- German index tests the historic high

- Will German stock index rise even higher?

- Technical analysis of the DE40 with Overbalance metodology

- German index tests the historic high

- Will German stock index rise even higher?

- Technical analysis of the DE40 with Overbalance metodology

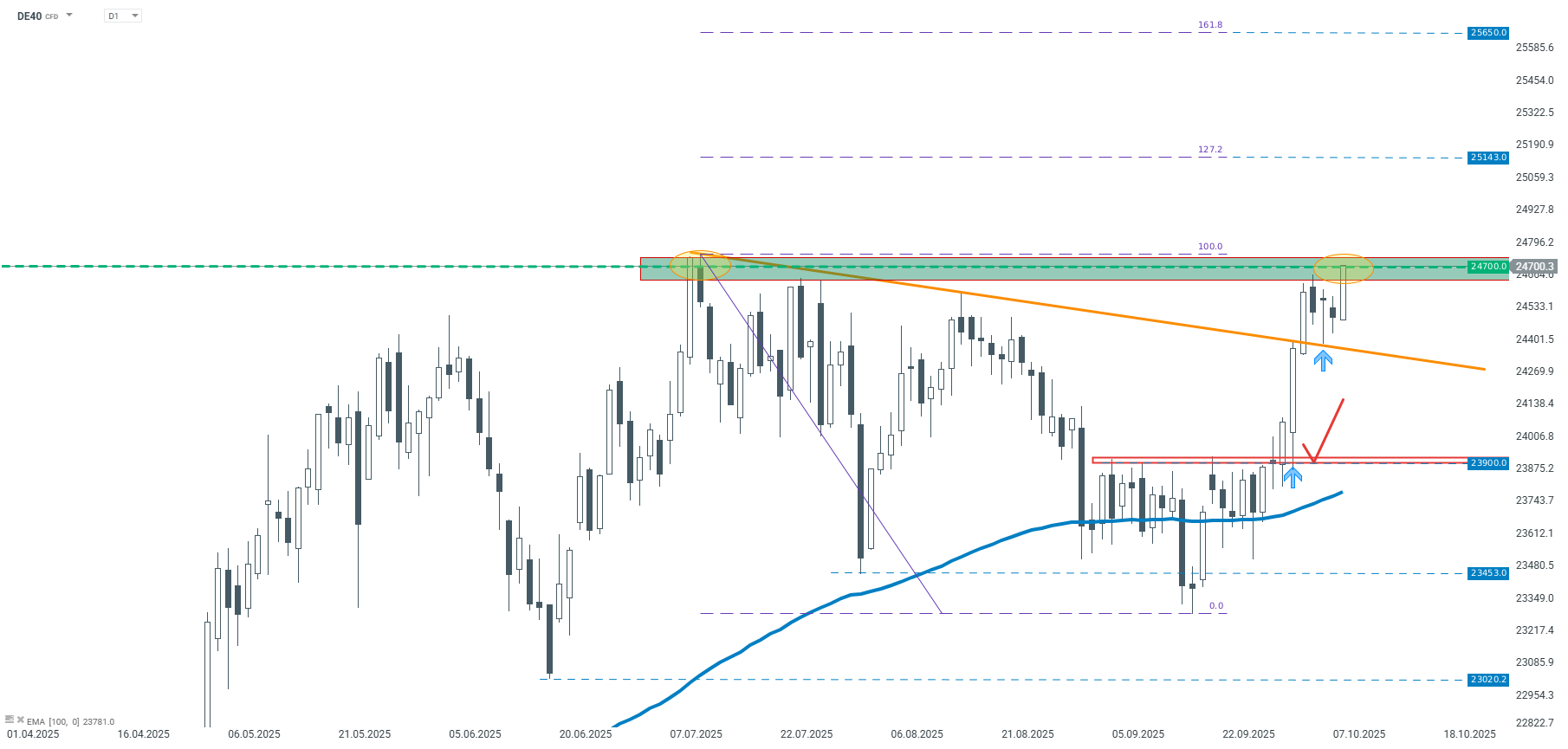

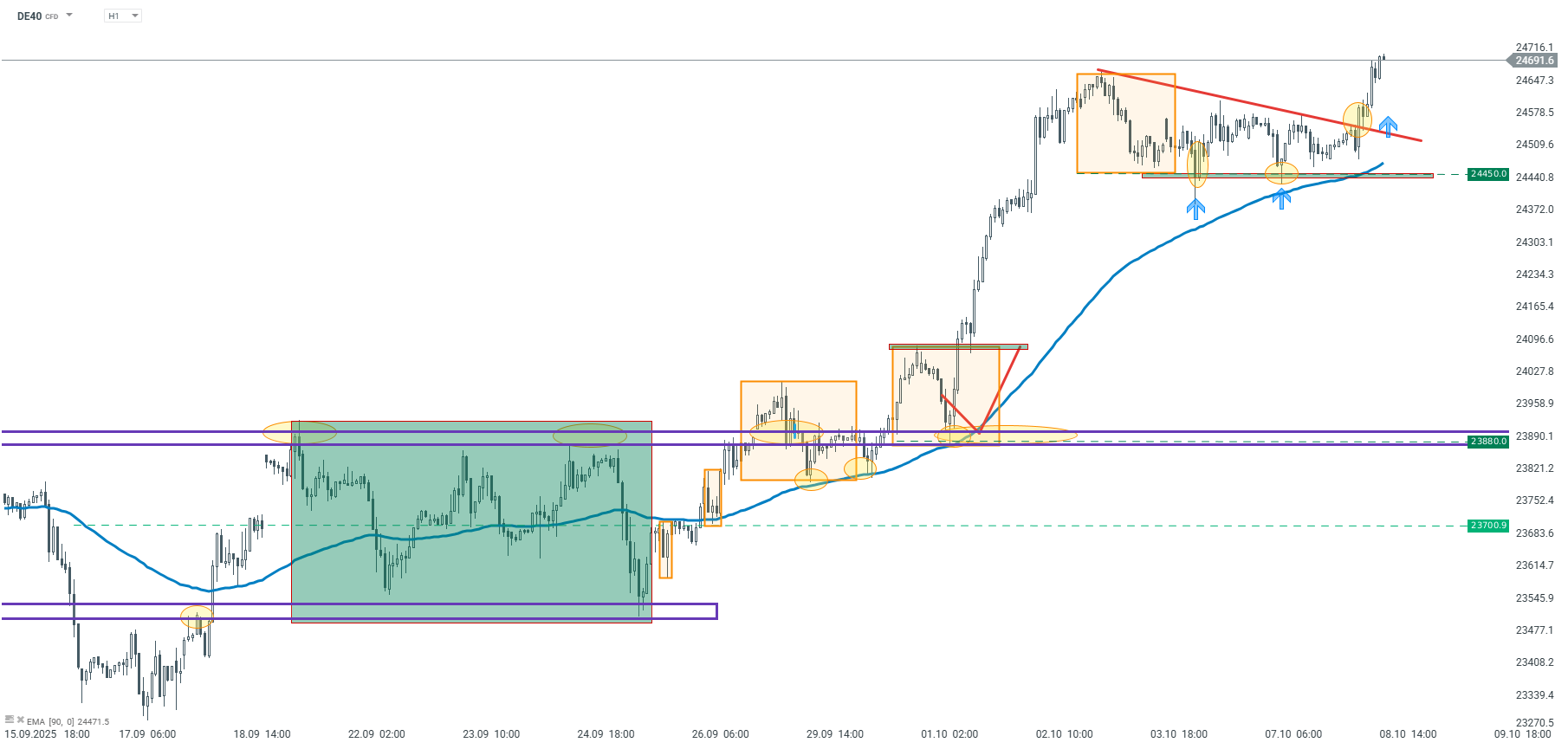

The German stock index DAX 40 remains in a long-term upward trend. On the daily (D1) timeframe, the price has managed to break above the 100-period moving average, marked by a blue line, following a period of consolidation. Moreover, it has surpassed the resistance zone around 23,900 points, which accelerated the upward move, pushing the index above a line drawn through recent highs.

Currently, the price is stuck just below the resistance area near 24,700 points — a level that has already been tested in recent days and is being tested again now. If the market manages to break above this zone, the upward trend could continue toward the external Fibonacci extension levels, measured from the last major correction — specifically, near the 127.2% and 161.8% ratios. On the other hand, if a bearish signal emerges, a corrective move toward the previously broken trendline drawn through the recent highs (marked in orange) cannot be ruled out. However, this is not the base-case scenario, given the prevailing dominant long-term uptrend.

Source: xStation5

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.