- Wall Street futures sharply limited their losses during yesterday's session and are gaining ground today following comments from Fed Chair Powell hinting at the imminent conclusion of the balance sheet reduction program.

-

Further positive earnings from major US banks.

-

Donald Trump threatens new negative steps directed at China.

- Wall Street futures sharply limited their losses during yesterday's session and are gaining ground today following comments from Fed Chair Powell hinting at the imminent conclusion of the balance sheet reduction program.

-

Further positive earnings from major US banks.

-

Donald Trump threatens new negative steps directed at China.

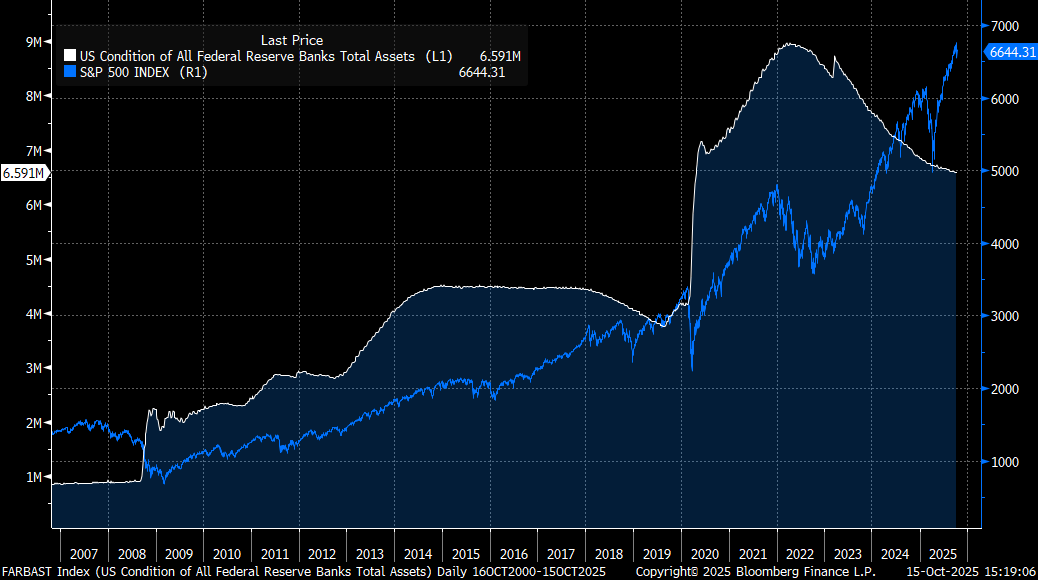

American indices continue the revival sparked by Jerome Powell's remarks yesterday, which suggested not only a readiness for interest rate cuts but also for the conclusion of the balance sheet reduction process (QT). The US Federal Reserve has been shrinking its enormous asset balance since 2022 by allowing bonds to mature without reinvestment. Over a quarter of the total balance has been reduced since 2022, though the total still remains elevated relative to the record purchases initiated in early 2020. Should the Fed decide to halt the balance sheet reduction, maturing bonds would necessarily have to be rolled over. This policy shift could lead to a general decline in market interest rates. Currently, yields remain at elevated levels, even amid the reduction of short-term interest rates.

The Fed Balance Sheet and the S&P 500 Index. It was once suggested that without asset purchases, the US stock market could no longer gain ground. As shown, the S&P 500 index has climbed nearly 3,000 points since the reduction began. Source: Bloomberg Finance LP

It is worth noting that Donald Trump is once again escalating tensions with China, signaling a potential suspension of edible oil purchases from the country. In response, China is reportedly considering halting soybean purchases from the US, sparking unease among farmers. Nevertheless, positive signals concerning trade negotiations currently outweigh the negative ones in the market.

ASML reported solid financial results, showcasing a high level of orders for chip manufacturing machinery, which demonstrates the sustained momentum of the AI trend. Investors remain optimistic ahead of tomorrow's earnings release from the Taiwanese firm TSMC, the world's largest semiconductor manufacturer and a key supplier to companies like Nvidia.

