Yesterday's speech by Fed Chairman Jerome Powell cooled investor sentiment. His remarks that asset prices are "relatively high" and that the central bank will be cautious with further rate cuts pushed indices down. As a result, the S&P 500, Nasdaq, and Dow ended the session slightly weaker. However, today the market is trying to recover some losses, with futures contracts slightly up at the opening, but unable to maintain the growth.

Markets are still analyzing yesterday's comments from Jerome Powell and other Fed members, which reminded investors of the central bank's cautious approach to further policy easing. As a result, sentiment remains volatile, and market participants are looking for further impulses, both from new macroeconomic readings this week and from data that will arrive next week. These are the ones that may set the direction for further index movements and expectations for the Fed's next decisions.

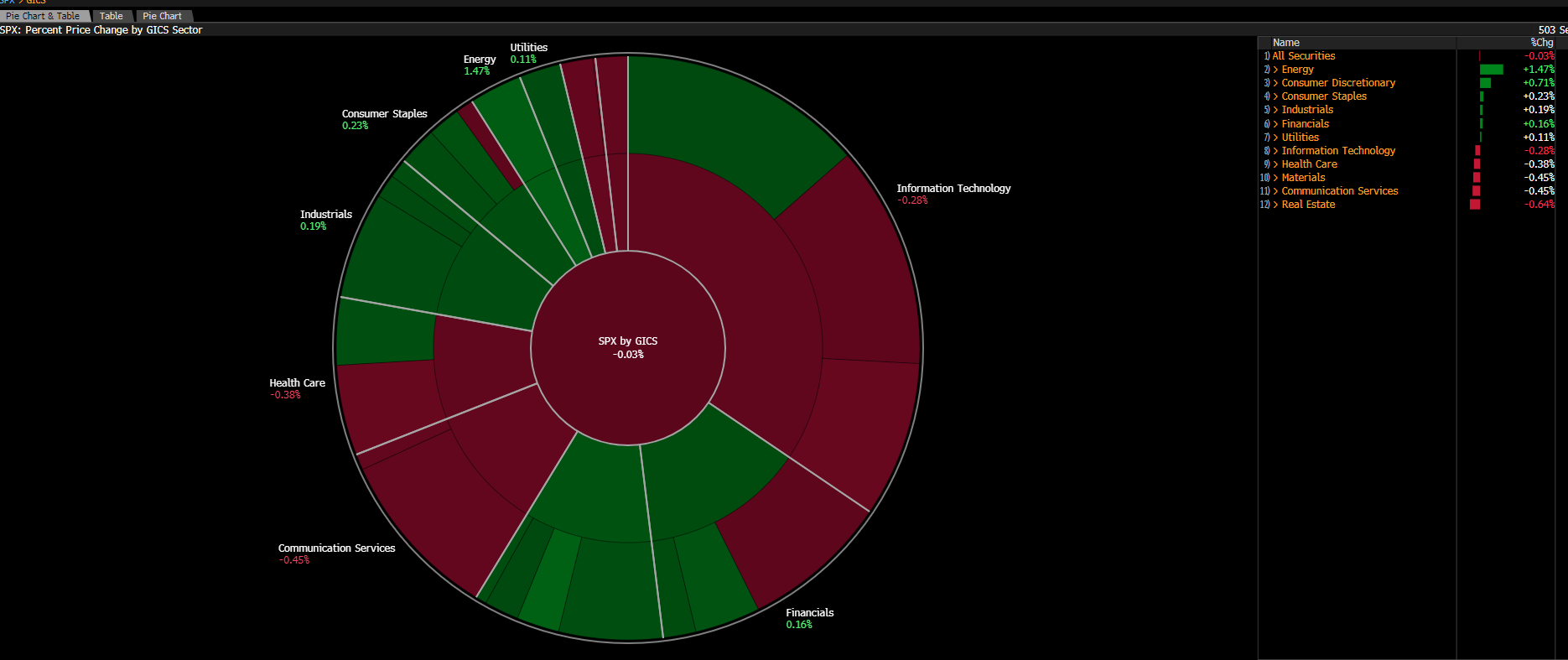

Source: Bloomberg Finance LP

Today, the real estate, health, and technology sectors are clearly losing ground. Indices are being pushed up by mining and consumer goods companies.

Macroeconomic Data:

Today at 4:00 PM, we learned about new home sales data in the USA:

-

Home sales in September: 800k (Expected: 650k, Previous: 652k)

Today's new home sales data in the USA surprised the market. Housing demand remains high despite still costly mortgage loans. This is a signal that consumers have a relatively strong financial position, and the economy continues to show resilience.

Such a strong reading may reinforce concerns about persistent inflationary pressure and put further Fed cuts into question, which may exert pressure on markets but support the dollar.

