Recent weeks have seen a rapid reversal of sentiment and the short-term trend on the stock market. Over the past three weeks, the broad S&P 500 index has lost more than 5%, and the Nasdaq 100 has lost more than 7%.

- Although there is no single direct cause for this correction, and the US earnings season has been fairly solid, it seems that the main reasons remain: uncertainty about the state of the economy, in the absence of the latest data (government shutdown), high stock valuations, and the risk of excessive concentration of capital in a narrow group of selected companies' shares.

- Investors are beginning to price in less optimistic scenarios and are uncertain about the continued AI bull market, as we can see, for example, in the declines in CoreWeave (CRWV.US) and Japan's Softbank — perceived as the “most aggressive” players in the artificial intelligence infrastructure industry.

- Concerns about the impact of the government shutdown on the economy, weaker consumer sentiment, and a weakening labor market. One clear indication of such weakness is the recent results of Home Depot (HD.US), which is clearly warning of an economic downturn.

- In these circumstances, the FOMC has begun to signal in recent weeks that a rate cut in December is not as certain as it seemed to the market until recently. The chances of a rate cut in December have fallen from around 40% last week to 20% this week. Stock valuations reacted “allergically” to this scenario.

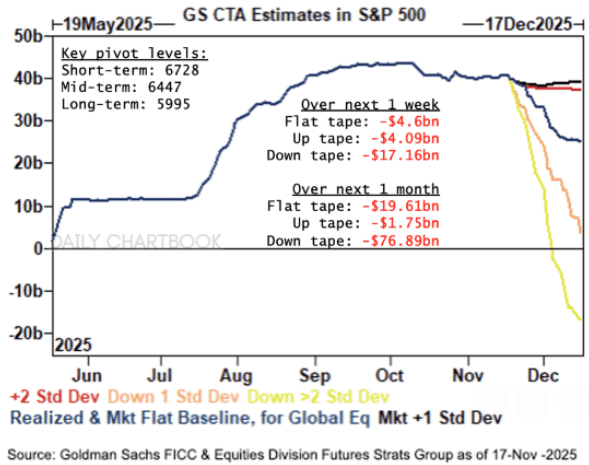

After the S&P 500 index fell below 6,728 points, CTA funds joined the sellers. Due to the specific nature of their activities and strategies, they did not contribute to the declines as long as the index remained above the 50-day EMA. Now, however, so-called “systemic strategies” are complicating Wall Street's chances for a sudden reversal of sentiment and a rebound, as CTAs have to sell “along with the market". In the short term, Nvidia's results and the FOMC's position, which the central bank will communicate on Wednesday, remain indicators for the further direction of the market.

Źródło: Goldman Sachs FICC

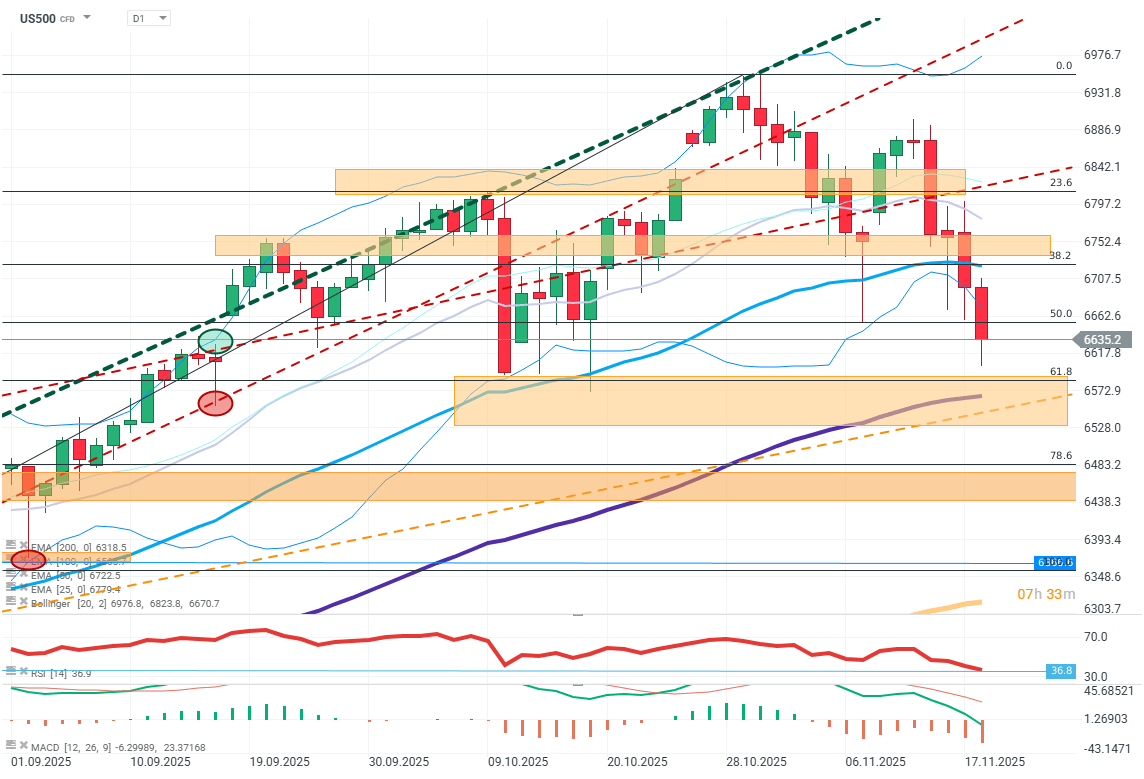

US500 (D1)

Futures on S&P 500 (US500) loses more than 1% today, falling below EMA50.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.