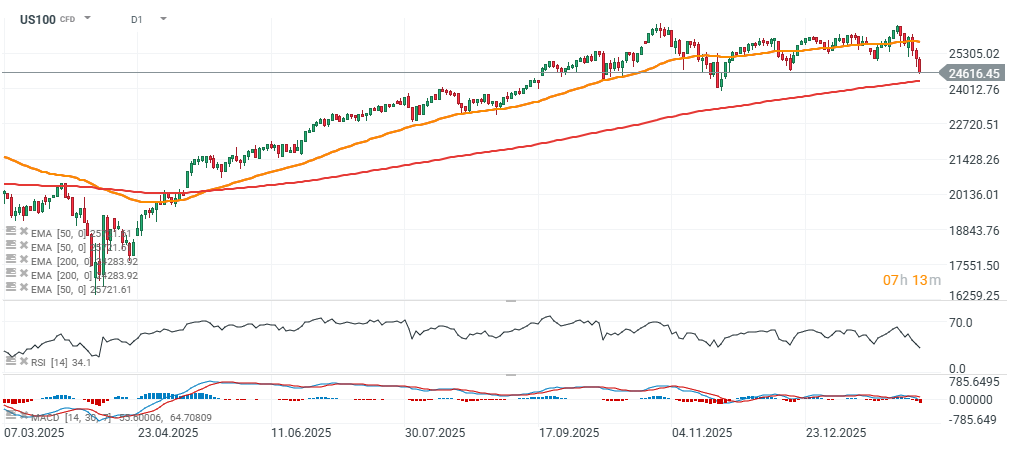

Nasdaq 100 (US100) futures are extending the early-week sell-off and are down more than 2% today. Weak sentiment in the technology sector has been further intensified by weaker-than-expected labor market data. Jobless claims rose more than forecast, while Challenger-reported layoffs surged by over 200% year-on-year in January. As a result, US100 is now trading only about 300 points above the 200-session exponential moving average (EMA200), marked by the red line. Cash indices are also under pressure: the DJIA and S&P 500 are down around 1.2%, while the small- and mid-cap Russell 2000 is down more than 1.3%.

Key US labor-market figures

• Initial jobless claims: 231k vs 212k expected and 209k prior week

• JOLTS (December): 6.54m vs 7.25m expected and 7.14m prior

• Challenger (January): 108.4k vs 35.5k in December

US100 (D1 timeframe)

The daily RSI for Nasdaq 100 futures is falling to around 34 today, a level not seen since the autumn correction. The EMA50 is located near 25,700 points.

Source: xStation5

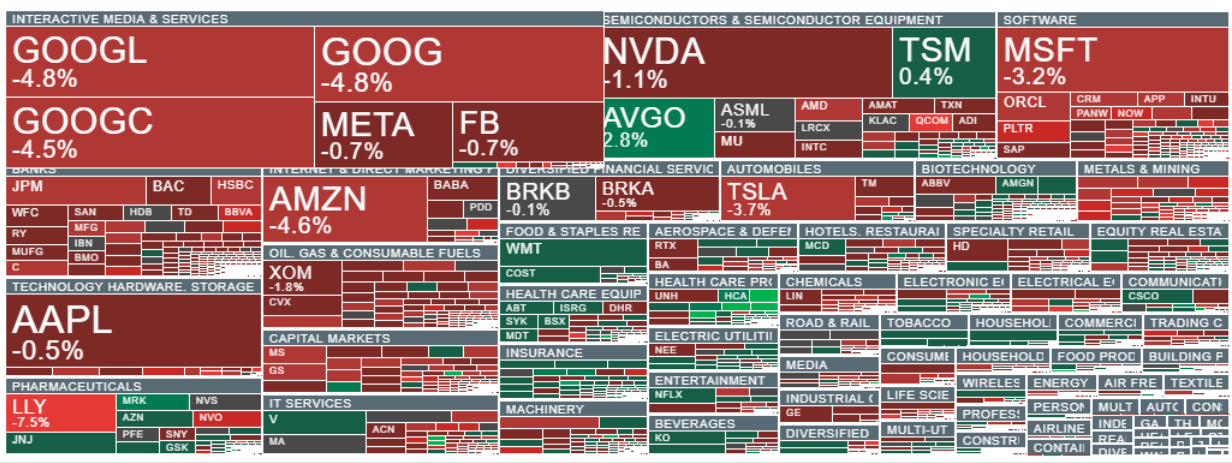

Negative sentiment in the software space has now spread across the broader tech sector, and the pullback is visible across almost all sub-sectors. Semiconductors are also declining, with Broadcom (AVGO.US) and TSMC (TSM.US) standing out as the only notable gainers. Heavy losses are seen in major names: Amazon and Alphabet (down nearly 5%), Microsoft (down more than 3%), and Tesla (down nearly 4%). Sentiment is also weak in financials and banking, where concerns over loan exposure to the software sector and a broader deterioration in market mood have triggered profit-taking. Recent gains are reversing in obesity drug maker Eli Lilly (LLY.US) as well, with the stock down more than 7%.

Source: xStation5

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

Disaster for Volvo shares. Is this the end of an iconic brand?

Stock of the week: Alphabet is no longer just a search engine (05.02.2026)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.