- Lululemon soars on potential strategy pivot

- Gold miners benefit from higher prices of precious metals

- Broadcom disappoints with AI-driven sales outlook

- Trump prevents state-level AI regulation

- Promise of loosened regulation sends cannabis stocks higher

- Lululemon soars on potential strategy pivot

- Gold miners benefit from higher prices of precious metals

- Broadcom disappoints with AI-driven sales outlook

- Trump prevents state-level AI regulation

- Promise of loosened regulation sends cannabis stocks higher

At the beginning of Friday's session in the USA, one can observe the continuation of the nervous sentiment from yesterday. On Thursday, the main Wall Street indices fell by over 1%, but by the end of the session, buyers managed to maintain the initiative. The session opens with a drop in US 100 contract prices by almost 1%. The market may once again try to discount the sustainability of the AI boom and whether the cuts expected by the FED are adequate to the economic condition.

Austan Goolsbee, a member of the FOMC known for his conservative approach to lowering rates, will have his speech today. Markets can expect insight into the hawkish side of the FOMC's perspective.

Donald Trump signed a decree prohibiting individual states from introducing local regulations regarding AI. The Secretary of Commerce has 90 days to evaluate existing state-level laws that would conflict with the new document written in close collaboration with representatives from Google, Nvidia, OpenAI, and Apple.

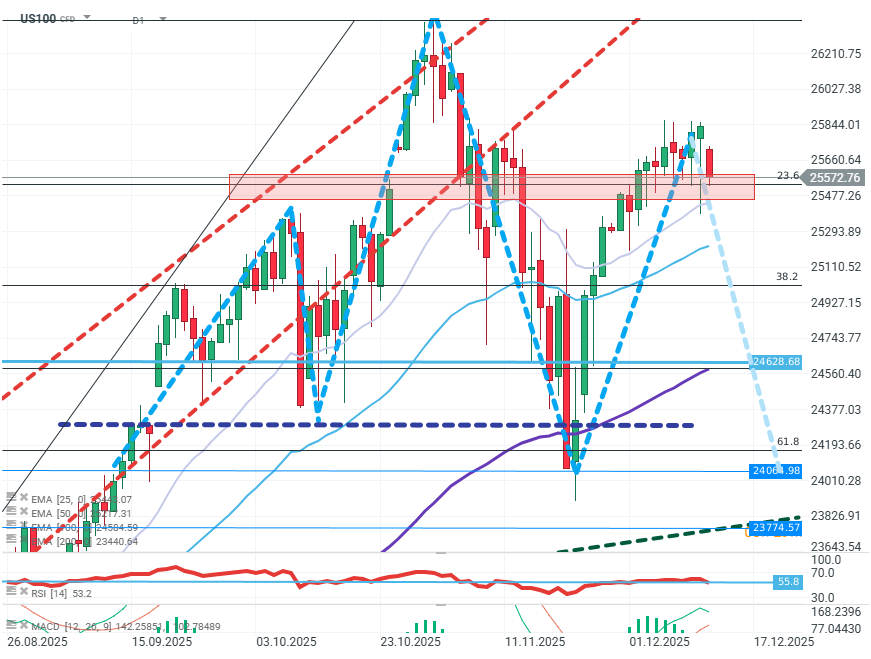

US100 (D1)

Source: xStation5

On the chart, we can observe a formation that could potentially turn out to be an extended H&S pattern. For buyers, the key task will be to defend the FIBO 23.6 and FIBO 50 levels, which will allow negating the realization scenario. Support for demand will not only be the FIBO levels but also the EMA100 average. Potentially significant, one can also observe a sudden narrowing of the distance between the signal line and the MACD average, which may give the first signals of valuation weakness.

Company News:

- Lululemon (LULU.US) - The company gains 12% after the resignation of the current CEO.

- Broadcom (AVGO.US) - The specialist electronics manufacturer loses over 7% after disappointing sales forecasts.

- Roblox (RBLX.US) - The online platform/game operator loses about 4% after receiving a negative recommendation from an investment bank.

- Eli Lilly (LLY.US) - The American FDA plans to accelerate the drug licensing cycle.

- Newmont Corp. (NEM.US) - Mining companies dealing with gold gain on the wave of precious metal increases. The company grows by 1.5%.

- Quanex Building (NX.US)—The designer and manufacturer of building components grows by 25% after significantly beating expectations for Q4 results. Earnings per share amounted to 83 cents per share compared to forecasts of about 52%, EBITDA and net sales fell.

- Lockheed Martin (LMT.US)—Switzerland reduced its order for F-35A aircraft to maintain the current budget allocated for order fulfillment after unexpected price increases.

- Canopy Growth (CGC.US) - Companies involved in the production and distribution of marijuana grow after comments from Donald Trump, who announced the lifting of some restrictions related to the substance trade. The price rises by about 25%.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.