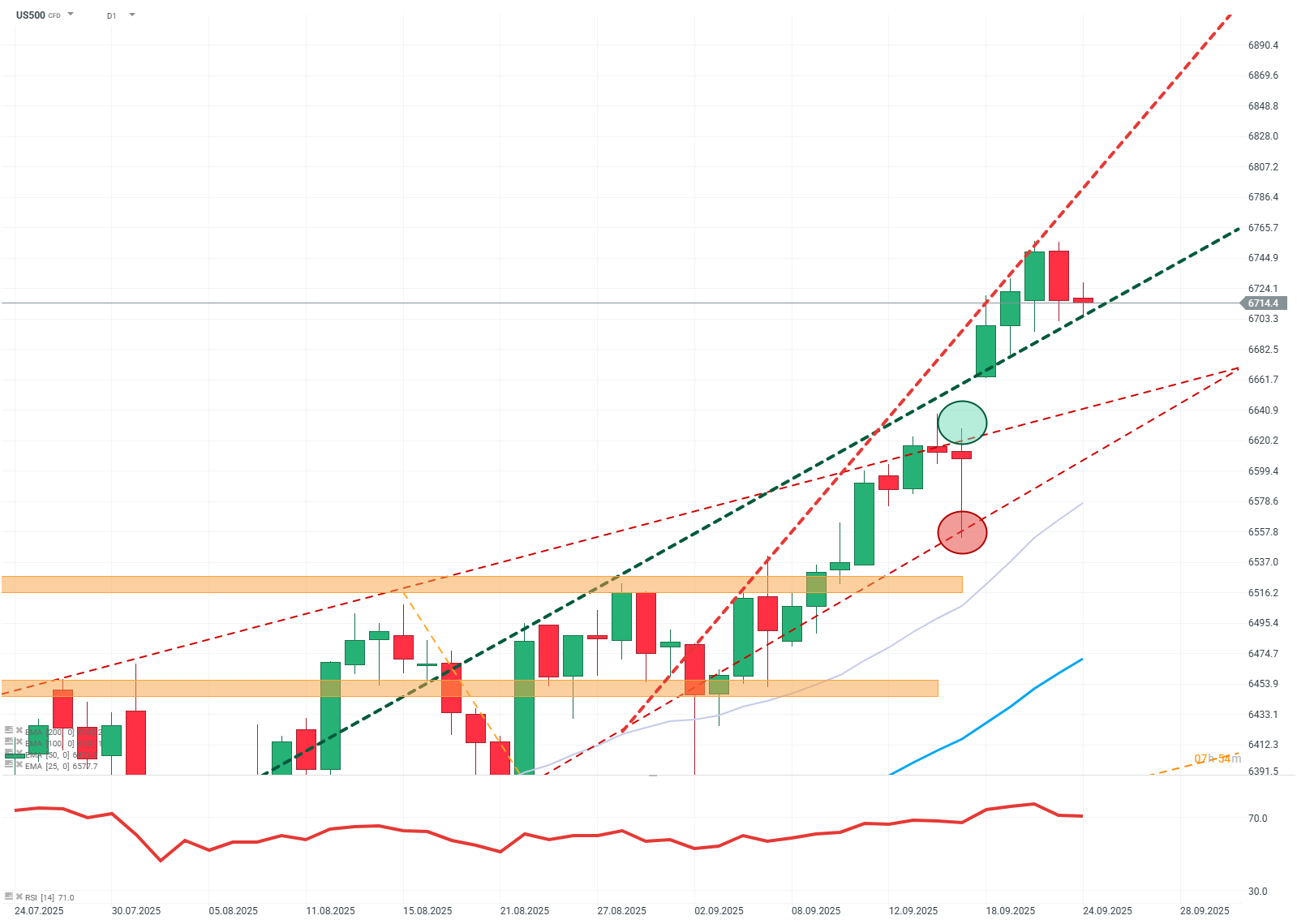

US500 (D1)

Source: xStation

The index broke out of the previous upward channel at the top and established another, steeper one. Considering the "overbought" RSI indicator, buyers may have trouble maintaining the pace. In the case of a breakout from the new channel at the bottom, a test of support around 6660 dollars is possible. If the support is breached, the most likely scenario is consolidation around 6500 dollars.

Company News:

Lithium Americas (LAC.US) - The lithium mining company soared over 50% at the opening after announcing the purchase of 10% of shares by the US government as part of strategic sector control.

Adobe (ADBE.US) - The software company is down about 1.5% after Morgan Stanley lowered its forecasts for the company.

Alibaba (BABA.US) - The Chinese e-commerce giant announced an increase in its AI development budget to 50 billion, causing the stock to rise over 8% at the opening.

Micron (MU.US) - The semiconductor manufacturer published optimistic sales forecasts on the wave of AI demand. The company is up over 2%.

Daily Summary: Strong Russel and metals, ATH in UK

Bitcoin surges 2% approaching ATH levels 📈

BREAKING: China signals readiness for record investments in the US 🗽

Copper on the raise, close to ATH again! 📈🏗️

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.