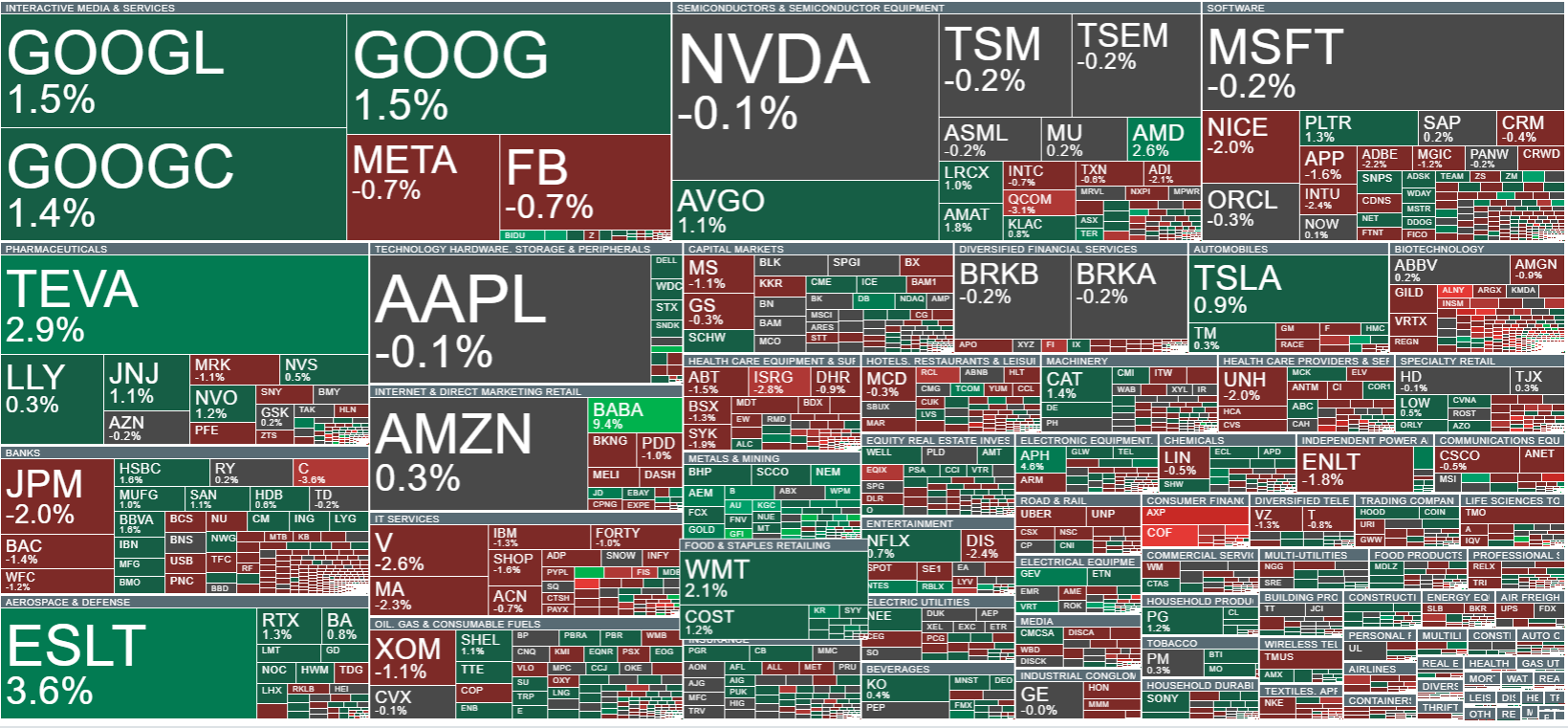

At the opening of the Wall Street session, the Dow Jones Industrial Average is down 0.5%, the S&P 500 has lost 0.2%, and the Nasdaq Composite is down 0.1%, reflecting growing investor uncertainty amid escalating political tensions surrounding the Federal Reserve. Over the past weekend, U.S. federal prosecutors launched a criminal investigation into Fed Chair Jerome Powell concerning the bank’s headquarters renovation project and his Senate testimony. The Department of Justice has issued grand jury subpoenas and suggested the possibility of charges, an unprecedented event in the modern history of the Fed. Powell has denied the allegations, calling them a politically motivated attack aimed at pressuring the central bank to lower interest rates faster, as requested by President Donald Trump’s administration.

The declines in equities are driven by investors’ concerns over the Fed’s independence and the potential increase in risk and volatility in monetary policy. Political pressure on the central bank could influence interest rate decisions, borrowing costs, and the overall stability of the U.S. economy, heightening uncertainty in both the short and long term.

Source: xStation5

US500 (S&P 500) futures are falling today amid rising tensions between President Trump and the Federal Reserve. Markets fear an escalation of the conflict and uncertainty regarding the Fed’s future decisions, which could impact interest rates, credit costs, and the stability of the U.S. economy.

Source: xStation5

Company News:

- Beam Therapeutics (BEAM.US) shares are up around 20% after announcing progress in developing precision genetic medicines and presenting the company’s strategic plans for 2026. The company highlighted recent achievements in liver-targeted genetic diseases and hematology, outlined strategic priorities for the year, and extended its projected funding runway through 2029. Expansion of the liver-targeted genetic disease portfolio is also underway, with a new program to be announced in the first half of 2026.

- Birkenstock (BIRK.US) shares are up more than 2% following preliminary fiscal Q1 2026 revenue of €402 million, reflecting a 11.1% year-over-year increase on a reported basis and 17.8% growth in constant currency. The company will release full results on February 12.

- UnitedHealth Group (UNH.US) shares are down nearly 2% after a Senate committee found the company had employed “aggressive tactics” to boost federal payments in the Medicare Advantage program. The company denies some of the allegations

Daily Summary: Conflict with the Fed Does Not Stop Wall Street📈

Nvidia in Laboratories: AI Drives Drug Discovery

Strategic Move by Apple in AI: Gemini Powers Siri 📈

Crypto News: Bitcoin builds momentum 📈 Is a triangle pattern forming on Ethereum?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.