The US2000, also known as the Russell 2000, monitors the performance of 2,000 small-cap companies in the United States. It is a favoured index for investors seeking to diversify their portfolios beyond large-cap stocks.

Various financial instruments, including CFDs, allow traders to invest in US2000. CFDs, or contracts for difference, enable traders to speculate on the price fluctuations of an underlying asset without owning it directly. Traders can profit from both rising and falling markets while using leverage to increase their market exposure when investing in CFDs.

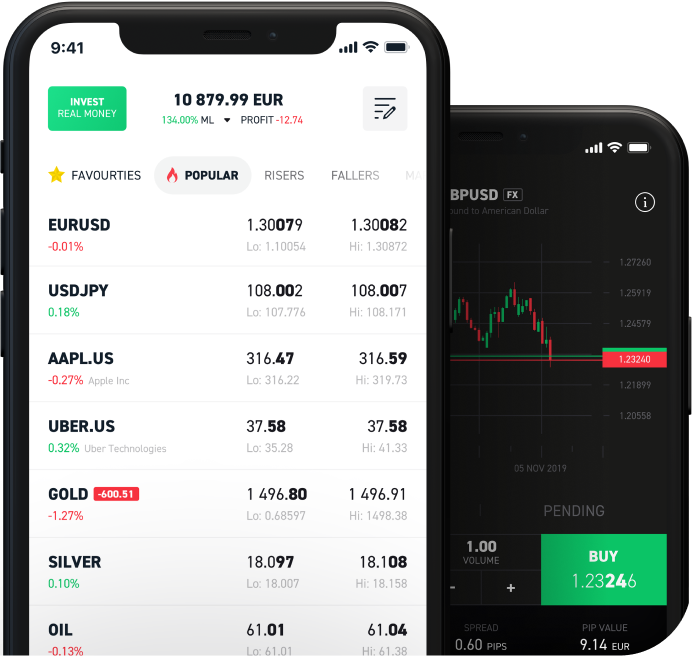

Thanks to the XTB offering, it is possible for traders to invest in the US2000 using CFDs.

The ideal time to trade the US2000 CFD is dependent on the trader's strategy and time zone. However, the US stock market operates from 9:30 AM to 4:00 PM Eastern Time (from 13:30 to 20:00 GMT times), with most trading volume occurring during these hours. Traders who desire to avoid the busiest hours may consider trading during the first or last hour of the trading day when there tends to be higher volatility.

An interesting fact about the US2000 is that it serves as a barometer of the US economy as it comprises small-cap companies that are more sensitive to changes in the domestic economy. Additionally, the index was established in 1984 and is maintained by FTSE Russell, a subsidiary of the London Stock Exchange.

Over extended periods, US2000 has historically outperformed the broader market, including the S&P 500. However, it is more volatile than its larger-cap counterparts, which means that investing in the index entails higher risks, but also higher potential returns.

The US2000 is often used as a benchmark for actively managed small-cap funds, which aim to surpass the index's returns. Many financial professionals believe that beating the US2000 is difficult because it is well diversified and encompasses a wide range of small-cap companies from diverse industries.