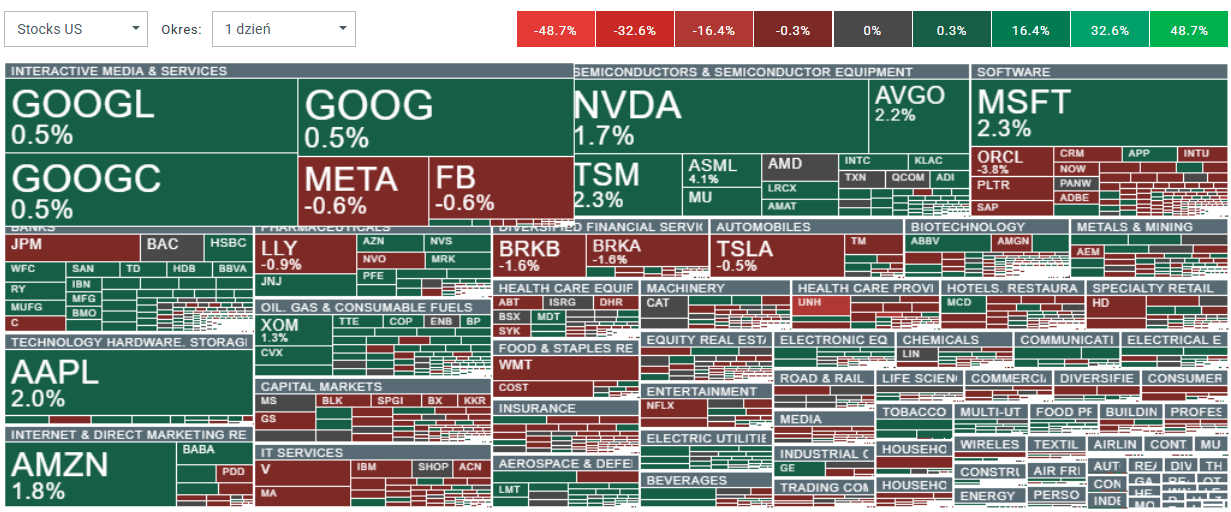

Shares of the largest U.S. technology companies are supporting gains in Nasdaq 100 (US100) futures ahead of tomorrow’s key risk events: the Fed decision (6 PM GMT, with Powell’s press conference at 6:30 PM GMT) and after-hours earnings from Meta Platforms (META.US) and Microsoft (MSFT.US). Both companies will report Q4 2025 results after the U.S. close and will likely shape expectations into what is effectively the “peak” of the current U.S. earnings season. Broader U.S. equity sentiment is also being helped by a sharply weaker dollar today.

- Big Tech is clearly outperforming the wider market. Nvidia, Apple, Amazon, and Microsoft are up close to 2%, while additional momentum is coming from semiconductors. Shares of Taiwan Semiconductor and ASML are rising even more than the flagship U.S. tech names, giving the index a meaningful tailwind.

- Strength in mega-cap chip stocks is more than offsetting visible weakness in software, where Oracle is down nearly 4%. The outperformance of large-cap leaders may also reflect a degree of portfolio rebalancing, after the “Mag 7” names were among the weakest parts of major U.S. indices for months.

- Looking at the S&P 500 companies earnings season so far (FactSet data as of January 23, with 13% of S&P 500 reported), 75% have beaten net profit expectations and around 70% have topped revenue estimates. Current year-over-year EPS growth for the S&P 500 is running near 8%, but after Big Tech reports that figure will likely rise materially, potentially toward roughly 15% YoY.

- This quarter marks the 10th consecutive quarter of year-over-year EPS growth for the index. The S&P 500 is currently valued at around 22x earnings, roughly 10% above its 5-year average and close to 15% above its 10-year average near 19.

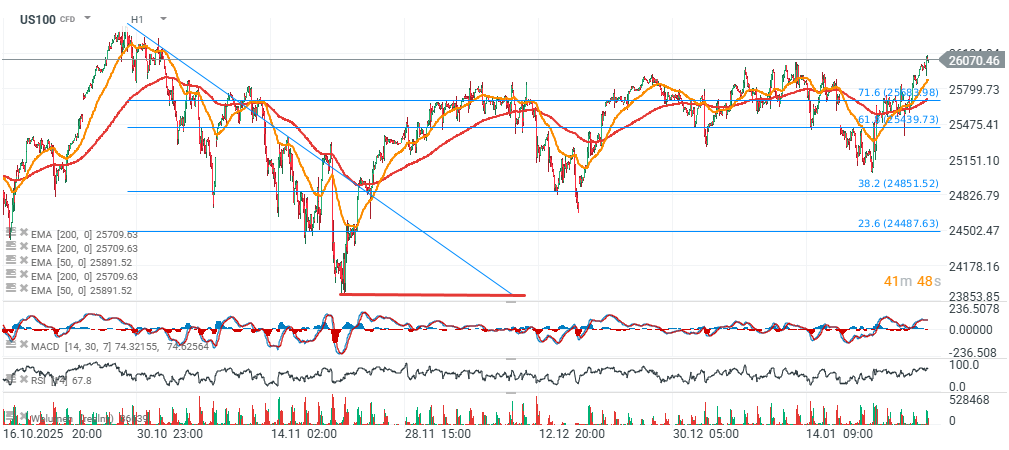

US100 (H1 timeframe)

Source: xStation5

Sentiment across the broader equity market is generally mixed today, but BigTech supports Nasdaq 100 momentum. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.