- Company managed to slightly beat revenues expectations

- Operating profit feel, pressured by tariffs, which caused caution among investors

- Net profit raised substantially but mainly due to foreign exchange difference

- Guidance for end of the FY was lifted

- Company managed to slightly beat revenues expectations

- Operating profit feel, pressured by tariffs, which caused caution among investors

- Net profit raised substantially but mainly due to foreign exchange difference

- Guidance for end of the FY was lifted

Key financial information:

- Revenue is 12.38 trillion yen, an increase of 8% and above the consensus of 12.18 trillion.

- Net profit increased by a 62%, reaching 932 billion yen.

- A concerning fact is that operating profit fell by 27% year-on-year.

- The difference between operating profit and net profit was mainly due to investment returns and exchange rate differences. Operating profit itself was under significant pressure from labor costs and additional American tariffs.

The company communicated a series of important information regarding its strategy and future. Toyota continues its strategy of expansion in multiple sectors of the industry simultaneously. Other companies might struggle with this, but Toyota, due to its size, can not only afford it but is also in the best position to maximize benefits while taking relatively low risks.

The expansion mentioned primarily involves investing simultaneously in the EV market and Hybrids. Low-emission vehicles already account for 46.9% of the company's sales.

Toyota is also following other industry trends. The company boasts its new "Arene" system and proudly announces further development towards "Software Defined Vehicles."

Toyota shows its confidence by raising forecasts for the end of the fiscal year. By the end of FY2026, operating profit is expected to reach 3.4 trillion yen, an increase from the previous forecast of 3.2 trillion.

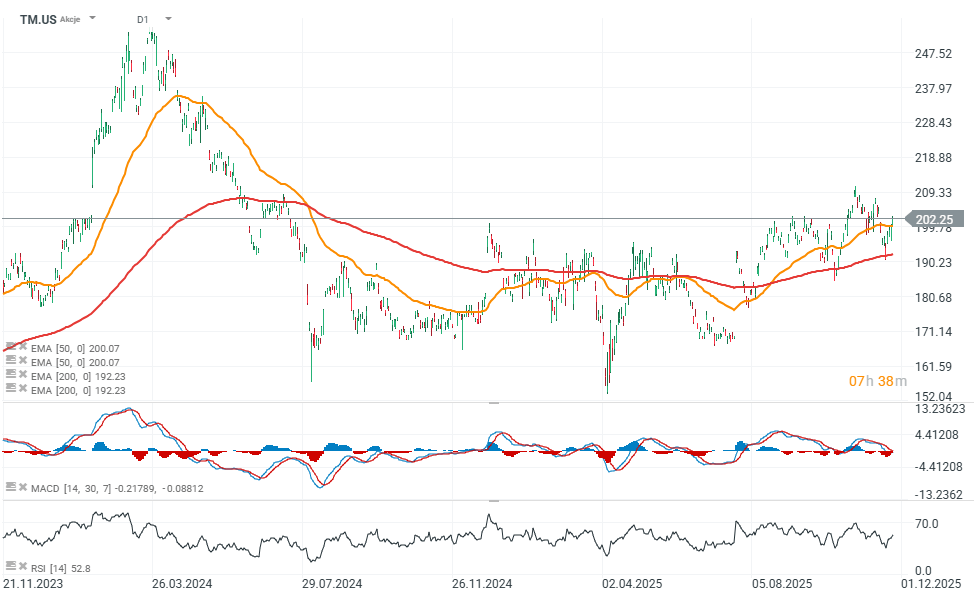

The market reacted with slight concern to the news of a significant drop in operating profit and the impact of tariffs. Initially, the company lost about 1.6% of its valuation. However, positive forecasts allowed the company's valuation to return to its previous levels over time.

TM.US (D1)

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.