- Wall Street indices open slightly higher

- US500 tests 4,745 pts resistance zone

- Boeing drops 8% after issues with 737 Max 9 jets

Wall Street indices launched today's trading slightly higher, following small gains made by European indices earlier today. S&P 500 gained 0.2% at session launch, Dow Joens traded 0.1% higher while Nasdaq jumped 0.5%. Small-cap Russell 2000 dropped 0.4%.

Economic calendar for today's US session is empty. Investors will only be offered a speech from Atlanta Fed chief, Raphael Bostic at 5:30 pm GMT. US economic calendar gets more interesting in the second half of the week with US CPI data for December on Thursday and Q4 banking earnings on Friday.

Source: xStation5

Source: xStation5

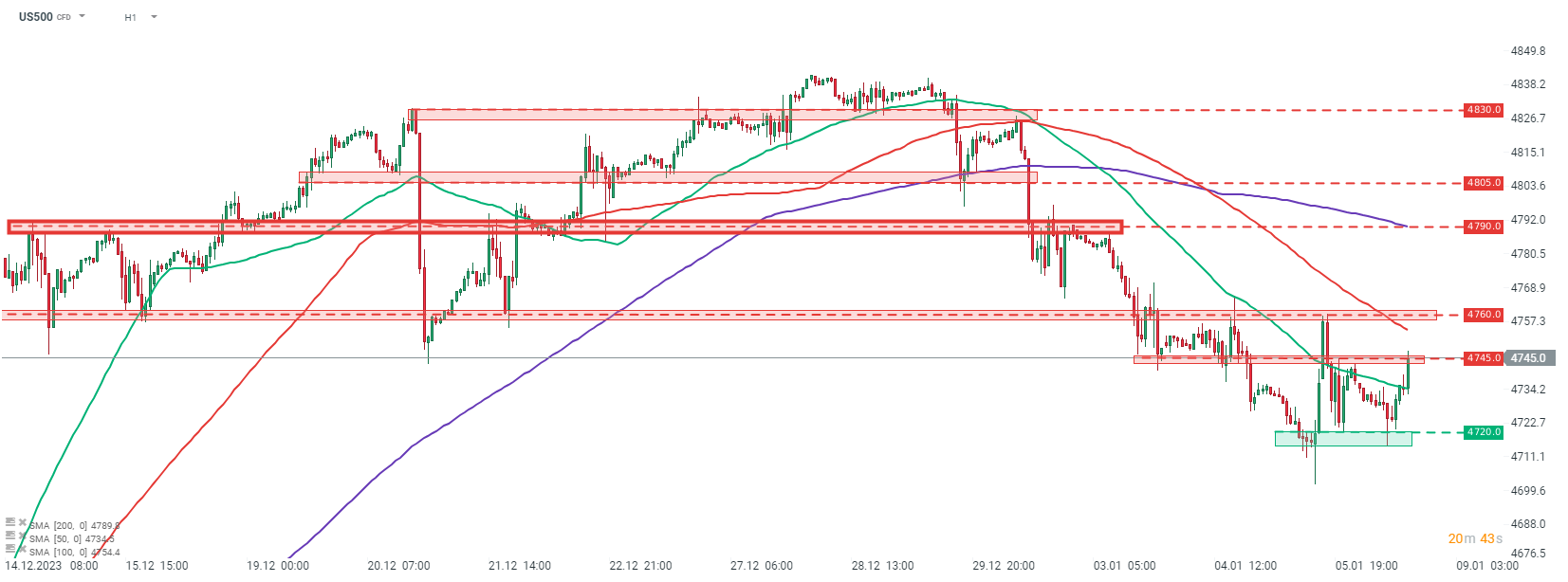

S&P 500 futures (US500) are trading higher today, with gains accelerating after launch of the US cash session. Taking a look at the index at H1 interval, we can see that bulls are attempting to break above the 4,745 pts resistance zone, that was tested a few times recently. Should buyers clear this area, the next resistance in-line can be found in the 4,760 pts area. Breakout would make short-term technical situation more bullish and, given a light newsflow, technicals may play a key role in today's price moves.

