- Abbott reports Q3 results in line with forecasts

- However, concerns about tariffs push share prices down ahead of Wall Street opening

- Abbott reports Q3 results in line with forecasts

- However, concerns about tariffs push share prices down ahead of Wall Street opening

Abbott (ABT.US) published a solid report for the third quarter of 2025, presenting results in line with market expectations, although the context surrounding the company was not free from tensions resulting from the threat of new trade tariffs from the Trump administration.

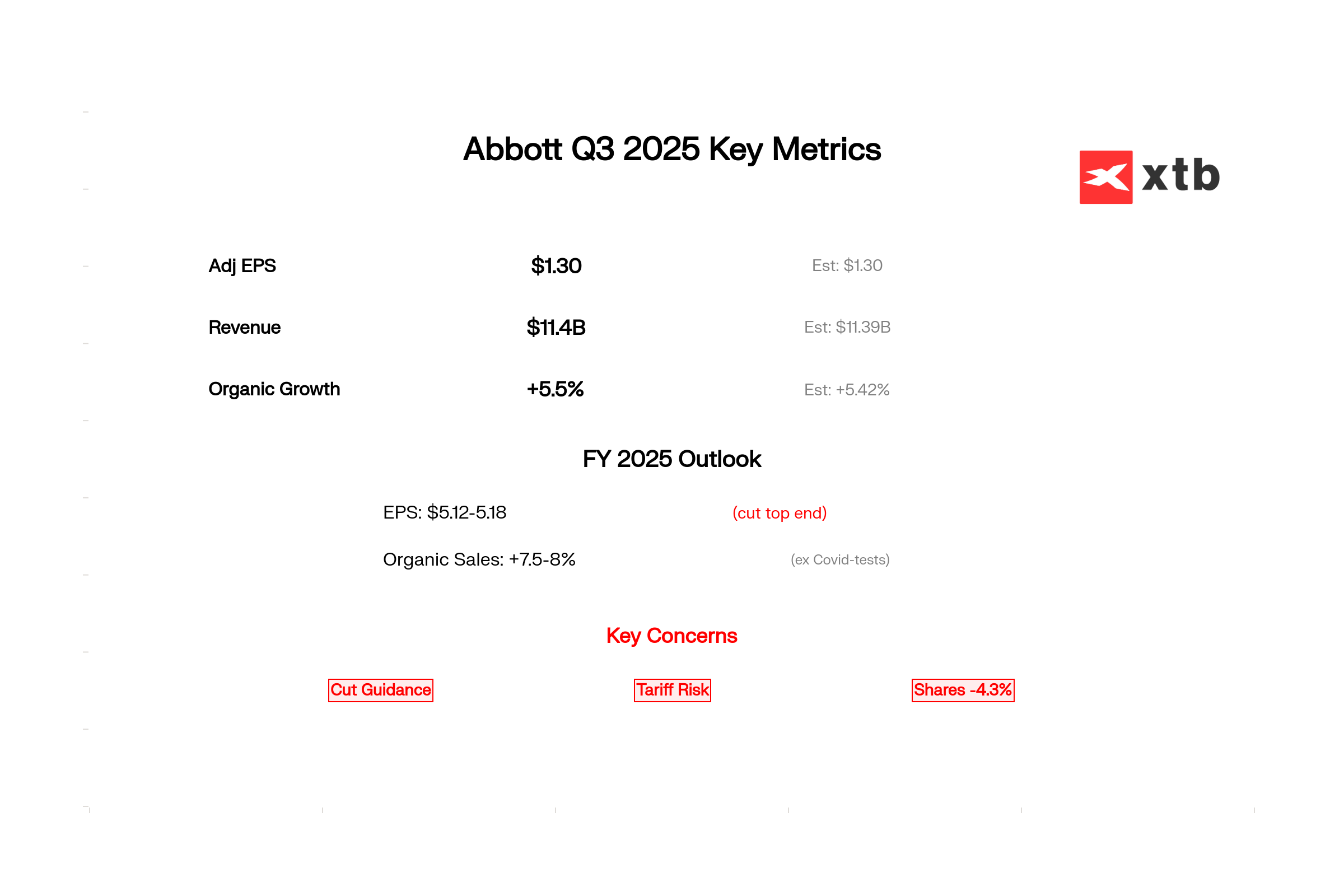

In Q3, Abbott reported adjusted earnings per share (EPS) of $1.30 and revenues of $11.4 billion, both in line with analyst consensus. Organic sales growth was 5.5% y/y, while sales in the Medical Devices segment grew by as much as 15%. The company reported a mixed annual EPS forecast of $5.12–5.18 (expected $5.15; the upper limit, which was $5.20, was lowered) and expects organic sales growth in 2025 to be 7.5-8% (excluding COVID-19 tests; 7.74% was expected).

Despite the figures being in line with forecasts, concerns about potential US tariffs on medical devices had a negative impact on the stock price, which fell by more than 4% before the opening of Wall Street sesion. At the same time, Abbott is not slowing down its investments in the US, expanding production and adapting to new regulatory challenges.

Abbott Q3 2025: earnings, sales, and forecasts. Source: XTB

TSMC Earnings Preview: Will the Key Semiconductor Supplier Surprise the Market?

US Open: American Indices Rally on Anticipated End of Fed Balance Sheet Reduction

Bank of America, Wells Fargo, and Morgan Stanley: Q3 2025 Earnings Overview

DE40: Good earnings and cautious optimism

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.