- Market declines on the opening of the Friday session

- Government shutdown impact becomes increasingly serious

- University of Michigan confirms declining customer's sentiment

- GTA6 postponed, Take-Two stock sharply declines

- AirBnb satisfied investors with earnings and outlooks

- Market declines on the opening of the Friday session

- Government shutdown impact becomes increasingly serious

- University of Michigan confirms declining customer's sentiment

- GTA6 postponed, Take-Two stock sharply declines

- AirBnb satisfied investors with earnings and outlooks

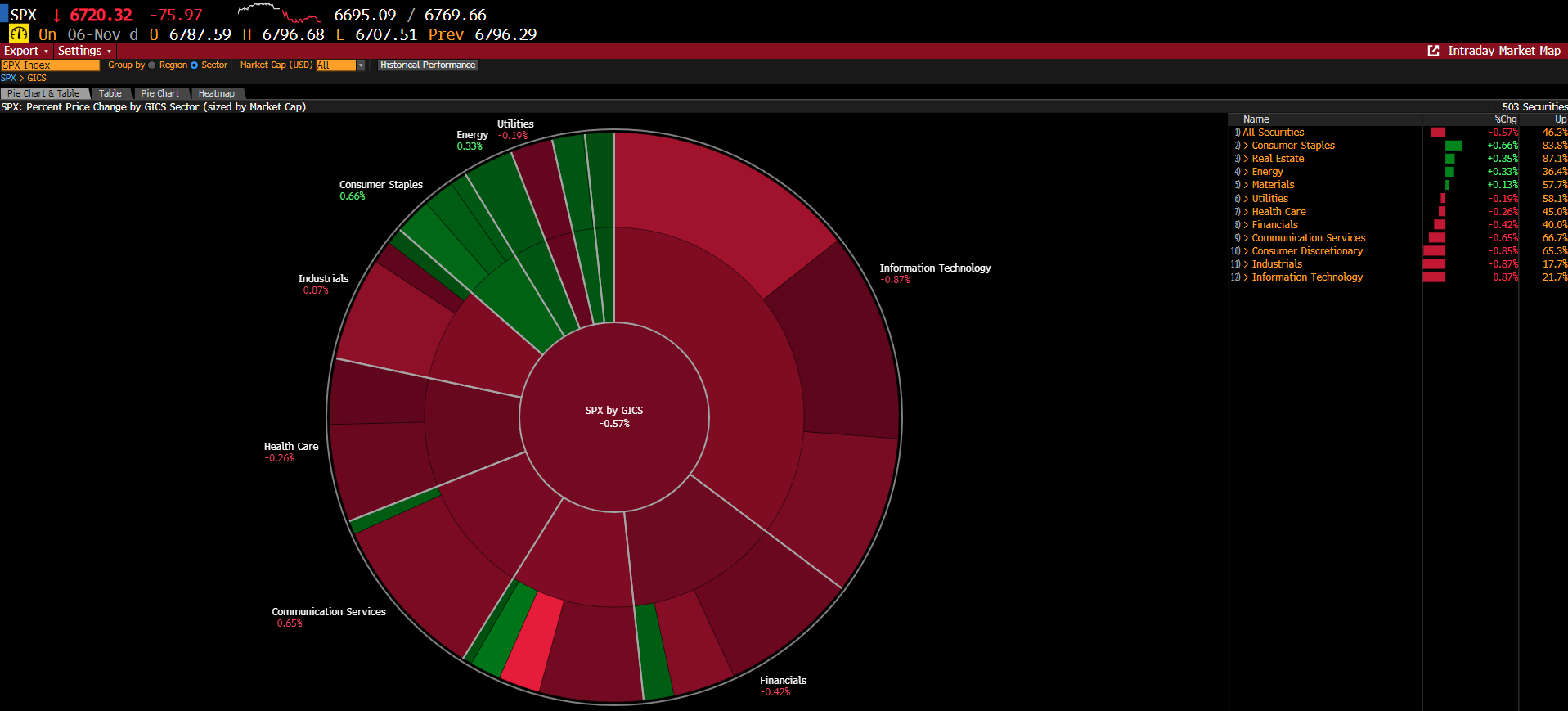

End of the week does not bring an improvement in sentiment on Wall Street. American indices are opening with significant declines for another day, which is a culmination of growing risks and changing sentiment. NASDAQ100 contracts are losing the most, down by 1.4%. S&P 500 and DOW are performing better, with contracts declining by approximately 0.6 - 1.1%.

The elephant in the room that markets have started to notice recently is the US government shutdown. The shutdown has become the longest in history. Previous episodes of this type ended with limited impact on the economy, but the situation is becoming increasingly serious, as confirmed by comments from Kevin Hassett, one of the main economic advisors to the White House. Hassett states that the effects of the shutdown are "much worse than expected." Comments from Scott Bessent, who claims that a large part of the US economy is already in a real recession, do not improve the situation. These concerns are shared by the Speaker of the House of Representatives — Johnson. A lack of quick addressing of the US budget problem could push indices significantly lower if further risks materialize.

