-

Record Valuations: Silver and gold are hitting historic highs due to a weakening dollar 💵 and attacks on the Fed's independence 🏛️.

-

Geopolitical Triggers: Unrest in Iran and Venezuela, along with intervention threats from Donald Trump, are driving "safe haven" demand 🌎.

-

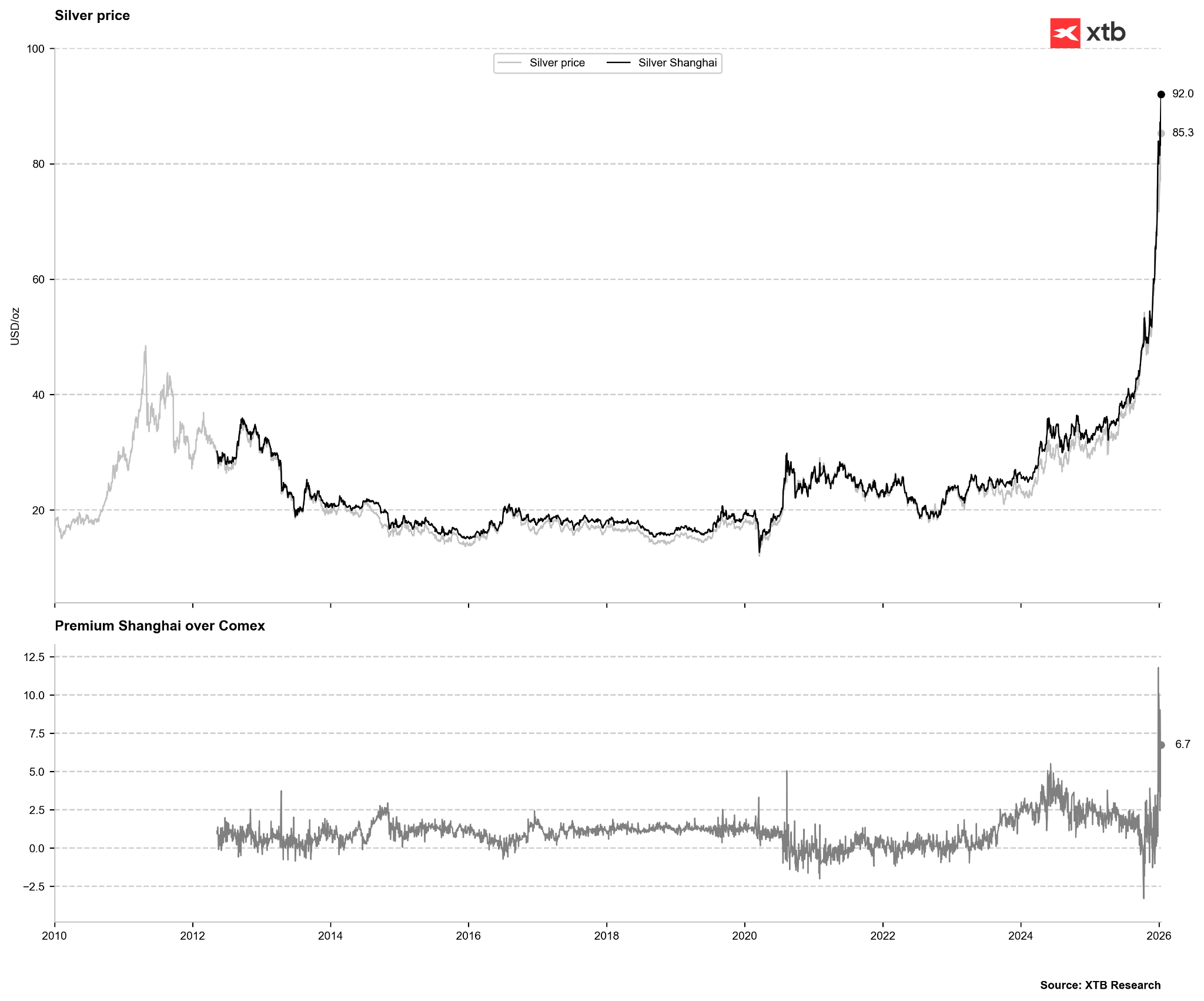

Shanghai Premium: Prices in Shanghai exceeding $90 indicate massive physical demand, pulling global rates higher 📈.

-

Record Valuations: Silver and gold are hitting historic highs due to a weakening dollar 💵 and attacks on the Fed's independence 🏛️.

-

Geopolitical Triggers: Unrest in Iran and Venezuela, along with intervention threats from Donald Trump, are driving "safe haven" demand 🌎.

-

Shanghai Premium: Prices in Shanghai exceeding $90 indicate massive physical demand, pulling global rates higher 📈.

Gold and silver futures have scaled new historic peaks today as the US administration intensifies its pressure on the Federal Reserve. The Department of Justice has launched a criminal investigation into Chair Jerome Powell’s testimony regarding the renovation of the Fed’s historic headquarters. Mr. Powell has categorized the probe as a "pretext" designed to exert political influence and force interest rate cuts. This direct challenge to the central bank’s credibility has triggered a sharp sell-off in the US dollar, providing a powerful tailwind for precious metals.

Geopolitical tensions further bolster the haven bid. Global "flashpoints" remain active, notably in Venezuela and Iran, where reports of large-scale casualties among anti-government protesters have emerged. President Donald Trump has refused to rule out intervention should the violence against protesters continue.

Simultaneously, acute concerns regarding physical metal availability in China are mounting. On the Shanghai Gold Exchange (SGE), silver prices have surged past the $90 per ounce mark.

The China price premium has jumped once again. Source: Bloomberg Finance LP

The China price premium has jumped once again. Source: Bloomberg Finance LP

Notably, earlier fears of a significant drop in COMEX open interest due to commodity index rebalancing have, thus far, failed to materialize. However, investors are closely watching the gold-to-silver ratio, which is currently approaching its historical average of approximately 50-53 points. While the ratio has dipped lower during past precious metal bull markets, mean reversion remains a powerful force. For context, the 10-year moving average of the ratio stands just above 80 points—well above the current 54 points.

Technical Outlook

Silver has decisively broken above the $80 level today, surpassing both its early January peak and the previous all-time high recorded in December. The market is currently testing the $85 region. Support is identified at $84, where price action on the last two candles suggests immediate buying interest. Source: xStation5

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.