- Wall Street higher on Trump's re-aproach to China's tariffs

- Bessent, concerned with shutdown impact on the economy

- Rare earth metals surge on wave of export restrictions

- Wall Street higher on Trump's re-aproach to China's tariffs

- Bessent, concerned with shutdown impact on the economy

- Rare earth metals surge on wave of export restrictions

American indices are rebounding on Monday after a very negative end to last week. Following a series of declines and growing concerns about the economy's condition, investors are entering the new week with a slightly better mood, which translates into moderate gains for the main benchmarks - S&P 500, Dow Jones, and Nasdaq. There's an attempt to recover losses, although market sentiment remains fragile.

Some tensions on Wall Street have eased after President Donald Trump softened his rhetoric towards China, suggesting the possibility of resuming constructive trade dialogue. Market participants interpreted this as a signal of potential de-escalation of tensions between the world's two largest economies. However, comments from Treasury Secretary S. Bessent had the opposite effect, stating that the prolonged government shutdown is starting to have a real impact on economic activity. The lack of significant macroeconomic data from the USA means that the market is reacting more to political factors and investor sentiment today than to hard data.

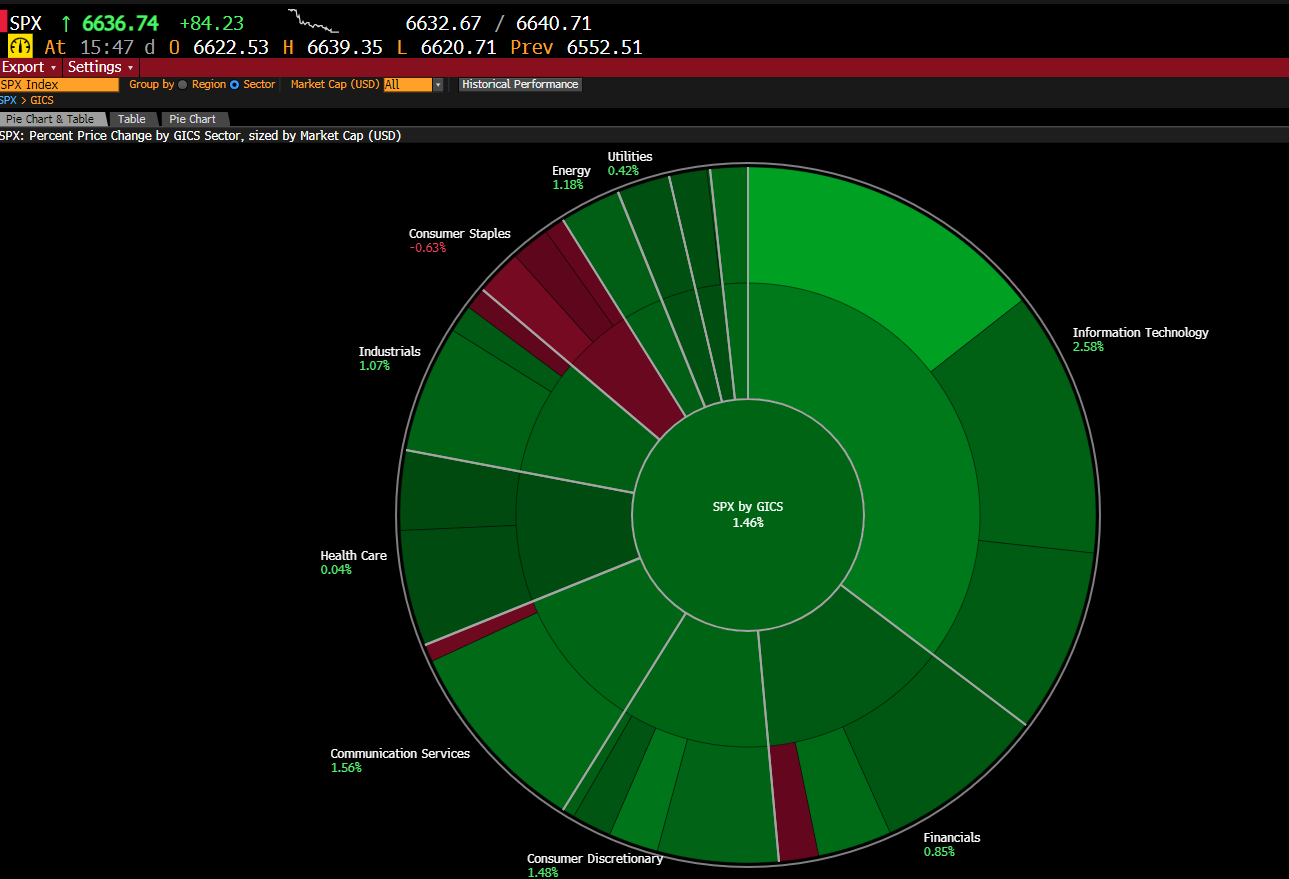

Source: Bloomberg Finance Lp

The main indices of the American stock exchange are rising across the board today, with IT remaining the leaders of growth. Behind them, industry and finance are performing very well, albeit slightly weaker.

