Shares in Europe's largest aerospace-industrial conglomerate Airbus (AIR.FR) are trading down 12% today, as the company lowered its financial forecast for the full year 2024. It now expects lower pre-tax profits and fewer aircraft to add to its fleet this year. The company also indicated that the decision to lower expectations was influenced by higher costs in the space operations segment and problems in supply chains (particularly in the engine and cabin equipment sectors).

- The company expects EBIT to be around €5.5 billion this year, compared to the €6.5 to €7 billion estimated on April 25. Aircraft deliveries are expected to reach 770 models this year, against 800 expected; at the same time, Airbus has postponed the return of A320 production.

- Airbus relayed that costs for its space systems unit rose to €900 million in the first half of the year, as a result of higher service and labor costs. Airbus has already surprised the market once this year with a weaker-than-forecast report, and investors expect the problems with satisfactory profitability to continue. Half-year results will be released on July 30, 2024.

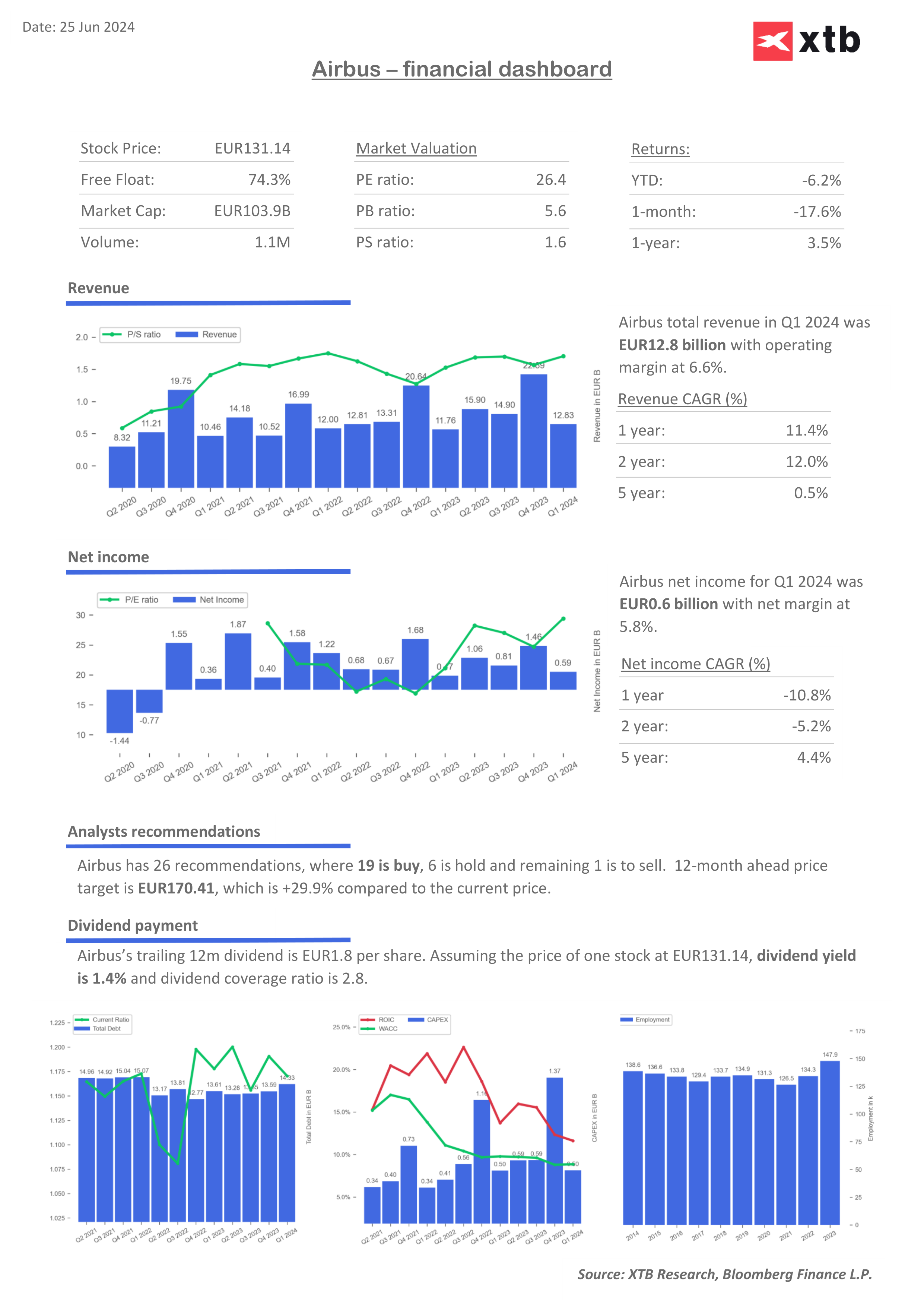

Airbus shares (AIR.FR)

Airbus shares are experiencing one of the biggest sell-offs in their history and are trading 10% below the 200-day simple moving average (SMA200, red line). The relative strength index (RSI) is trading at 20 points, signalling a deep oversold condition. Significant support can be found around EUR120 per share.

