- Despite beating expectations and raising its full-year earnings guidance, shares dropped more than 5%, signaling heightened investor expectations.

- Management signals risks related to the federal budget and government contracts, while uneven segment growth dampens market optimism.

- Despite beating expectations and raising its full-year earnings guidance, shares dropped more than 5%, signaling heightened investor expectations.

- Management signals risks related to the federal budget and government contracts, while uneven segment growth dampens market optimism.

Teledyne Technologies Reports Strong Results, but Market Reaction Is Negative. What’s Behind the Stock Price Drop?

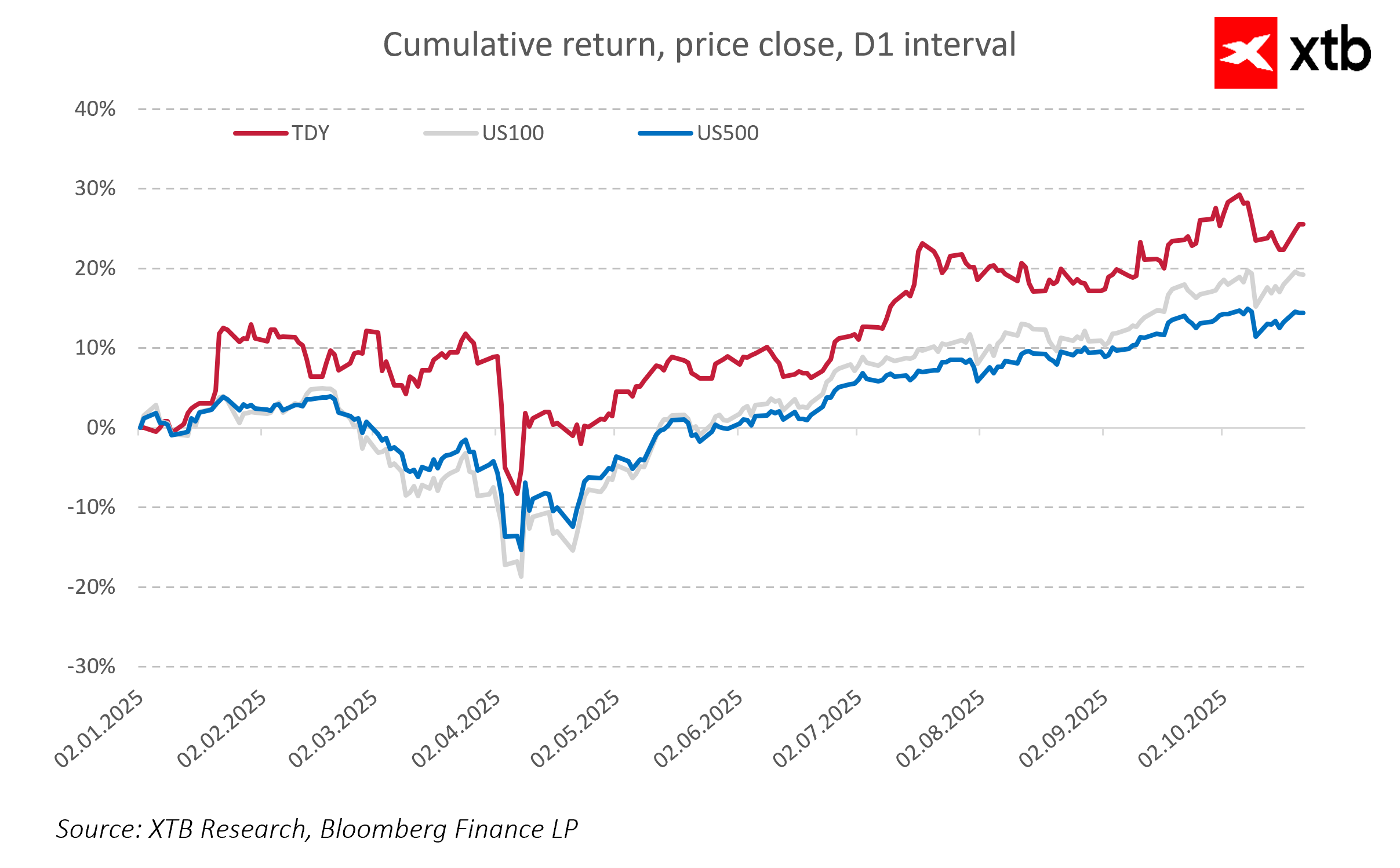

Teledyne Technologies, an advanced technology company operating in electronic systems, satellite imaging, precision sensors, and software, released its financial results for the third quarter of 2025. The company serves key sectors including aerospace, defense, science, industrial, and energy. Its business is largely based on long-term government contracts, primarily in the United States. Despite exceeding analyst expectations and raising its full-year outlook, the stock price fell by more than five percent. This suggests that market expectations were higher both in terms of growth pace and the tone of the management’s communication.

Q3 2025 Financial Highlights

-

Revenue: $1,539.5 million (up 6.7% year-over-year), above consensus (~$1,530 million)

-

Adjusted EPS (non-GAAP): $5.57 (up 9.2% year-over-year), beating expectations ($5.47)

-

GAAP Net Income: $218.8 million versus $260.9 million a year earlier (down 16%)

-

GAAP EPS: $4.65 versus $5.54 a year earlier

-

Free Cash Flow: $313.9 million (versus $220.4 million in Q3 2024)

-

Raised full-year EPS guidance: $21.45–$21.60 (previously $21.10–$21.50)

Although operating results were strong, investors responded with a stock price decline. This indicates that expectations for the company were even more optimistic. One factor potentially contributing to this reaction is the significant difference between GAAP net income and the adjusted non-GAAP result. While such adjustments are common in the technology sector, the magnitude of the gap may raise concerns about the quality of earnings.

Source: xStation

Despite revenue growth, the operating margin declined slightly, possibly due to rising costs or significant investments that temporarily reduce profitability. Segment analysis reveals uneven growth across the business. The Aerospace & Defense Electronics segment posted an impressive increase of over 37 percent, while Digital Imaging, the largest segment, grew by only 2.2 percent and saw a decline in operating profit. The Engineered Systems segment also experienced a revenue decline.

Additionally, the management highlighted key risks related to the strained U.S. budget situation, including the possibility of a federal government shutdown. This could impact the pace of new contract signings and the delivery of existing orders, which is a significant risk for a company heavily reliant on government spending.

The market’s reaction also reflects broader macroeconomic and geopolitical factors, where defense and advanced technology companies are vulnerable to changes in budget policies, interest rates, currency fluctuations, trade policies, and export regulations. In times of uncertainty, even solid financial results may not suffice to maintain positive investor sentiment, especially if the stock price already reflects optimistic forecasts.

Outlook and Challenges Ahead

Fundamentally, Teledyne remains a company with strong foundations, generating stable cash flow and well positioned in key strategic sectors. At the same time, current results show uneven growth rates, with some segments needing improvement in profitability and development pace. Cautious management communication combined with macroeconomic factors may limit short-term stock price growth potential.

For long-term investors, Teledyne could still be an attractive option, particularly if the company can improve results in less dynamic segments and maintain stable government contracts in upcoming quarters. Meanwhile, the market will closely watch the company’s ability to sustain margins and accelerate growth outside the defense segment.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.