- Tesla delivered record revenue and free cash flow on higher vehicle volumes and surging energy-storage deployments, though auto margins stayed pressured.

- Management emphasized an AI-led roadmap (FSD v14, Robotaxi pilots) and new products (Model 3/Y Standard, Megapack 3/Megablock).

- Outlook remains growth-oriented but cautious given tariffs and macro uncertainty.

- Stock declines 1.30% after hours.

- Tesla delivered record revenue and free cash flow on higher vehicle volumes and surging energy-storage deployments, though auto margins stayed pressured.

- Management emphasized an AI-led roadmap (FSD v14, Robotaxi pilots) and new products (Model 3/Y Standard, Megapack 3/Megablock).

- Outlook remains growth-oriented but cautious given tariffs and macro uncertainty.

- Stock declines 1.30% after hours.

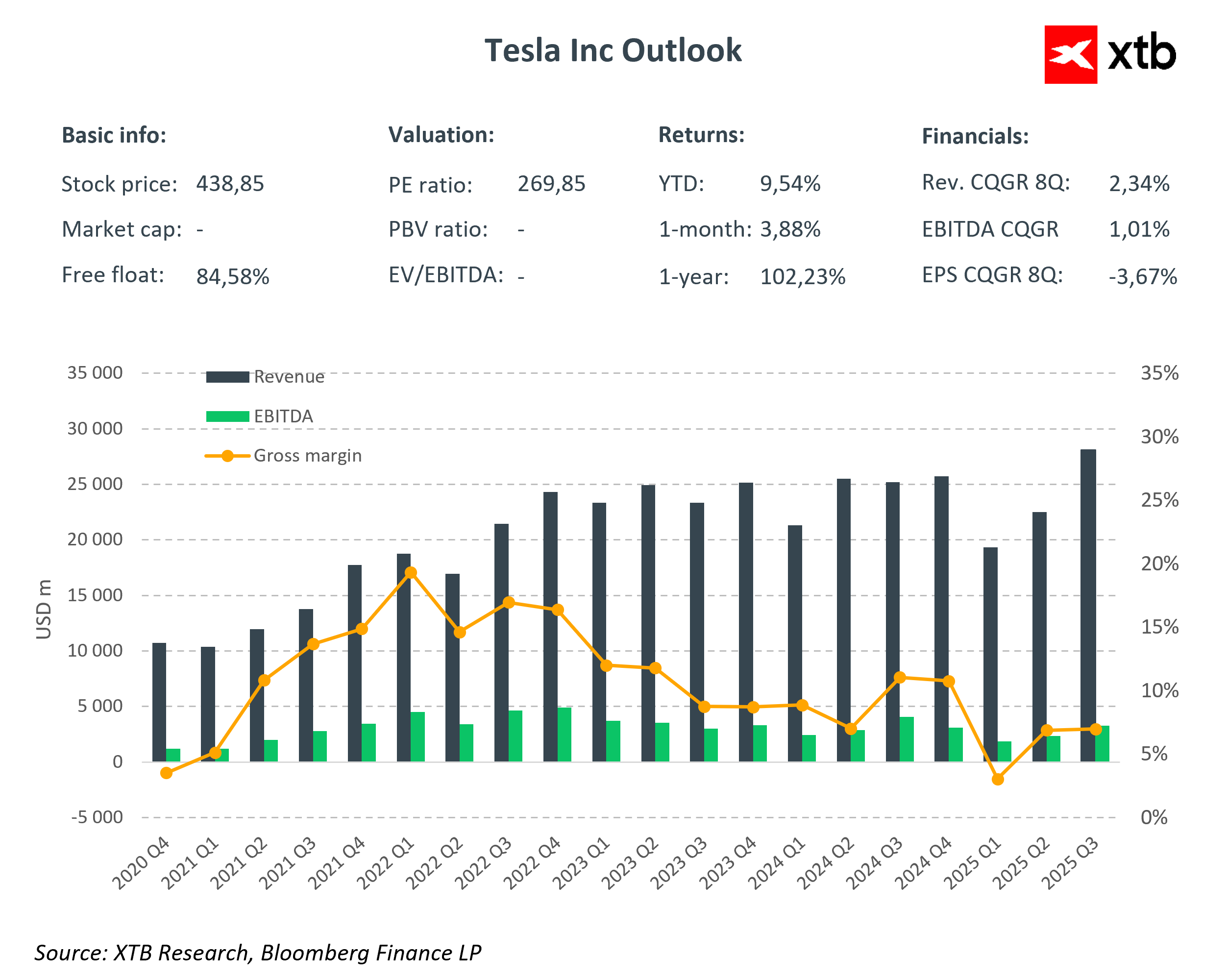

Tesla reported record quarterly revenue and significantly higher free cash flow, driven by the highest vehicle deliveries in its history and record energy-storage deployments. Automotive margins remain lower year-on-year due to higher operating costs, tariffs, and sales mix. Nevertheless, the company still managed to generate substantial cash surplus. Management continues to lean heavily into AI (FSD v14 rollout, Robotaxi pilots) and new products (Model 3/Y Standard, Model YL, Megapack 3/Megablock) while maintaining a cautious tone regarding macro and trade risks.

Key results

- Total revenue: $28.10B (+12% YoY)

- GAAP operating income / margin: $1.62B / 5.8%

- GAAP net income: $1.37B; non-GAAP net income: $1.77B (non-GAAP EPS $0.50)

- Adjusted EBITDA / margin: $4.23B / 15.0%

- Operating cash flow / FCF: $6.24B / $3.99B (record)

- Cash & investments: $41.65B (+$4.9B QoQ)

- Vehicle deliveries: 497,099 (+7% YoY); days of inventory: 10

- Energy storage deployments: 12.5 GWh (+81% YoY)

- Supercharger network: 7,753 stations / 73,817 connectors (+16–18% YoY)

Management commentary

Management remains optimistic, emphasizing that current production serves as the foundation for monetizing the company’s AI-based services offering. Comments indicate short-term uncertainty related to trade and fiscal policy, but upcoming production lines (Cybercab/Robotaxi, Semi, Megapack 3, Optimus) sustain strong commercialization potential.

- FSD v14 has begun rolling out, integrating a large portion of the Robotaxi model with improved handling of complex scenarios. The Robotaxi service was expanded in Austin, and a ride-hailing program was launched in the Bay Area to collect data ahead of full commercial scaling.

- Management points to rising tariffs and supply-chain uncertainty as factors driving costs and limiting pricing flexibility. Localized sourcing of batteries and drivetrains is expected to reduce these risks over time.

- AI training capacity increased to approximately 81,000 H100-class GPUs, with further growth expected through collaboration with Samsung on advanced AI chip manufacturing in the U.S.

Segment details

- Deliveries: 497,099 vehicles (+7% YoY); inventory days fell to 10. Model 3/Y accounted for 481,166 deliveries.

- Energy storage: 12.5 GWh deployed (+81% YoY) and a record quarterly gross profit in the energy segment ($1.1B TTM).

- Network & services: Around 7,753 Supercharger stations and 73,817 connectors (+16–18% YoY). The first v4 units were launched, featuring higher power density and throughput.

Tesla shares declined 1.3% to $433 in after-hours trading.

Chart of the day: US100 (20.11.2025)

NVIDIA Beats Expectations: The AI Powerhouse Saving the Future

Daily Summary: Market attempts recovery, all hope in Nvidia

Constellation Energy and Three Mile Island — Nuclear Past and Future

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.