A wave of optimism on Wall Street is pushing CBOE VIX futures lower. Over the past 30 years, there have been only a handful of instances when the VIX surged by roughly 25% in a single session and then closed the following day about 15% lower. Historically, this pattern has tended to precede weaker performance in both the S&P 500 and the Nasdaq 100 over the days that followed, particularly over a one-week horizon.

- Even so, equities are extending gains today as well. Hopes for easing tensions around Greenland, along with the decision to suspend an additional 10% tariff rate on eight EU countries, have calmed markets that had previously been pricing in the risk of an escalating trade war.

- From a dealer gamma perspective, yesterday’s key positive-gamma area for S&P 500 options was around 6,875, while the gamma flip level—where dealers are forced to “follow” the market and buy into strength - sat near 6,847.

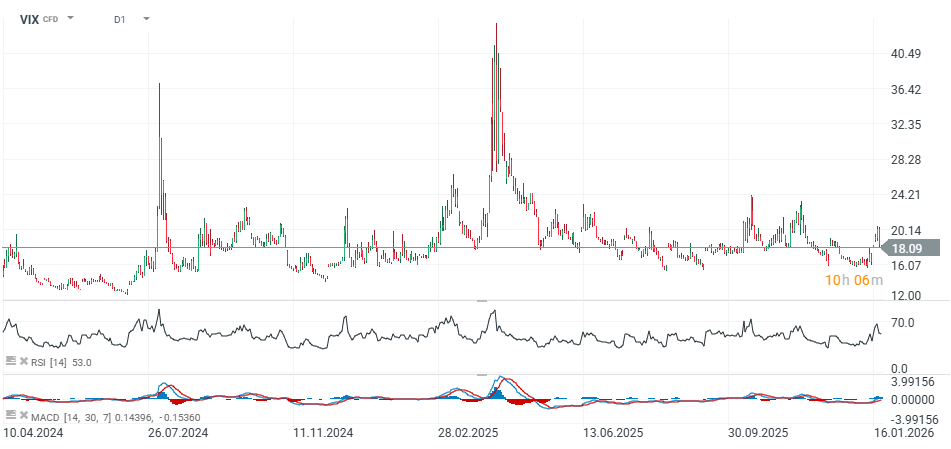

- If the uptrend in equity indices holds, the VIX could retreat again toward the 16 area. Conversely, if sentiment reverses sharply and the US equity sell-off deepens, a retest of the 21 zone cannot be ruled out (the upper side of the price channel).

VIX index (H1 timeframe)

Source: xStation5

VIX index (H1 timeframe)

Looking at the VIX on a higher timeframe, we can see that sharp pullbacks have often preceded sudden volatility spikes.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.