar are fueling euphoric gains in the platinum market, which is up 4.3% today. During the recent days, gold ETF net inflows reached the highest level since 2021.

- The prospect of lower interest rates in the U.S. (as well as rate cuts in other central banks) supports global liquidity and credit impulse, which naturally translates into higher demand for spot platinum – not only for investment purposes but also for industrial and automotive applications.

- Today’s U.S. data came in weaker than expected (September PMI, Richmond Fed regional index), while Federal Reserve officials (including Michelle Bowman) pointed to rising risks of significant labor market deterioration, which could force the Fed into even more aggressive moves. Investors are now pricing in at least two more rate cuts in the U.S. this year.

- Soaring gold prices are not only boosting interest in precious metals in general but are also bringing platinum “back into favor” in the jewelry sector. Interest in platinum as a “luxury,” cheaper, and rarer alternative to gold has risen after years of dormant demand for white-gold jewelry.

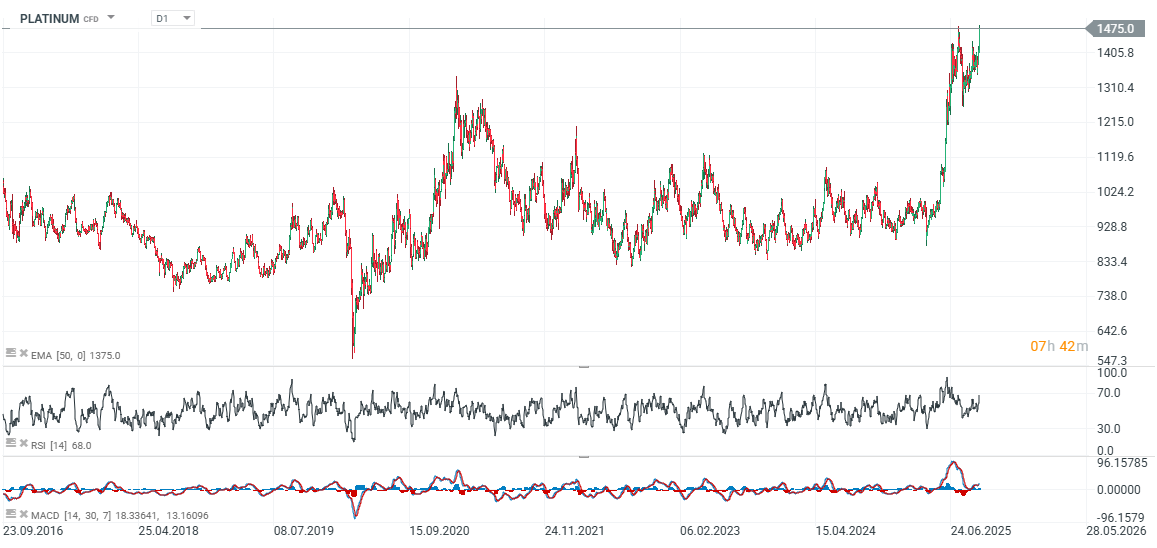

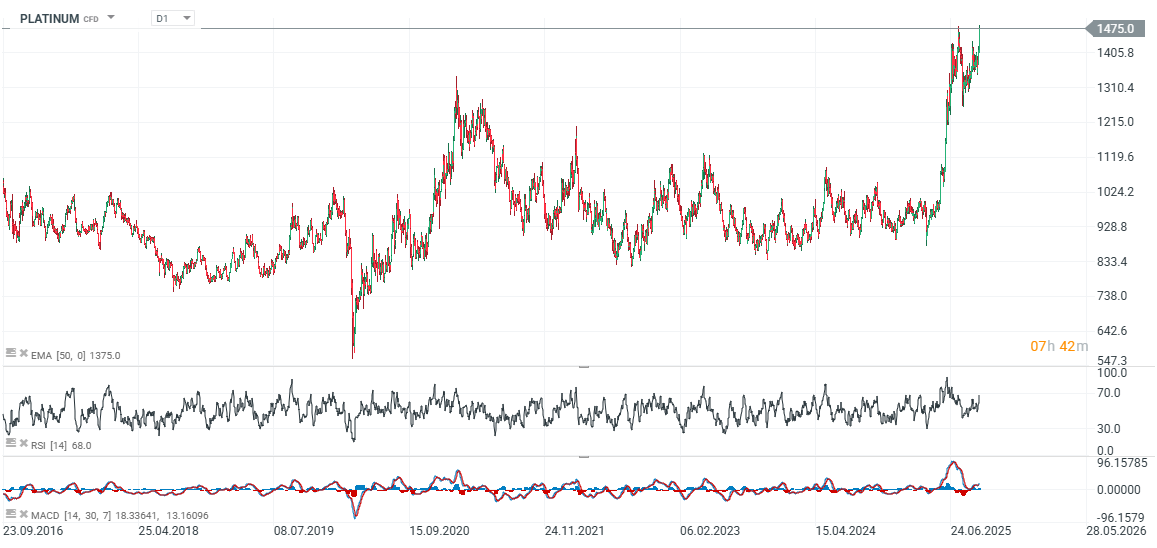

Platinum (charts)

Platinum prices are up nearly 5% today, surging to previous record highs around $1,480 per ounce, where the first strong wave of selling pressure has emerged.

Source: xStation5

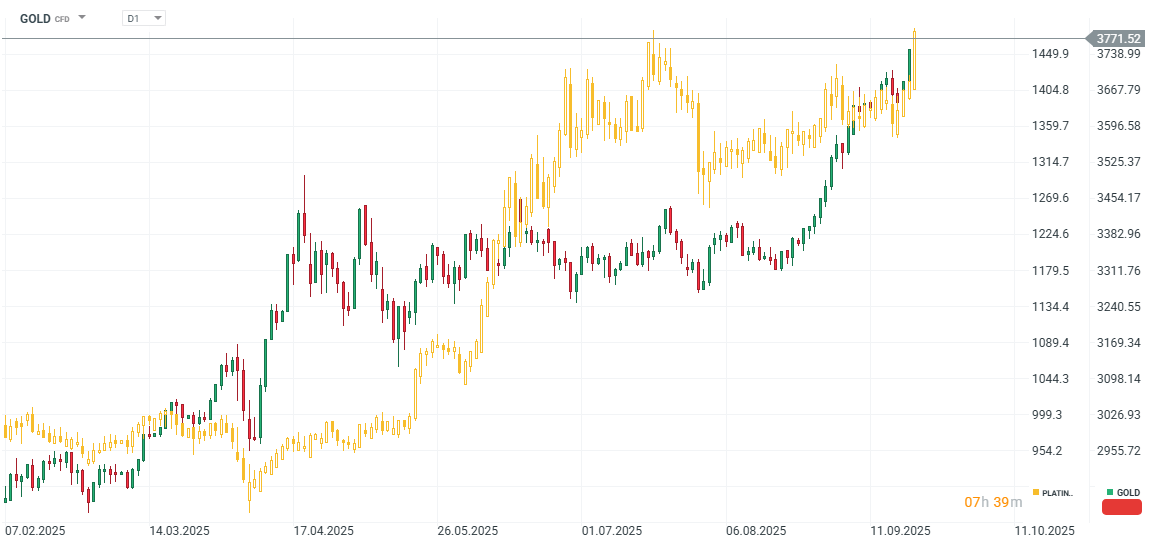

Platinum prices (gold-colored chart) are moving broadly in line with gold’s dynamics, though volatility is higher and price movements are more abrupt.

Source: xStation5

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.