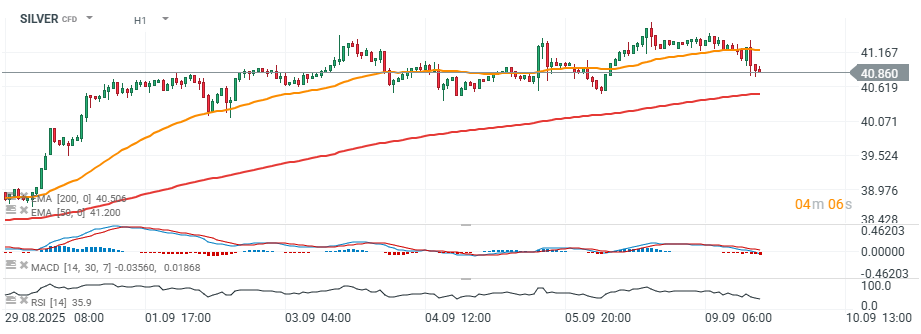

Silver prices are falling more than 1% today, despite a lower than expected BLS data revision, signalling a weakening US economy. Despite weak jobs revision (-911k for 2024, ended in March 2025), futures on US Dollar Index (USDIDX) try to stabilize after the sell-off, gaining almost 0.3% today (EURUSD pair loses almost 0.4%).

That's also probably the reason why gold gains are limited to 'just' 0.3%. On the other hand, today we have seen strong NFIB Index, almost 6.6% YoY growth in US Redbook report, suggesting rising sales at US department stores. So, the despite the weak jobs report, we can assume that not every macro data are 'recessionary'.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.