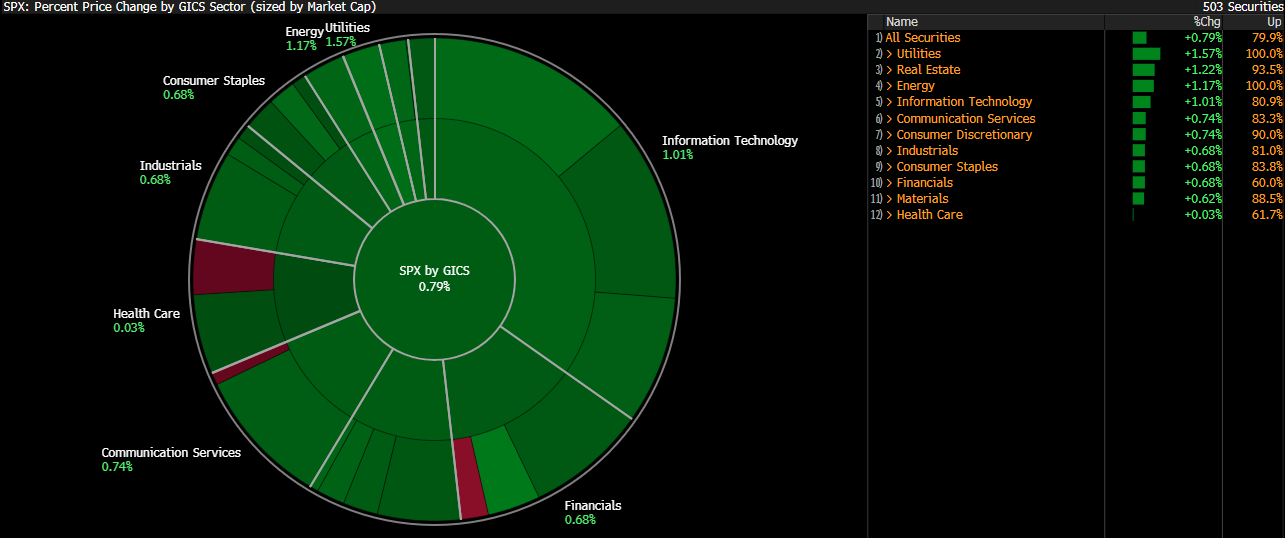

All Key S&P 500 Segments Advance

We are observing gains across the majority of segments within the S&P 500 index today. Notably, the Utilities sector is making the strongest gains, while the largest sector, Technology, is up 1%.

Today we are observing gains in most segments of the S&P 500 index. Source: Bloomberg Finance LP

The US500 is up 0.8% today, which closely aligns with the move in the cash market. Smaller capitalization companies are outperforming, with the Russell 2000 rising by 1.3% at the open. Today's advance recoups over two-thirds of the losses incurred during the last two sessions of last week, effectively negating the bearish signal. Crucially, the index did not breach the largest correction level within the existing trend from May and July, potentially indicating a return to the main upward trajectory. Furthermore, the US500 avoided falling below the 50.0% retracement level of the shorter rally wave that began in early September.. Source. xStation5

Corporate News Highlights:

-

Apple (AAPL.US) intends to increase its investments in Vietnam to reduce its operational exposure in China. Concurrently, Bloomberg reports that the company plans to collaborate with China's BYD to test, produce, and package a new product—an alleged home command center. AAPL shares are up approximately 0.8% at the open, though they remain down slightly year-to-date.

-

Stellantis (STLA.US) announced plans to invest $13 billion in the US over the next four years to modify its supply chain and minimise the impact of trade tariffs. STLA shares are gaining nearly 0.7% at the open. Stellantis owns brands including Fiat, Chrysler, Jeep, and Peugeot.

-

Papa John’s (PZZA.US) soared by as much as 10% at the session open following a Reuters report suggesting that Apollo Global, an asset management firm, may propose a buyout of the company at $64 per share with the intention of taking it private.

-

Bank of America (BAC.US) advanced 4% at the open after delivering better-than-expected third-quarter results, driven by increased activity in investment banking and M&A. EPS came in at $1.06, exceeding the market consensus by $0.11. The bank's revenue was also stronger by roughly half a billion, reaching $28.09 billion.

-

Morgan Stanley (MS.US) also reported a strong Q3, benefiting from a high volume of transactions and robust performance in its investment banking segment. The firm posted a record 44% jump in investment banking revenue, while assets under management (AUM) reached $8.9 billion, approaching its $10 billion target. The bank's shares are up 6.75% early in the session.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.