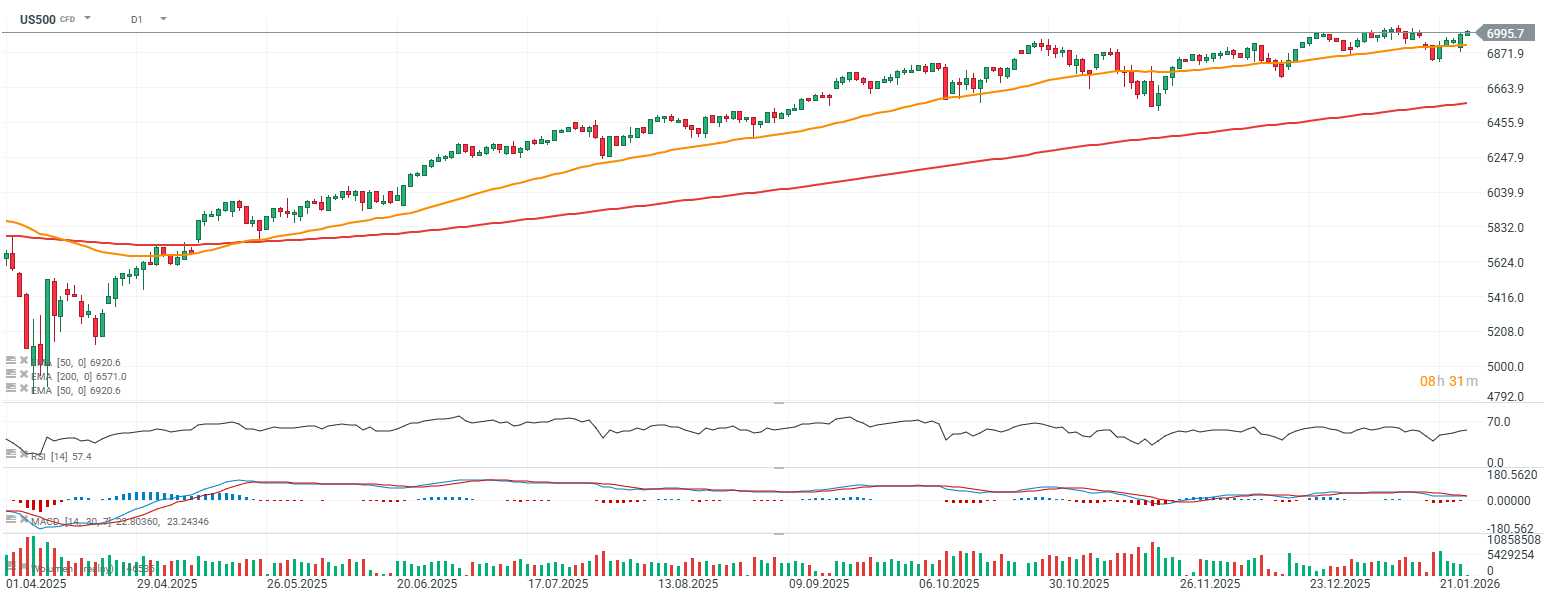

The US stock market is posting gains at the start of Tuesday’s session, with investors gradually positioning ahead of tomorrow’s Fed decision and Jerome Powell’s press conference. That event risk is likely to trigger some reshuffling in index and dollar positioning. On the macro side, today’s key release is the Conference Board index, which will offer a fresh read on US consumer sentiment. This morning’s US housing data surprised to the upside: home prices rose 0.6% m/m versus 0.3% expected and 0.4% previously, while prices across the 20 largest US metro areas increased 1.4% y/y versus 1.2% expected and 1.3% previously. In addition, the weekly ADP employment change came in at 7.5k jobs versus 8k previously. US500 is pushing toward the 7,000 level, an area that triggered two downside impulses in December.

