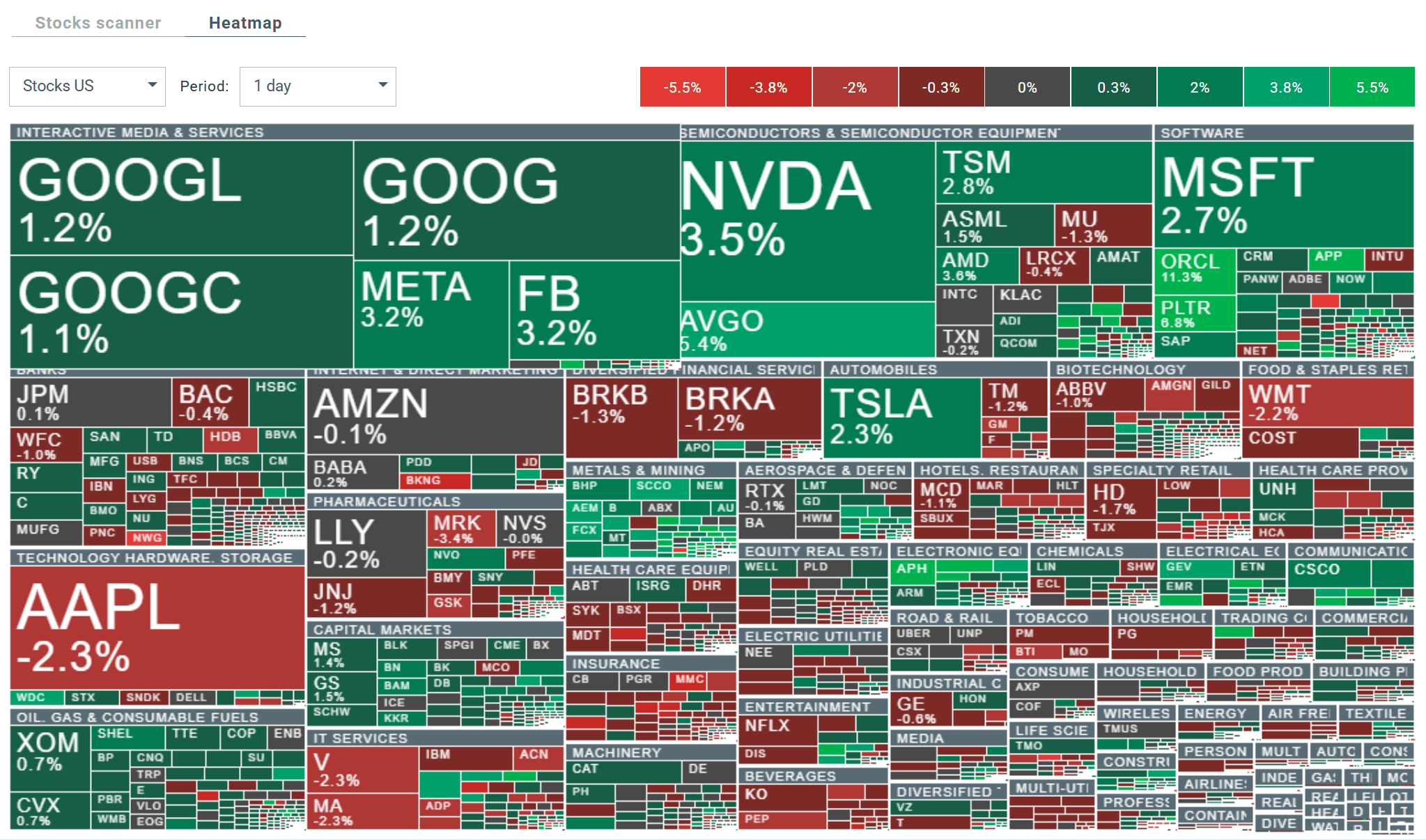

Sentiment at the end of the day in Europe and in the second phase of the Wall Street session is clearly improving. The US100 contract is already up more than 1%, while the US500 and US2000 are up 0.7% and 0.8% respectively. Today's gains are primarily driven by large-cap technology companies. Shares in companies such as Oracle, Palantir and Applovin are gaining between +7% and +15%. At the same time, Nvidia is up 3.5% and Broadcom 5.4%.

Source: xStation

The US100 changed its outlook in response to what was happening at the opening of Wall Street. The increases accelerated and currently managed to break through the 100-day EMA (purple curve), which has repeatedly been a key point of support for the upward trend on the chart. The longer the price remains above this barrier, the greater the chance of extending the overall upward trend.

Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.