Wells Fargo (WFC.US) announced its results for the fourth quarter of 2025, which fell short of analysts' expectations. Revenue was $21.29 billion against a forecast of $21.65 billion, and earnings per share (EPS) were $1.62 against an expected $1.67. Nevertheless, net profit rose to $5.36 billion from $5.08 billion a year earlier, driven by a 4% increase in interest income to $12.33 billion, which was below the bank's own upper target range of $12.4-12.5 billion.

The dynamic results stem from expansion in the consumer and commercial segments, where the bank recorded impressive growth. CEO Charlie Scharf noted that operational savings are financing investments in infrastructure and development, visible, among other things, in a 20 per cent increase in new credit cards and a 19 per cent increase in car loans. After the asset cap ($1.95 trillion) was lifted in June, assets exceeded $2 trillion for the first time, enabling further expansion. The bank closed seven regulatory orders related to the fictitious account scandal, leaving only one from 2018. WFC shares, after a 32.7 per cent increase in 2025, fell by about 2 per cent today before the session.

Key Q4 results vs expectations:

-

Revenue: $21.29 billion (lower than the forecasted $21.65 billion)

-

Net profit: USD 5.36 billion (+5.5% y/y); excluding one-off items: USD 5.8 billion and EPS USD 1.76

-

Net interest income (NII): $12.33 billion (lower than the expected $12.46 billion, but close to the bank's targets)

-

Provisions for credit losses: USD 1.04 billion (down from USD 1.10 billion y/y)

-

ROE: 12.3%

-

Deposits: USD 1.38 trillion (higher than the forecasted USD 1.36 trillion)

-

Restructuring cost: $612 million ($0.14 per share) for workforce reduction.

Forecasts for 2026:

-

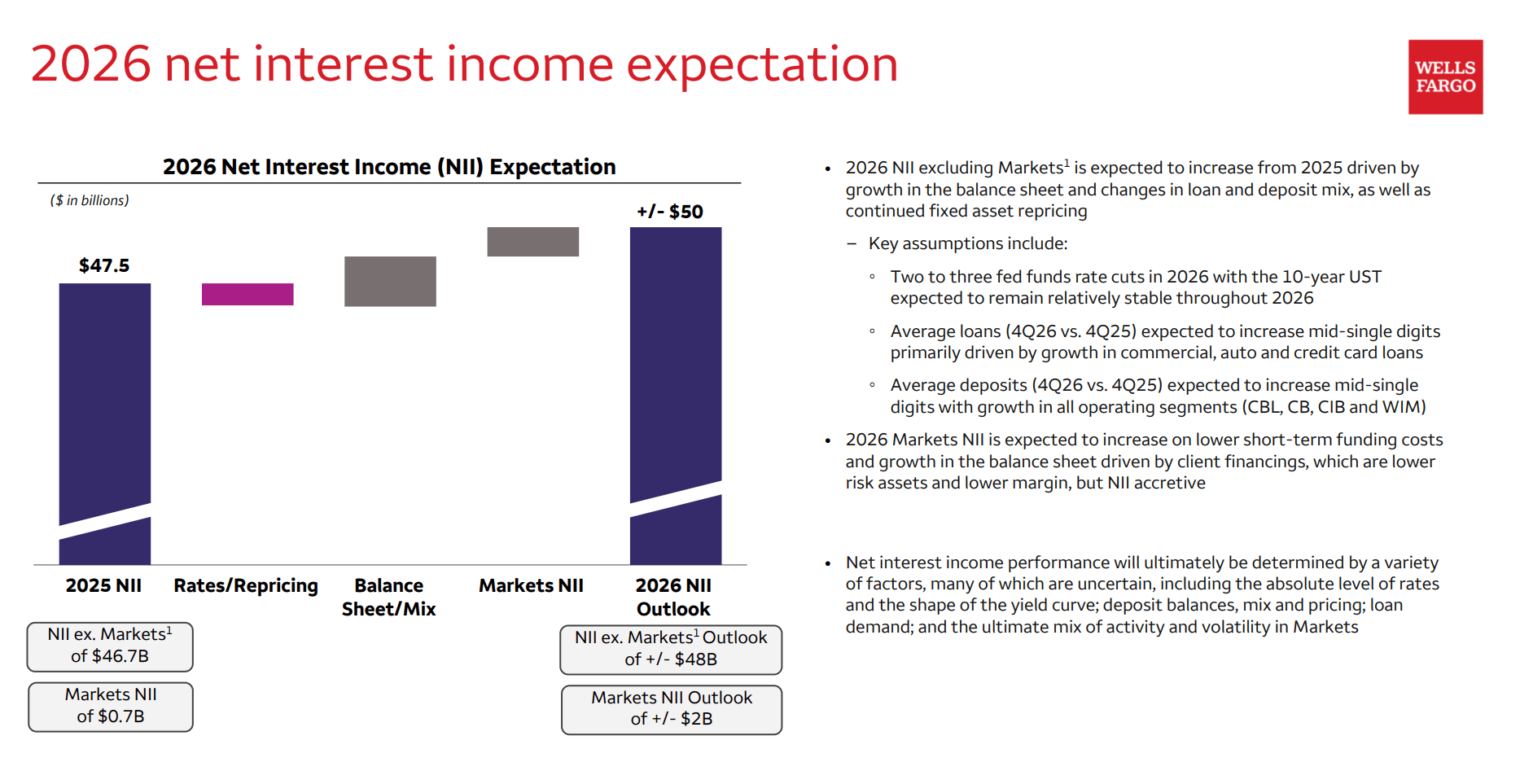

Interest income (NII): +/- USD 50 billion (up approx. 5% y/y from USD 47.5 billion in 2025; analysts expected USD 50.21 billion); excluding the Markets segment: +/- USD 48 billion compared to USD 46.7 billion in 2025

-

Total expenditure: approx. USD 55.7 billion (stable or minimal increase of 1–2% y/y from 2025, thanks to savings and AI)

-

NII in Markets (division covering trading in equities, bonds, currencies and commodities): +/- USD 2 billion (increase due to lower financing costs and balance sheet growth; in 2025 it was only USD 700 million)

Wells Fargo enters 2026 in a strong position, focusing on artificial intelligence to improve efficiency. Wells Fargo interest rate forecasts above. Source: Wells Fargo

Summary:

Wells Fargo announced its Q4 2025 results, which disappointed analysts – revenue and earnings per share were weaker than forecast, despite year-on-year net profit growth thanks to higher interest income. The bank praised its expansion in consumer and commercial lending, exceeding the $2 trillion asset threshold after the regulatory cap was lifted, and closing most of the orders related to the fake account scandal. Deposits exceeded market expectations, and loan loss provisions decreased. For 2026, management expects stabilisation of expenses and growth in interest income, particularly in the Markets segment with stock and commodity trading.

Although the Bank's shares are losing ground today before Wall Street opens, in the long term they continue to move in an upward trend determined by exponential moving averages. Particular attention should be paid to the 100-day EMA (purple curve), which repeatedly provided price support for WFC.US shares in 2025. Source: xStation

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.