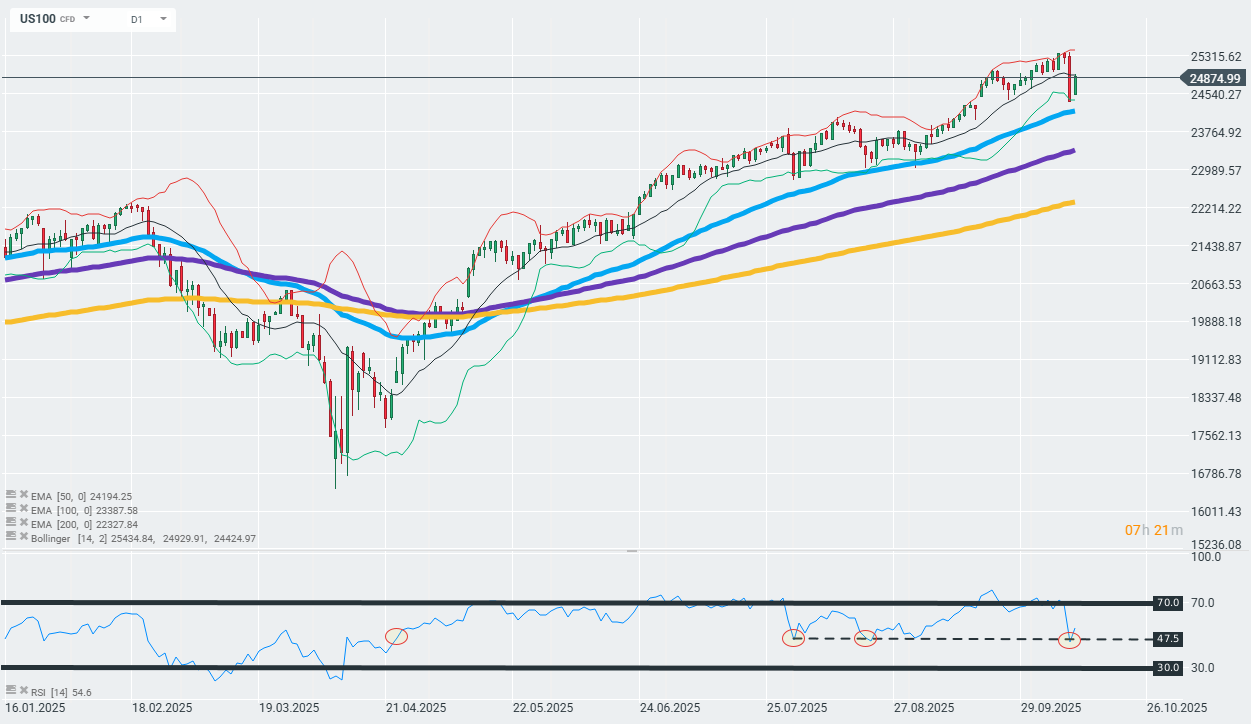

The US100 is rebounding after significant declines on Friday amid growing uncertainty between the US and China. From a technical perspective, the uptrend remains very strong. The 50-day exponential moving average, which hasn't been tested by the sell side since early September, could remain a significant support point. Source: xStation 5

Company News

The so-called "Magnificent 7" companies are rebounding after Friday's corrections. Nvidia (NVDA.US) is up over 2% at the opening, while other market leaders are up about 1%.

There are huge gains in companies related to rare earth metals following China's announcement of restrictions on the export and resale of rare earth metals and products containing them. Critical Metals is up 20%, and MP Materials (MP) is up 8%.

Estee Lauder — The beauty industry company is up over 4% following a positive recommendation from Goldman Sachs.

Warner Bros — The media giant is up 4% after rejecting a purchase offer from Paramount. Unconfirmed sources indicate that the offered amount was too low.

Rocket Lab — The space company is up over 6% after Morgan Stanley expressed optimism about the company's new product — the orbital carrier "Neutron."

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.