Source: xStation5

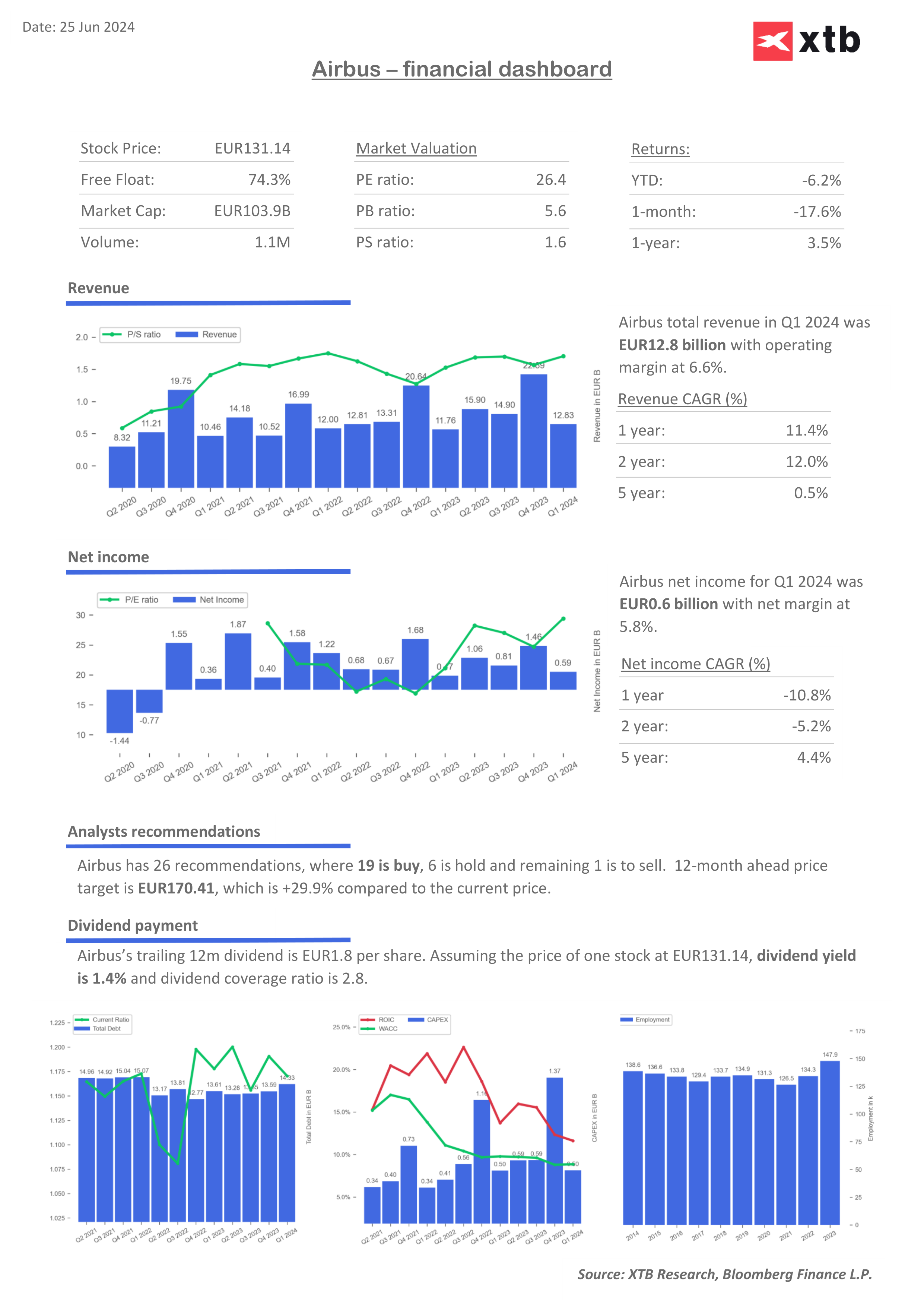

Airbus valuation forecasts and multipliers

As a result of lower earnings, the price-to-earnings ratio for Airbus shares is rising, while ROIC or ROE ratios are falling, suggesting challenges in the business. Higher costs could eventually cause the WACC ratio to rise above ROIC, reducing economic value added (EVA).

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.