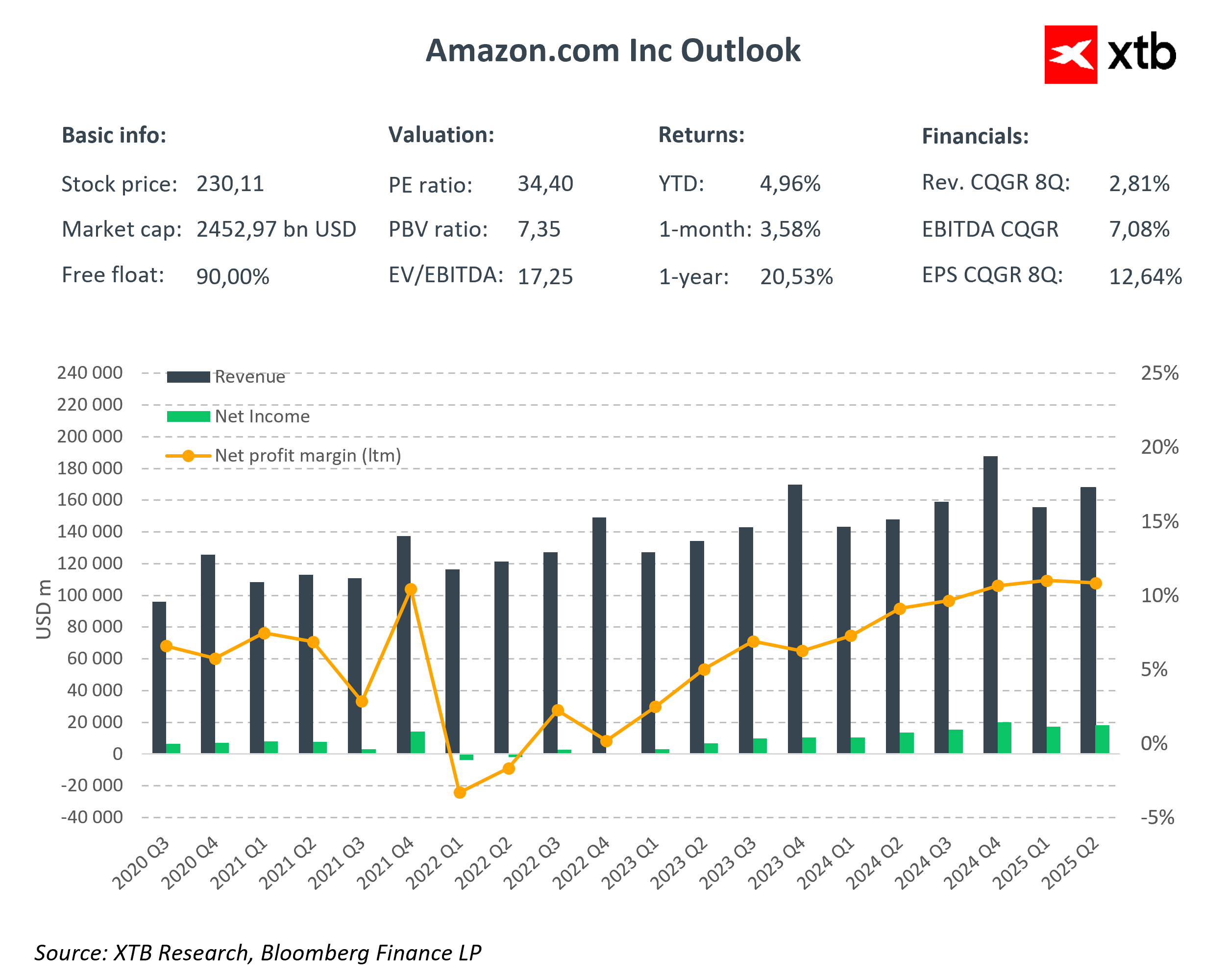

Amazon (AMZN.US) will report its Q3 2025 earnings today after the U.S. market close. Investors expect another solid quarter, though there is uncertainty surrounding the pace of cloud growth and the company’s positioning in AI. Consensus forecasts call for $177.8 billion in revenue and EPS of $1.58, up 12% and 10% y/y, respectively. This represents steady growth, though clearly slower than during the pandemic years.

The main focus will be on AWS, Amazon’s current profit engine. Although it accounts for only about 20% of total revenue, it generates around 40% of operating income. AWS’s operating margin fell last quarter from 36% to 33%, and its market share declined by roughly 2% in favor of Microsoft Azure and Google Cloud. Any sign of margin recovery or changes in AI-related market share will be crucial for sentiment.

Key expectations

- Revenue: $177.8B (+12% y/y)

- AWS revenue: $32.3B (+18% y/y)

- Advertising services: $17.3B (+21% y/y)

- Online store: $66.5B (+8% y/y)

- Third-party seller services: $41.9B (+11% y/y)

- EPS: $1.57–$1.58 (+10% y/y)

- Operating income: $23.7B (+4% y/y)

AI ambitions under scrutiny

Artificial intelligence remains the key growth driver for the entire tech sector. Investors expect management to explain how record-high capital expenditures will translate into future revenue growth. Currently, high CAPEX is weighing on free cash flow. Recent comments from Jeff Bezos emphasize that AI is the company’s “top priority,” spanning everything from logistics and automation to personalized shopping experiences.

Amazon’s stock remains below its all-time highs, unlike other Big Tech peers such as Apple, Microsoft, Alphabet, and Nvidia. Given the strong results from Microsoft and Alphabet yesterday, investors are likely to scrutinize Amazon’s report even more closely.

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.