- Accumulation of macroeconomic data moves the markets.

- Moderately strong consumer and labour market, rising inflation expectations.

- The US defence industry is uncertain about its position.

- Huge write-off at General Motors.

- Meta with new energy suppliers.

- Accumulation of macroeconomic data moves the markets.

- Moderately strong consumer and labour market, rising inflation expectations.

- The US defence industry is uncertain about its position.

- Huge write-off at General Motors.

- Meta with new energy suppliers.

Friday's session on Wall Street promises to be full of volatility and price-driving factors for the markets. The session starts with a slight increase, but sellers gradually take the initiative in the market. The biggest declines are noted in the Dow, with contracts falling by almost 0.3%. The US500 is relatively well-off, with declines limited to about 0.1%.

For almost the last 12 months, investors' attention has been mainly focused on Donald Trump, whose policy remains as volatile as it is controversial. Just in the last few days, the US president ordered the purchase of mortgage debts and threatened to ban the purchase of single-family homes by institutional entities - aimed at improving the situation for buyers in the US real estate market.

At the same time, controversies around American defence companies do not cease. On one hand, the president threatens to limit the ability to buy shares and pay dividends, while on the other, he promises a significant increase in the military budget. The market still seems uncertain about how to price these revelations.

Macroeconomic Data:

American institutions provided a range of important readings from the economy today, mainly concerning the labour market and real estate.

- The labour market situation remains moderately good, at least in terms of statistical data, but doubts persist about the quality of the data.

- Employment change in December in the non-agricultural sector amounted to 50,000 compared to the expected 60,000 - a decline compared to the previous month. However, the unemployment rate fell from 4.5% to 4.4%. What may raise doubts is that despite the drop in unemployment, employment in the private sector increased by 37,000 compared to the expected 64,000 - this is particularly puzzling in the context of the seasonality of the labor market in the USA. It is possible that the data was again influenced by the re-employment of some personnel laid off during the government shutdown.

- Supply side data in the real estate market also looks moderately good, with permits and housing starts remaining at high levels despite market uncertainty.

- Optimistic data also came from the University of Michigan, with all consumer sentiment indicators exceeding market expectations. However, this increase is accompanied by a slight rise in inflation expectations.

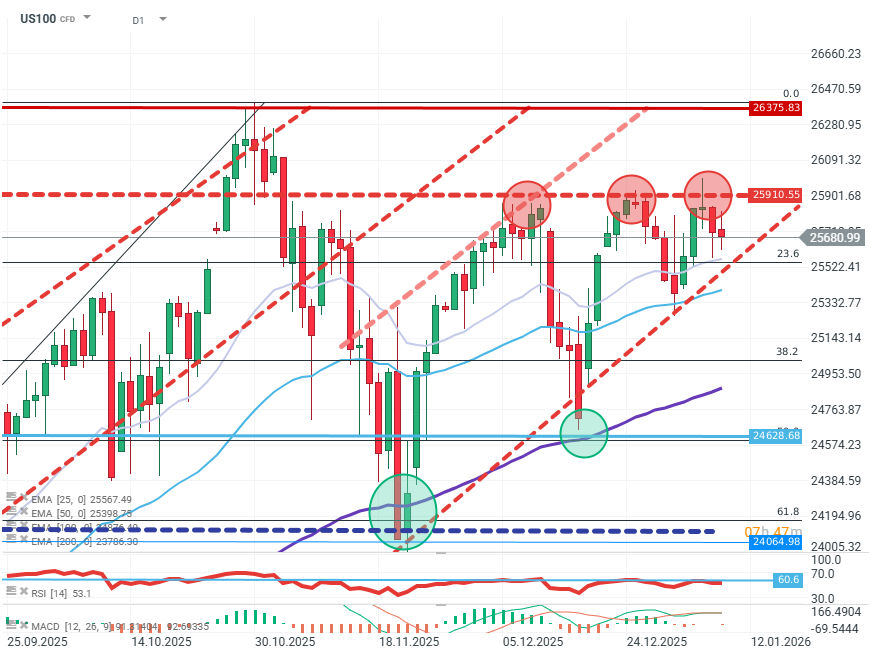

US100 (D1)

Source: xStation5

Buyers have a clear problem overcoming the resistance zone at around 25,900. The upward momentum clearly weakened at the end of 2025 and still faces challenges. The market has already bounced off the resistance zone three times, creating a high probability of correction with a target range between FIBO levels 23.6 and 38.2.

Company News:

- TSMC (TSM.US) - The Taiwanese chip manufacturer published results, again boasting double-digit revenue growth. However, most of the growth was already priced in, and the company's valuations show no reaction to the publication.

- Johnson & Johnson (JNJ.US) - The drug manufacturer and distributor reached an agreement with the US president's administration regarding drug prices and tariffs.

- General Motors (GM.US) - The automotive conglomerate loses 2% after announcing it will incur losses of $6 billion due to recent changes in the US president's administration policy regarding electric vehicles.

- Oklo (OKLO.US) and Vistra (VST.US) - Energy distributors rise by several percent after signing an agreement to supply energy to Meta's data centres.

- WD40 (WDFC.US) - The manufacturer of the popular industrial lubricant loses about 7% after publishing results below expectations.

⏫Silver and gold rally ahead of FOMC minutes

Daily Summary: Declines on indices and a precious metals crash

US OPEN: Start of the week with mild discounts, amid geopolitical tensions

US OPEN: Holiday season extinguish volatility despite political risks

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.