Qualcomm (QCOM.US), world's leading manufacturer of smartphone processors and an important player in wireless technology, jumped recently amid the AI market craze. This should not come as a surprise as Qualcomm is already manufacturing chips used in AI and those products are even better than Nvidia's chips for some applications. Let's take a look at the company and recent news on it.

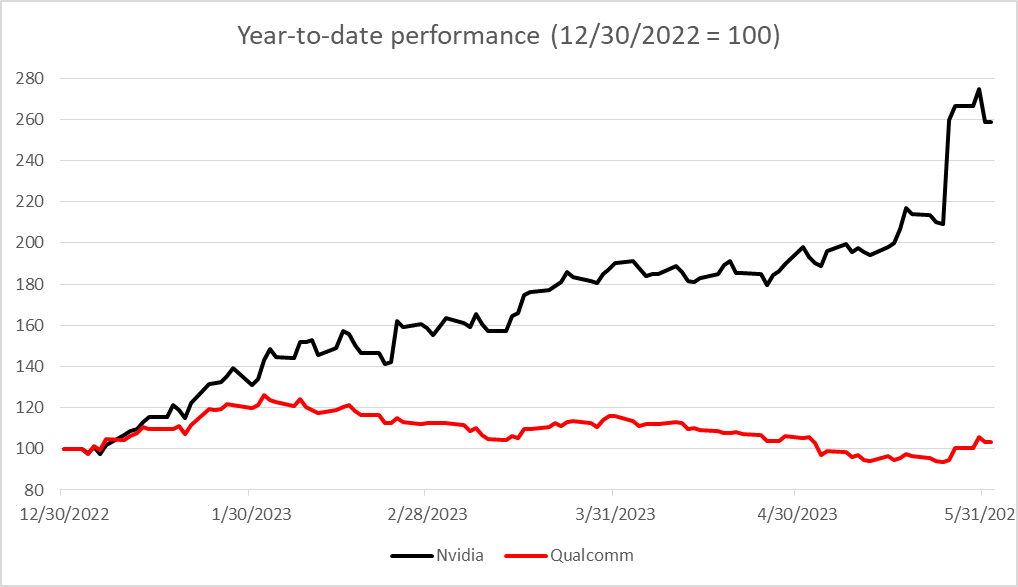

Qualcomm trails Nvidia this year

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appArtificial Intelligence (AI) is a new craze on markets with companies hinting at their involvement in the field experiencing steep share price increases recently. Qualcomm was also one of the stock's that saw strong gains since Nvidia's post-earnings rally in the previous week. It should not come as a surprise as Qualcomm is one of the world's leading semiconductor companies and is already producing chips used in AI. While Nvidia has been in the center of attention given an over-150% year-to-date rally, Qualcomm has been largely overlooked both in terms of media coverage and investors' interest. Nevertheless, tests conducted by MLCommons showed that chips from Qualcomm outperformed Nvidia's chips when it comes to classifying objects or object detection. However, Qualcomm's chips trailed Nvidia's products in natural language processing - technology that is used in chatbots and is therefore the most widely associated with AI in mainstream media right now.

While Qualcomm is already producing highly-rated AI chips, stock performed nowhere near as good as Nvidia did so far this year. Source: Bloomberg, XTB Research

While Qualcomm is already producing highly-rated AI chips, stock performed nowhere near as good as Nvidia did so far this year. Source: Bloomberg, XTB Research

A look at financials

Recent AI-fuelled jump in Qualcomm shares led to an almost complete erasure of share price drop triggered by a disappointing earnings report for fiscal-Q2 2023 (calendar Q1 2023), which was released at the beginning of May. Report showed a 17% YoY drop in revenue with double-digit declines being reported in all three major segments - QCT (development and supply of integrated circuits for mobile devices), QTL (technology licensing) and Internet of Things. The company guided for a weakish performance in fiscal-Q3 2023 (calendar Q2 2023), suggesting that weak demand in smartphones is likely to persist until, and possibly through, calendar Q3 2023.

Overall financial picture of Qualcomm is not bright as one can see on the dashboard below. Company has struggled to grow revenue in recent years and net income growth has also lagged. Nevertheless, the company has managed to improve its liquidity position significantly in recent quarters with the current ratio jumping above 2.4 in most recent quarterly data. Analysts see upside for the stock - 26 out of 38 recommendations compiled by Bloomberg are 'buy' recommendations and median 12-month ahead target price is 18% above current market price. Company is also sharing profits with investors via dividend payouts, what is not too common for tech stocks. Nevertheless, as demand for chips used in AI is expected to sky-rocket in the coming quarters and years, it could be a chance for Qualcomm's business to turn the tide.