Source: Bloomberg Finance LP

The biggest declines at the beginning of the session are recorded by technology companies. Investors clearly expect AI monetization strategies and returns from huge investments.

Macroeconomic Data:

Today, the market learned the results of the University of Michigan report on consumer sentiment and inflation expectations, which also does not allow for an improvement in market mood. The University pointed to a deterioration in sentiment among consumers in all segments. "Current conditions" recorded a particularly large decline. Short-term inflation expectations also slightly increased.

An interesting trend appeared in employment data from Canada. Unemployment fell and employment increased. However, full-time employment decreased while part-time employment saw a huge increase. The drop in unemployment can be interpreted as a seasonal rebound in a long-term upward trend, but the significant shift in employment dynamics to part-time jobs may indicate difficulties for companies in maintaining full-time hours.

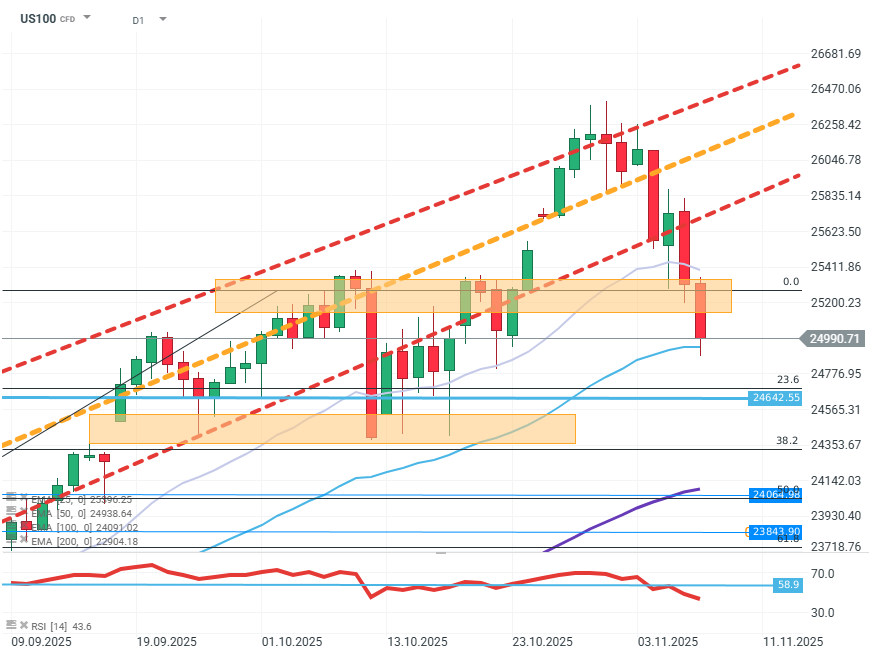

US100 (D1)

Source: xStation5

The strength of buyers has clearly exhausted at the upper limit of the upward trend line. Additionally, despite attempts, the lower limit could not be defended. A decisive break of resistance at the level of 25200 indicates a base scenario of extending the correction towards FIBO levels 23.6-38.2, where the market may seek support and a place for consolidation and further attempts to regain initiative by buyers. The RSI(14) indicator, which has entered the overbought zone, may start to work in favor of buyers.

Company News:

Expedia (EXPE.US) - The travel agency is up over 15% at market open after publishing excellent results, raising forecasts for future quarters allows for positive recommendations from investment firms.

MP Materials (MP.US) - The rare earth metals company records a 7% decline after results. Revenues fell below market expectations, but EPS performed better at -0.1, showing the company's ability to control costs and losses.

AirBnb (ABNB.US) — The short-term rental company published good results, with a particular emphasis on improved demand in the US market. The stock gains over 4%.

Take-Two Interactive (TTWO.US) — The video game publisher significantly delayed the release of the anticipated GTA6. The company loses over 6%.

Comcast (CMCSA.US) — The media company is in talks to acquire broadcaster ITV and collaborate with Warner Bros on streaming business.

Affirm Holding (AFRM.US) — The stock price of the deferred payment services company rises over 10% after the company raises its forecasts for next year.

SweetGreen (SG.US) — Another restaurant chain disappoints with results amid weakening consumer sentiment. After lowering forecasts for the end of the year, the company loses over 15%.

Globus Medica (GMED.US) — The medical equipment manufacturer rises by 30% after significantly beating investor expectations regarding revenue forecasts. Analysts share the company's confidence.

Daily summary - Government stays shut, Market declines, crypto recovers

Venezuela, what would a change in power mean for oil prices?

💷 GBPUSD Gains Ahead of BoE Decision

⏫US100 Jumps 1% on Tariffs Hopes

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.