Company News

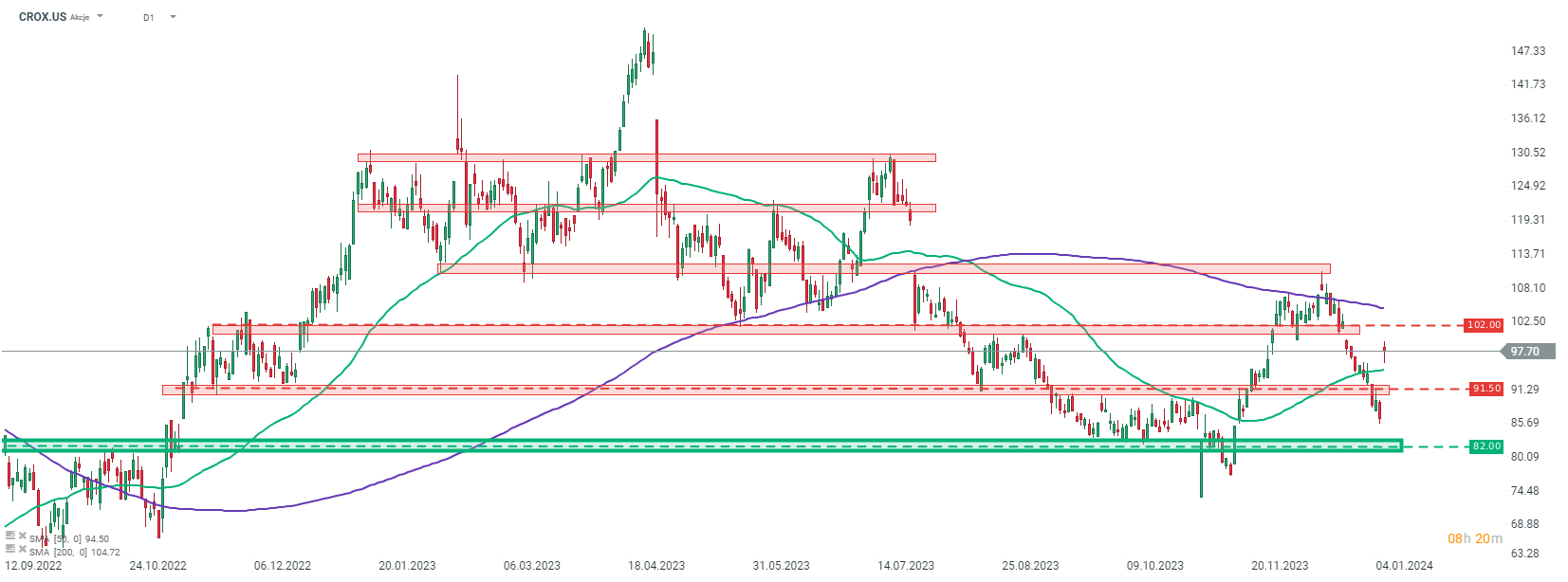

Shares of Crocs (CROX.US) rally today after company released updated full-year revenue guidance. Crocs said that it now expects 2023 revenue to be 11% YoY higher at around $3.95 billion. The outlook was upgraded on the back of a strong holiday season, with Q4 revenue now expected to have grown 1% YoY, while previous guidance called for a 1-4% drop.

Moderna (MRNA.US) said that its 2023 vaccine sales reached $6.7 billion, marking a massive drop from over $18 billion reported for 2022. Nevertheless, it is still above the $6 billion target the company has set for the previous year. Market share of Moderna's vaccine in the US increased from 37% in 2022 to 48% in 2023, but fewer people overall were interested in getting vaccine shot last year, what drove the sales plunge.

Shares of Boeing (BA.US) launched today's trading around 8% lower after a panel in one of Boeing 737 Max 9 jets owned by Alaska Airlines blew out mid-flight on Friday. US regulator ground over 170 aircraft to investigate. We wrote more on it in the earlier post. Shares of Spirit AeroSystems (SPR.US), a Boeing supplier, opened 13% lower.

Analysts' actions

- Dell Technologies (DELL.US) upgraded to 'overweight' at JPMorgan. Price target set at $90.00

- NetApp (NTAP.US) downgraded to 'underweight' at JPMorgan. Price target set at $87.00

- Garmin (GMRN.US) downgraded to 'neutral' at JPMorgan. Price target set at $135.00

- DoorDash (DASH.US) upgraded to 'buy' at Jefferies. Price target set at $130.00

- GitLab (GTLB.US) upgraded to 'buy' at Mizuho Securities. Price target set at $73.00

- ZoomInfo Technologies (ZI.US) downgraded to 'underperform' at RBC. Price target set at $14.00

Crocs shares (CROX.US) rally after company upgraded full-year revenue outlook. Stock launched today's trading with an over-10% bullish price gap but erased some gains after trading began. A near-term resistance zone to watch can be found ranging below $102.00 mark. Source: xStation5

Crocs shares (CROX.US) rally after company upgraded full-year revenue outlook. Stock launched today's trading with an over-10% bullish price gap but erased some gains after trading began. A near-term resistance zone to watch can be found ranging below $102.00 mark. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.