CBOE VIX volatility index futures (VIX) are down nearly -0.7% today, extending strong downward momentum. The decline is being driven by several factors that make equities and risk assets appear attractive to investors despite historically high valuations.Today, futures on US indices such as US100, US500 gain 0.1 - 0.15% but US30 and US200 are almost 0.3% higher.

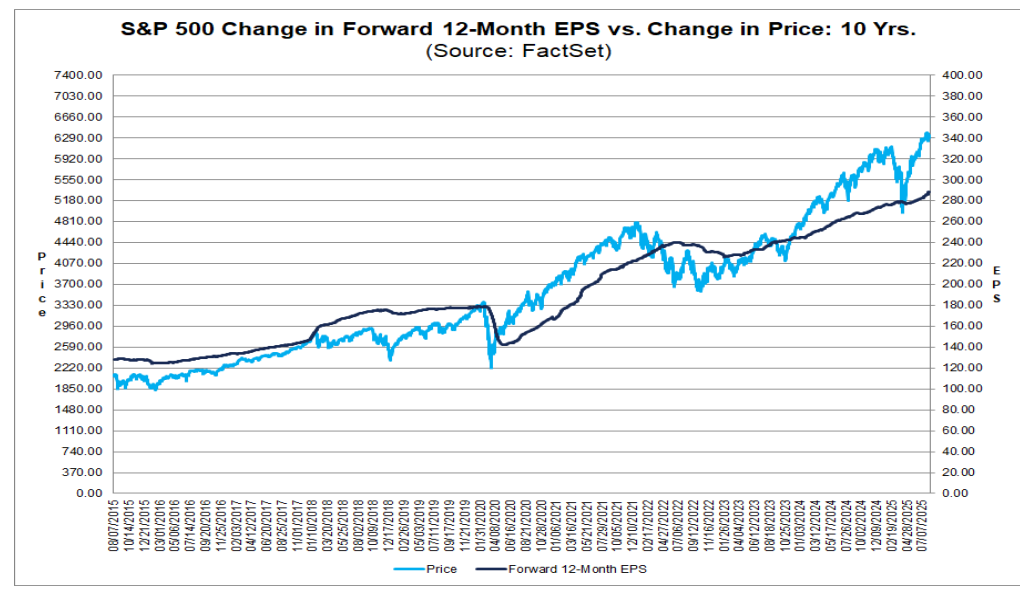

- The forward 12-month price-to-earnings ratio for S&P 500 companies stands at 22.1, versus the 5-year average of 19.9 and the 10-year average of 18.5. Now, investors are hoping that the Putin–Trump summit in Alaska will ease geopolitical tensions and perhaps trigger a sharper decline in energy commodity prices — especially if a peaceful resolution is truly reached in Ukraine and the U.S. eases sanctions on Russian resources, including oil. Such a scenario would reduce the inflation risk.

According to the Bank of America FMS survey, 78% of fund managers expect U.S. interest rate cuts within the next 12 months, while the probability of recession has dropped to its lowest since January 2025. Allocations to equities are also increasing. The survey sees the highest odds for the Fed chair position going to Waller, closely followed by Kevin Hassett. The biggest risks remain a trade war and higher inflation, which could prevent the Fed from cutting rates.

VIX chart (H1 interval)

VIX futures are trading within a downward price channel, with potentially strong resistance likely to emerge around 17.3 (50-period exponential moving average – EMA50).

Source: xStation5

After each of the last two VIX rollovers, the index has returned to a strong downward trend, and expectations of U.S. rate cuts mean investors see little need to “hedge” volatility, despite potentially favorable seasonal patterns for the index in the coming weeks.

Source: xStation5

First, the U.S. earnings season has been very solid, with Big Tech companies reporting rising revenues and profits, easing concerns over “stretched valuations.According to FactSet, S&P 500 companies’ earnings rose by an average of 11.8%, and as many as 81% of firms reported both earnings and revenues above Wall Street forecasts. Forty companies issued positive guidance for the next quarter, compared with 38 that issued negative outlooks.

Source: FactSet

VIX drops 10% amid Wall Street rebound attempt🗽

3 markets to watch next week - (17.10.2025)

Fed's Musalem remarks on the US economy and tariffs🗽

Precious metals decline 📉Gold down 2%; Silver loses 4%

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.