- US and Nvidia leverage strategy unfolded by China

- Large H200 orders

- Intel buys an AI start-up

- Romba vacuum creators bankrupt

- Gold miners benefit from higher prices

- US and Nvidia leverage strategy unfolded by China

- Large H200 orders

- Intel buys an AI start-up

- Romba vacuum creators bankrupt

- Gold miners benefit from higher prices

The first session of the week on Wall Street opens with a moderately positive sentiment. All contracts on the main indices of the American stock exchange are recording increases around 0.4%.

Nvidia and China are once again in the spotlight. During Friday's negotiations, the Chinese delegation reportedly indicated to the USA that Nvidia chips are not the bargaining chip that the USA thinks they are. According to Bloomberg Tech sources, the Chinese prefer to continue investing in their own products rather than relying on ready-made solutions that the USA will use against them at the slightest opportunity.

Macroeconomic data:

- The NY Empire Index showed a decline of -3.9, noticeably below expectations of 9.6.

- Later in the day, investors can expect speeches from FOMC members - Williams and Miran.

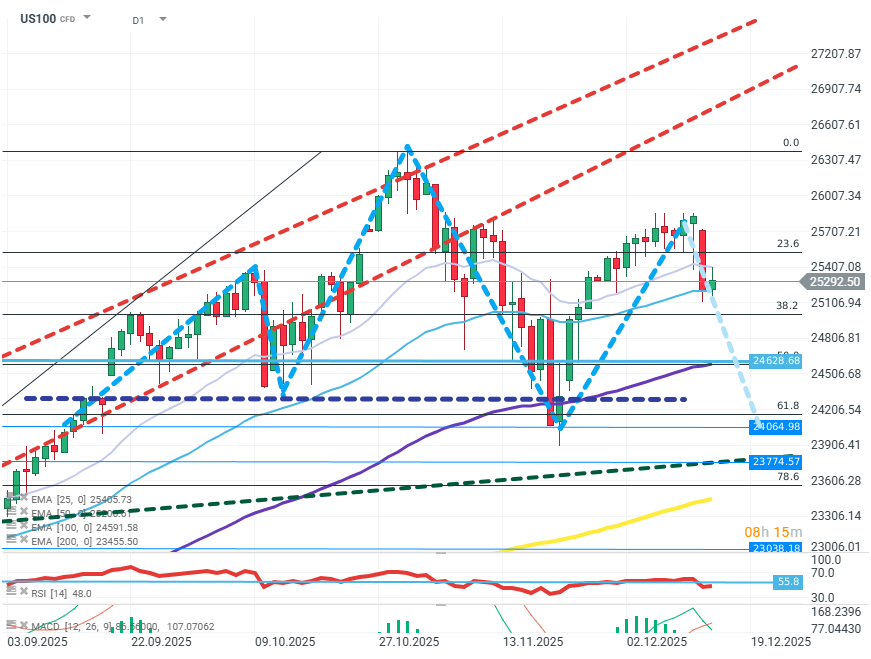

US100 (D1)

Source: xStation5

The valuation on the technology index chart continues the realization of the RGR formation. Today's session is yet another attempt to negate the formation. The key level for buyers is 26000 and FIBO 23.6. These levels must be exceeded to negate the formation. At the same time, sellers must bring the price at least around the neckline level of approximately 24200 to have hope for the realization of the formation.

Company news:

- Adobe (ADB.US) - An investment firm issues a series of negative recommendations for IT service companies, including Adobe, which is losing about 1% today.

- Immmunome (IMNM.US) - The biotechnology company published positive results of clinical trials for one of its potential products. The valuation is rising by over 20%.

- IRobot (IRBT.US) - The robot manufacturer, including the iconic "Roomba," announces bankruptcy. Valuations are falling by about 70%.

- Anglogold (AU.US) - Gold miners continue to see valuation increases on the wave of demand for precious metals. The company is growing by over 2%.

- Texas Instruments (TXN.US) - The company specializing in the production of specialized semiconductors and analog electronics is losing about 2%. The decline is caused by a negative recommendation from an investment bank, indicating low attractiveness of the company in the context of demand generated by AI.

- Nvidia (NVDA.US) - The producer of AI software and components is recovering some of the valuations lost due to the failure of Friday's negotiations. A number of Chinese companies have placed large orders for export versions of H20 chips, i.e., H200. Nvidia's valuation is rising by about 1%, although the transaction is still awaiting acceptance from the Chinese side.

- Intel (INTC.US) - The processor manufacturer purchased the AI startup SambaNova System for 1.6 billion dollars. The stock price is rising by about 1%.

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.