-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

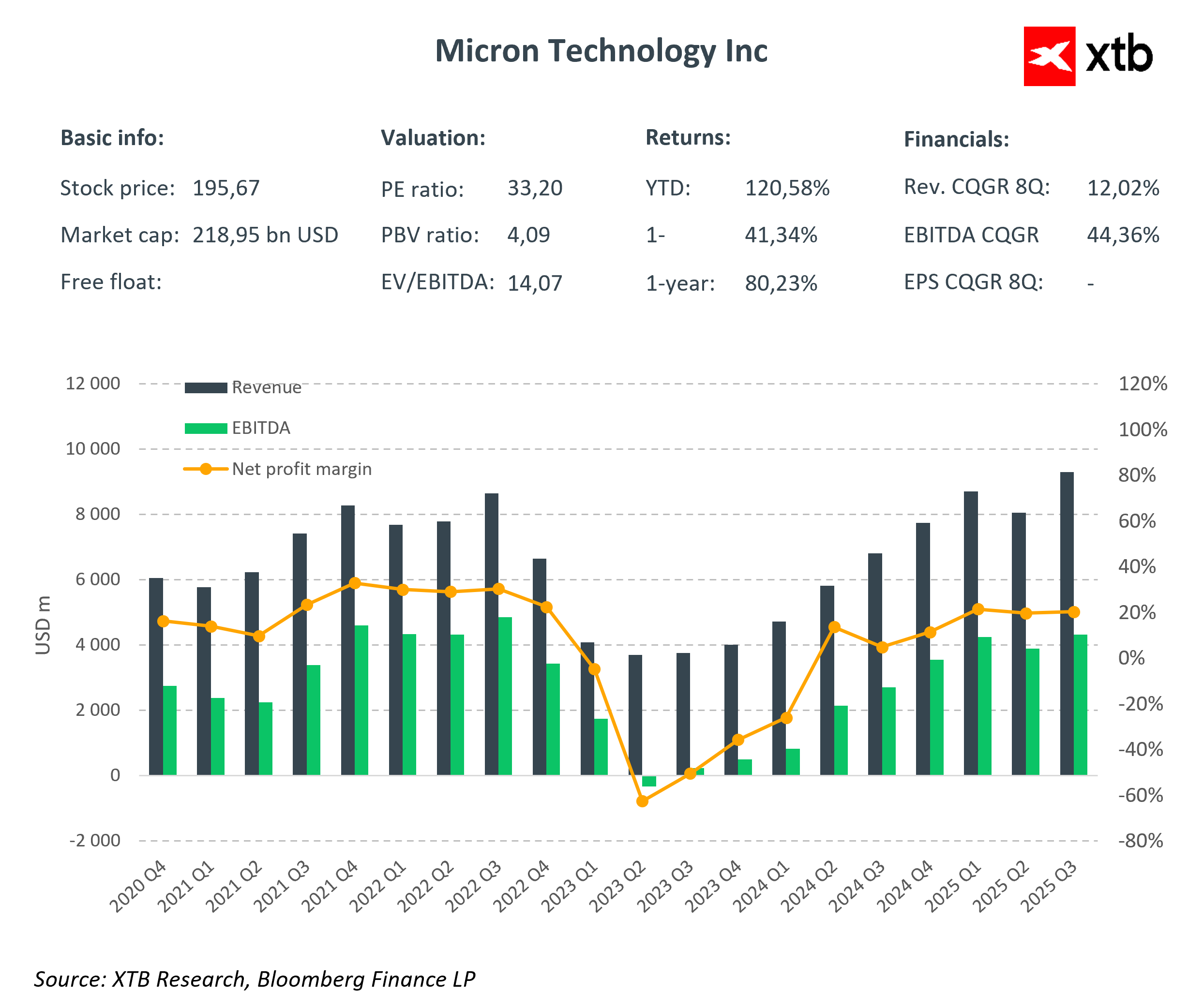

Positive news for Micron seems to be coming nonstop. UBS has just raised the stock price target from $195 to $225, maintaining its “Buy” recommendation. This is another sign of growing optimism around the memory chip manufacturer, mainly driven by the dynamic increase in demand for HBM (High Bandwidth Memory), a key component in the development of artificial intelligence and advanced computing systems.

UBS has revised its forecasts, expecting global demand for HBM to reach 17.1 billion GB in 2025 and rise to 27.2 billion GB in 2026, which is higher than previous estimates. One of the key customers is expected to be NVIDIA, further strengthening Micron’s revenue growth prospects. On the other hand, UBS points out production capacity constraints. The full capacity of the new factory in Idaho will only be reached in the second half of 2027, which may limit the pace of expansion. Despite this, the market remains positive.