Source: xStation5

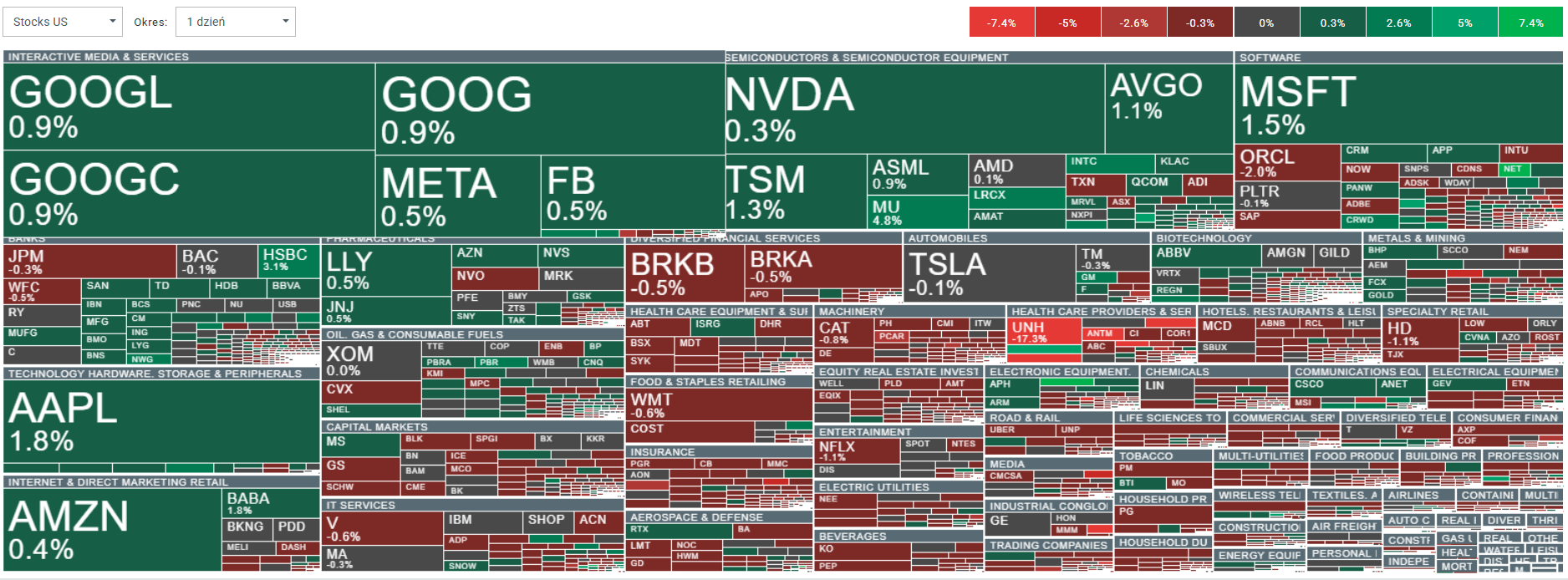

UnitedHealth shares are down more than 17%, but broader market sentiment is being supported by strength in Big Tech. Apple, Amazon, Alphabet, Meta Platforms, and Nvidia are higher, alongside semiconductor supply-chain names from Micron and Lam Research to cybersecurity player Cloudflare.

Source: xStation5

US stock market news

- US equities are showing clear sector selectivity today, with healthcare as the main source of pressure. Health insurers are sliding after the US proposed holding payments to private Medicare plans flat next year. Investors had expected mid-single-digit increases, so the market reaction has been sharp. Humana (HUM.US) is down around 15%, UnitedHealth (UNH.US) is off 17%, and CVS Health (CVS.US) is lower by 13%. Adding to the negative tone, UnitedHealth said it expects revenue to decline in 2026, which would mark its first annual contraction in more than three decades.

- In hospitality software, Agilysys (AGYS.US) is down 12% after posting fiscal third-quarter adjusted EPS that missed expectations, a typical repricing when results fail to justify valuation. Airlines are mixed: American Airlines (AAL.US) is up about 3% after fourth-quarter results, while JetBlue (JBLU.US) is down 3% after reporting a wider-than-expected loss, underlining the challenges of moving upmarket.

- In AI and cloud infrastructure, CoreWeave (CRWV.US) is up 4%, extending Monday’s rally after Nvidia invested an additional $2 billion in the company. Following the news, Deutsche Bank upgraded the stock to Buy, supporting sentiment across the AI infrastructure space.

- Sanmina (SANM.US) is among the notable laggards, down 8% after a second-quarter revenue outlook below consensus. In logistics, United Parcel Service (UPS.US) is up 3% after forecasting full-year sales above Wall Street expectations, while continuing its plan to remove less profitable package volume from its network.

- In autos, General Motors (GM.US) is up roughly 4% after guiding for profit growth of up to $2 billion this year and signaling a higher dividend and buybacks. In defense, Northrop Grumman (NOC.US) is down 1% after issuing a full-year adjusted EPS outlook below consensus, while small, space sector company Redwire (RDW.US) is up 15% after winning a contract tied to a US missile defense program. The biggest, US defense contractor, RTX Corp. (RTX.US; formerly known as Raytheon Corp) is gaining about 3% after beating expectations on fourth-quarter adjusted EPS.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.