Abbott Laboratories (ABT.US) stock fell over 2.0% in pre-market despite the fact that medical devices and health care companies posted quarterly figures which topped market estimates.

- Company earned $1.73 on revenue of $11.9B boosted mainly by high demand for its COVID-19 test kits and other medical devices. Meanwhile analysts expected earnings of $1.47 on revenue of $11.04B.

- Abbott expects a full-year 2022 diluted EPS on a GAAP basis around $3.35 and projected adjusted diluted EPS of at least $4.70 remains unchanged.

- Guidance for the current fiscal year includes projected COVID-19 testing-related sales of approximately $4.5 billion, which Abbott expects to largely occur in the first half of the year and will update on a quarterly basis.

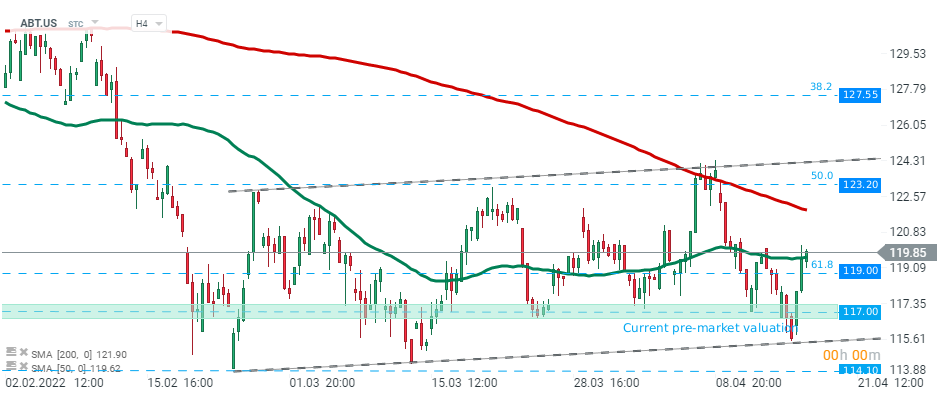

Abbott Laboratories (ABT.US) stock has been moving within an ascending channel since the end of February 2022. However price moved lower following the releases of quarterly figures and is currently approaching the lower limit of the formation. Should break lower occur, downward move may accelerate towards local support at $114.10. Source: xStation5

Abbott Laboratories (ABT.US) stock has been moving within an ascending channel since the end of February 2022. However price moved lower following the releases of quarterly figures and is currently approaching the lower limit of the formation. Should break lower occur, downward move may accelerate towards local support at $114.10. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.