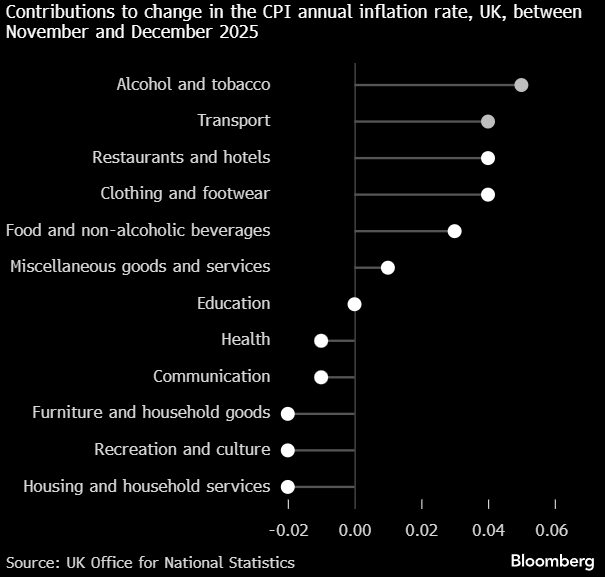

Inflation in the United Kingdom accelerated for the first time in five months, reaching 3.4% y/y in December, compared to 3.2% in November, slightly above economists' forecasts (3.3%). The rise in prices was mainly driven by an increase in tobacco excise duty and higher airfares. Services inflation, a key indicator for the Bank of England, rose to 4.5% from 4.4%, but weaker than expected. The Bank of England predicts that inflation will approach its 2% target in the spring, supported by government measures, including freezing rail fares and reducing energy bills. Despite this, the central bank is approaching the end of its cycle of interest rate cuts, monitoring the labour market for signs of a slowdown. The pound lost slightly in value after the data was released, but is currently hovering around USD 1.3440, and expectations for future rate cuts remain largely unchanged.

In December, tobacco prices rose by 3% month-on-month due to the postponement of tax increases, and airfare prices jumped by 28.6% m/m, leading to the highest inflation rate in transport since 2022. Food prices rose by 4.5% y/y, mainly due to bread and cereals, with declines recorded in categories such as recreation, games and sports equipment. At the same time, the data indicate a decline in cost pressures in industry – factory gate prices remained unchanged, while raw material and fuel prices fell. Bloomberg economists estimate that December's inflation rise will not change the Bank of England's policy, as the overall disinflationary trend continues. The labour market shows signs of weakening, with the lowest wage growth since 2020 and unemployment at 5.1%. signs of weakness, with the lowest wage growth since 2020 and unemployment at 5.1%, although the number of job vacancies rose slightly. In November, GDP surprised with a positive result of +0.3% m/m, suggesting some resilience in the economy.

Chart showing contributions to CPI inflation in the United Kingdom. Source: ONS, Bloomberg Financial Lp

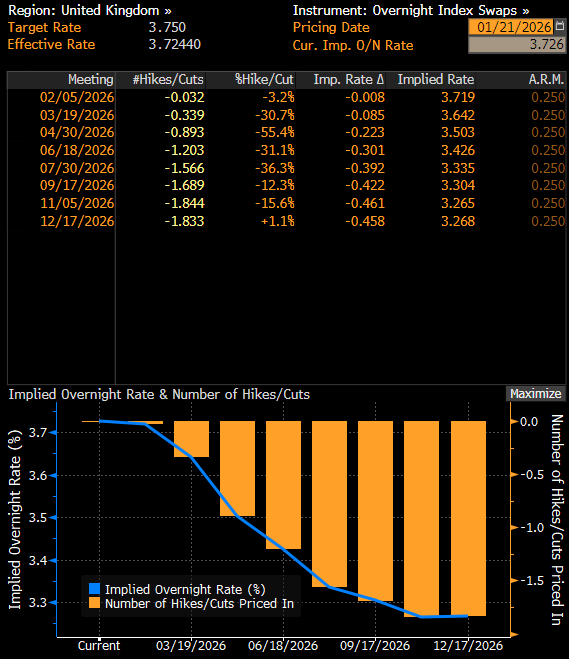

The futures market currently indicates that the Bank of England will decide on one interest rate cut in 2026 (fully priced in) with an 83% chance of a second such move at the end of the year. Source: Bloomberg Financial Lp

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.