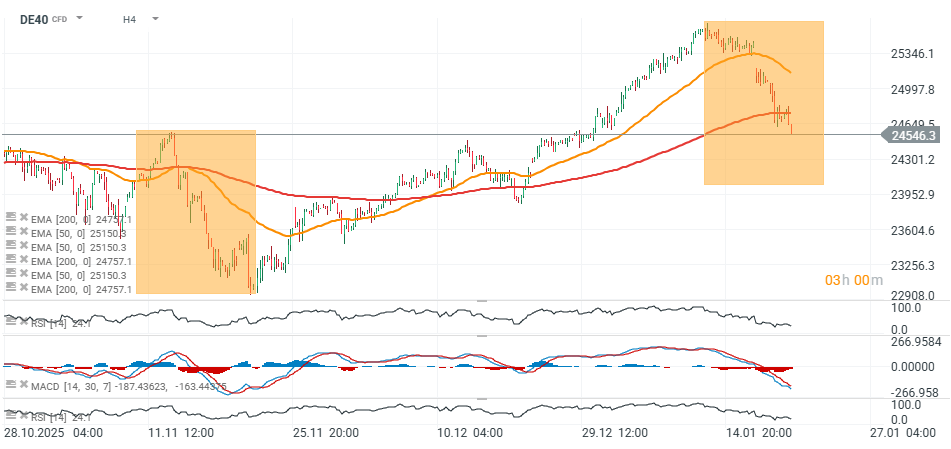

DAX (DE40) futures are extending today’s sell-off, retreating toward the 24,500-point area, where we can see the first meaningful price reactions (local highs from November 12 and December 12, 2025). This would suggest that the index may regain support and find room for a potential rebound closer to 24,300 points. On the other hand, if the downturn in the US equity market deepens, a 1:1 corrective move would imply a possible test of the 24,000 area and a “touch” of the mid-December local low.

Source: xStation5

Looking further back, breaks below the 50-day EMA on the daily timeframe have almost always been followed by an acceleration of the downtrend. Since May 2025, the three downside impulses had similar 1:1 projections, though with a slightly smaller range than the last two larger corrective legs from December and—potentially—the current move in January 2026. If the index were to test the strength of the long-term trend, the decline could extend even toward 23,800 points, where the 200-day exponential moving average currently sits on the daily chart (EMA200, red line). Conversely, a rebound from current levels could reignite the strong upward impulse, with potential resistance near 24,800 points (two local highs from July and October 2025).

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.