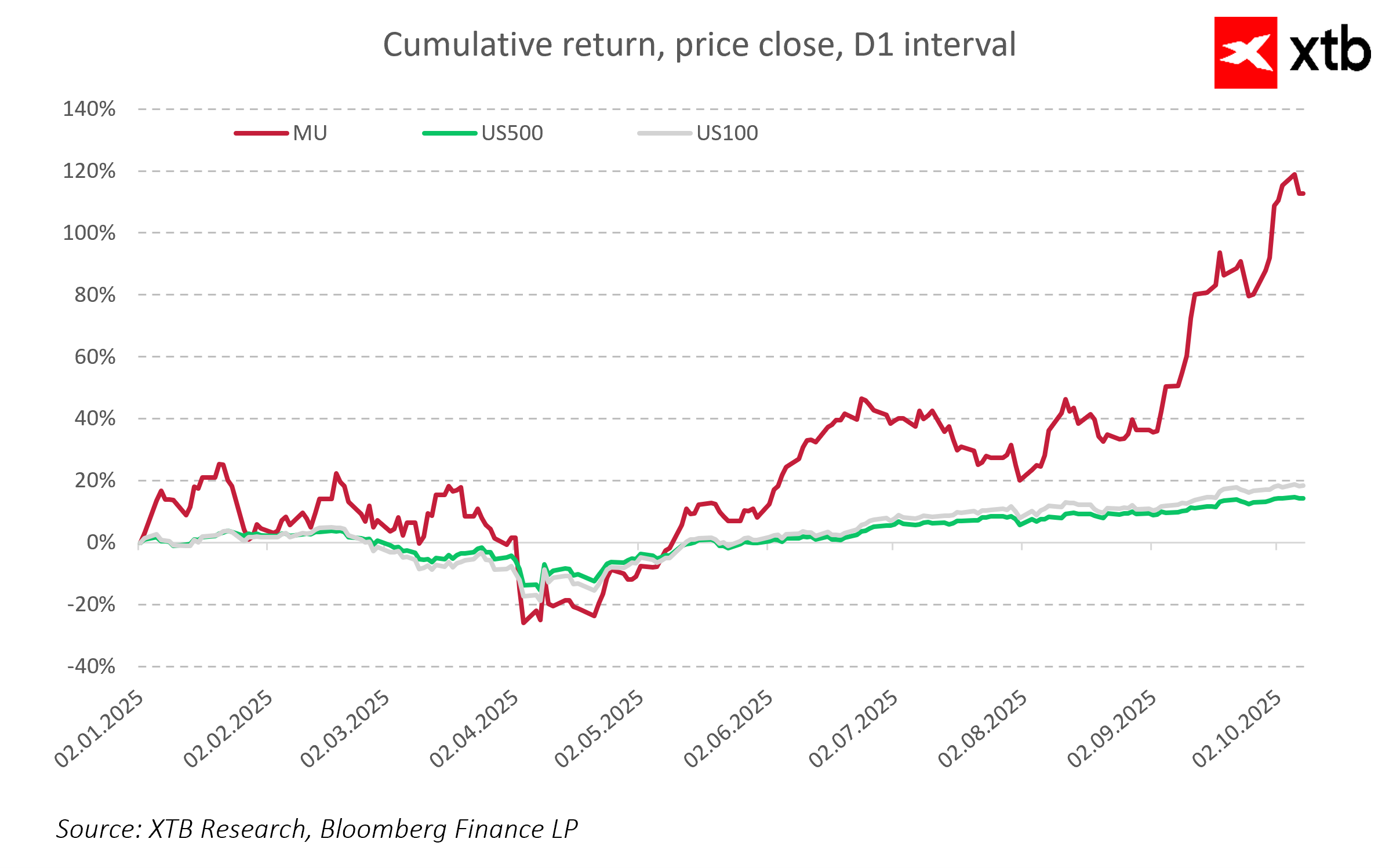

Micron’s shares are up 5 percent in today’s session and have already gained over 120 percent since january. The new valuation from UBS may act as an additional catalyst, but with such dynamic growth, it is wise to remain cautious and closely monitor whether the company can maintain its current growth pace.

Amazon and Apple beat estimates. Will it lift Wall Street higher?

Apple slightly gains after earnings 🗽China sales misses estimates

Amazon gains almost 10% after earnings report 📈US100 tries to recover

Daily Summary: ECB, FOMC and MAG7 - mixed signals and risk aversion

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.