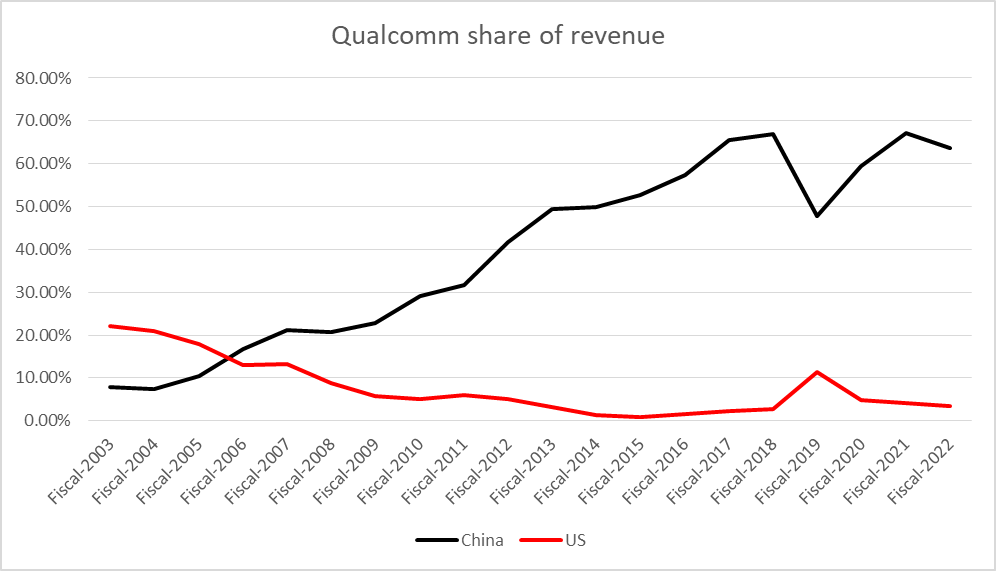

Huge reliance on China

Apart from a weak earnings report for the quarter ended on March 26, 2023, there is also one more source of concern regarding Qualcomm's business - China. Recent restrictions put on Micron Technology (MU.US) highlighted risks for US companies with exposure to China amid ongoing Sino-US tech war. While Micron generated around 11% of its revenue from China, this share is much higher for Qualcomm. Qualcomm generated over 63% of its revenue in China in the most recent full fiscal year (Q4 2021 - Q3 2022). This puts the company at huge risk should Chinese authorities target it next. However, it seems unlikely, at least for now, given that China lacks alternatives to replace products from Qualcomm like for example smartphone processors.

Share of China in Qualcomm revenue has been rising over the past two decades and sat above 63% in fiscal-2022. Source: Bloomberg, XTB

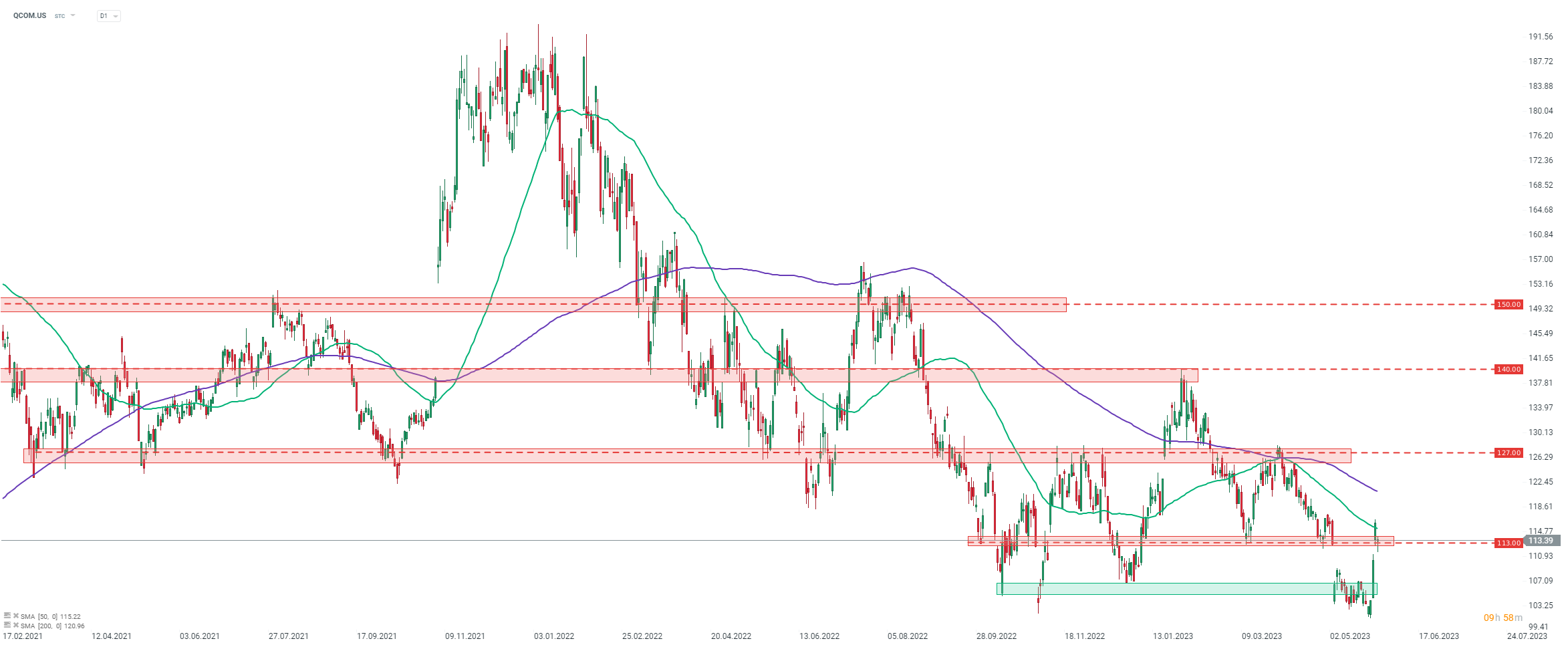

A look at the chart

Taking a look at the Qualcomm (QCOM.US) chart at D1 interval, we can see that the stock experienced strong gains recently, on the back of improved sentiment towards AI-related stocks following Nvidia's earnings last week. Stock attempted to break above the 50-session moving average on Tuesday (green line) but failed to do so and share price pulled back to the $113.00 price zone. Stock is trading little changed in premarket today. From a technical point of view, it will be important whether bulls manage to defend this area or not. Should they fail and stock moves lower, it would mean that a lower high was painted in a current downtrend sequence and may hint at a move towards recent local lows.

Source: xStation5

Source: xStation5

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.