-

US500 and US100 climb in first post-holiday session

-

Technology stocks post robust gains in the final trading session of the week

-

Investors bank on a sustained "Santa Rally" and continued momentum into early January

-

US500 and US100 climb in first post-holiday session

-

Technology stocks post robust gains in the final trading session of the week

-

Investors bank on a sustained "Santa Rally" and continued momentum into early January

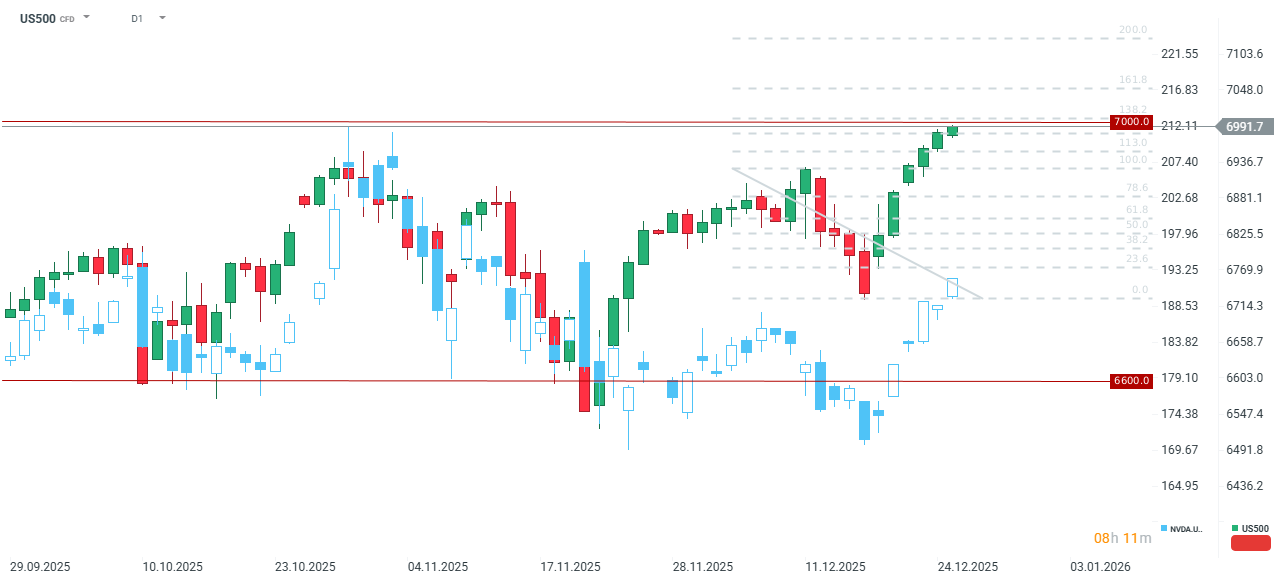

Wall Street opened in a measured mood following the Christmas break. Futures for the benchmark S&P 500 (US500) are trading at all-time highs, while the tech-heavy Nasdaq 100 (US100) sits approximately 2% below its intraday record set in late October. Investors are poised to close the year near peak levels, underpinned by expectations of further US interest rate cuts and resilient corporate earnings. The S&P 500 has gained nearly 18% this year, marking its third consecutive year of expansion following two years of returns exceeding 20%.

The US500 rose 0.11% during Friday’s session, potentially marking the sixth consecutive day of gains for Wall Street. As the index approaches the psychological 7,000-point threshold, analysts suggest further upside remains, given that heavyweights such as Nvidia and other tech majors are still trading below their individual historic peaks.

Corporate News

- Nvidia (NVDA.US): The chipmaker has announced the acquisition of AI startup Groq for $20bn, marking the largest deal in Nvidia’s history. By acquiring Groq, Nvidia gains access to LPU (Language Processing Unit) technology, which offers significantly higher performance for large language models compared to traditional GPUs. Given Nvidia’s dominant market share, the transaction is expected to trigger rigorous antitrust scrutiny. Nvidia shares rose 0.7% at the open.

- Micron (MU.US): Shares continued their ascent, adding to a monthly gain of over 20% driven by robust growth forecasts. As a primary manufacturer of memory essential for scaling processor sales, the company gained 1.5% in early trade.

- Biohaven (BHVN.US): The biotech firm plummeted over 11% at the open after its experimental depression treatment failed to meet its primary endpoint in a mid-stage trial. This latest setback compounds a difficult year for the firm, with the stock having lost nearly three-quarters of its value in 2025.

- Coupang (CPNG.US): The South Korean e-commerce giant surged over 8% following reports that leaked company data had been successfully deleted by a suspect.

- Precious Metals Miners: Producers, particularly those focused on silver, saw sharp gains at the open as silver prices hit fresh records of $75 per ounce. First Majestic, Coeur Mining, and Endeavour Silver all posted gains in the region of 3%.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.