- JPY weakens sharply on political risk

- Markets price in looser policy mix

- Intervention risk rises near key levels

- JPY weakens sharply on political risk

- Markets price in looser policy mix

- Intervention risk rises near key levels

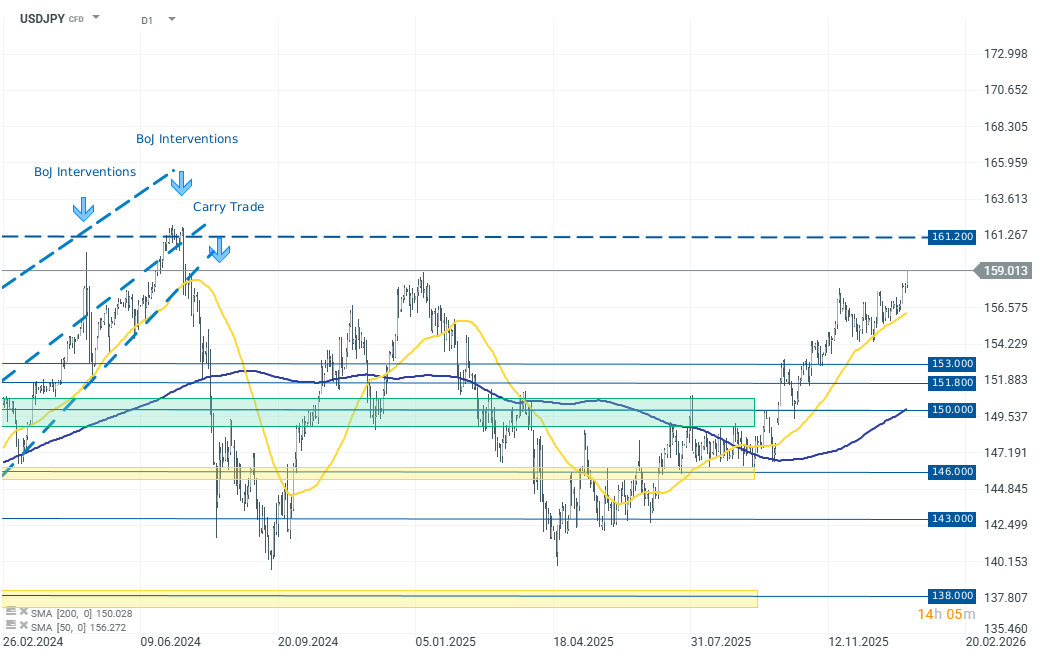

The Japanese yen has come under strong pressure again following reports that Prime Minister Sanae Takaichi is preparing to dissolve the lower house of parliament as early as the start of the legislative session on January 23. This would pave the way for snap elections, potentially on February 8 or 15. USDJPY climbed to 158.9500, marking the yen’s weakest level since July 2024. The currency also hit record lows against the euro and Swiss franc, and its weakest level versus the British pound since 2008. Markets have interpreted this political move as strengthening Takaichi’s mandate and increasing the likelihood of further fiscal expansion, reinforcing expectations that Japan will maintain an accommodative policy mix.

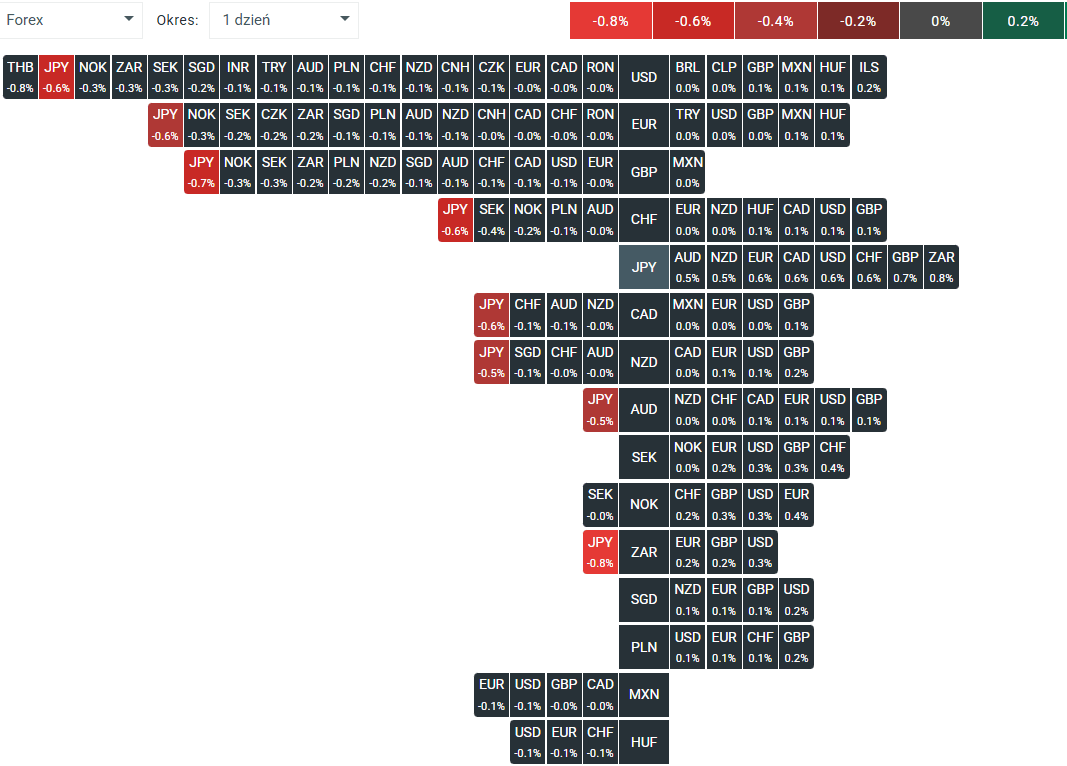

JPY is by far the weakest G10 currency, source: xStation 5

The sell-off in the yen reflects the growing prominence of the so-called “Takaichi trade,” under which investors price in looser fiscal policy and continued pressure on the Bank of Japan to delay monetary policy normalization. Political consolidation ahead of budget negotiations raises the risk of higher debt issuance.

Japanese authorities attempted to limit the scale of the declines through verbal intervention. Finance Minister Satsuki Katayama confirmed that, in talks with US Treasury Secretary Scott Bessent, she expressed concerns about the “one-sided” depreciation of the yen.

USDJPY is trading near multi-month highs, up 0.60% on the day to around 159.0000 at the time of writing, and approaching the psychological 160.00 level.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.