- Bitcoin and Ethereum are falling after the rebound attempt

- Whale address 0xb317 opens a new short position on BTC

- Sentiments on Wall Street are weakening again

- Bitcoin and Ethereum are falling after the rebound attempt

- Whale address 0xb317 opens a new short position on BTC

- Sentiments on Wall Street are weakening again

Bitcoin’s price is once again falling toward $111,000, and the current correction suggests that bears may have an appetite to test recent lows around $108,000. Market sentiment on Wall Street is weakening, and additionally, the whale address 0xb317 — known for its $192 million short bet on Bitcoin, opened just before Donald Trump’s tweet on Friday — has now opened another short position worth $163 million. The position currently shows about $5 million in unrealized profit, with a liquidation price at $125,500. This development has fueled market speculation about potential insider trading by the 0xb317 address.

Source: xStation5

Ethereum has fallen below the key $4,000 level and has failed to break above the 50-day EMA to regain sustained bullish momentum. The current key support level is at $3,600 (200-day EMA).

Source: xStation5

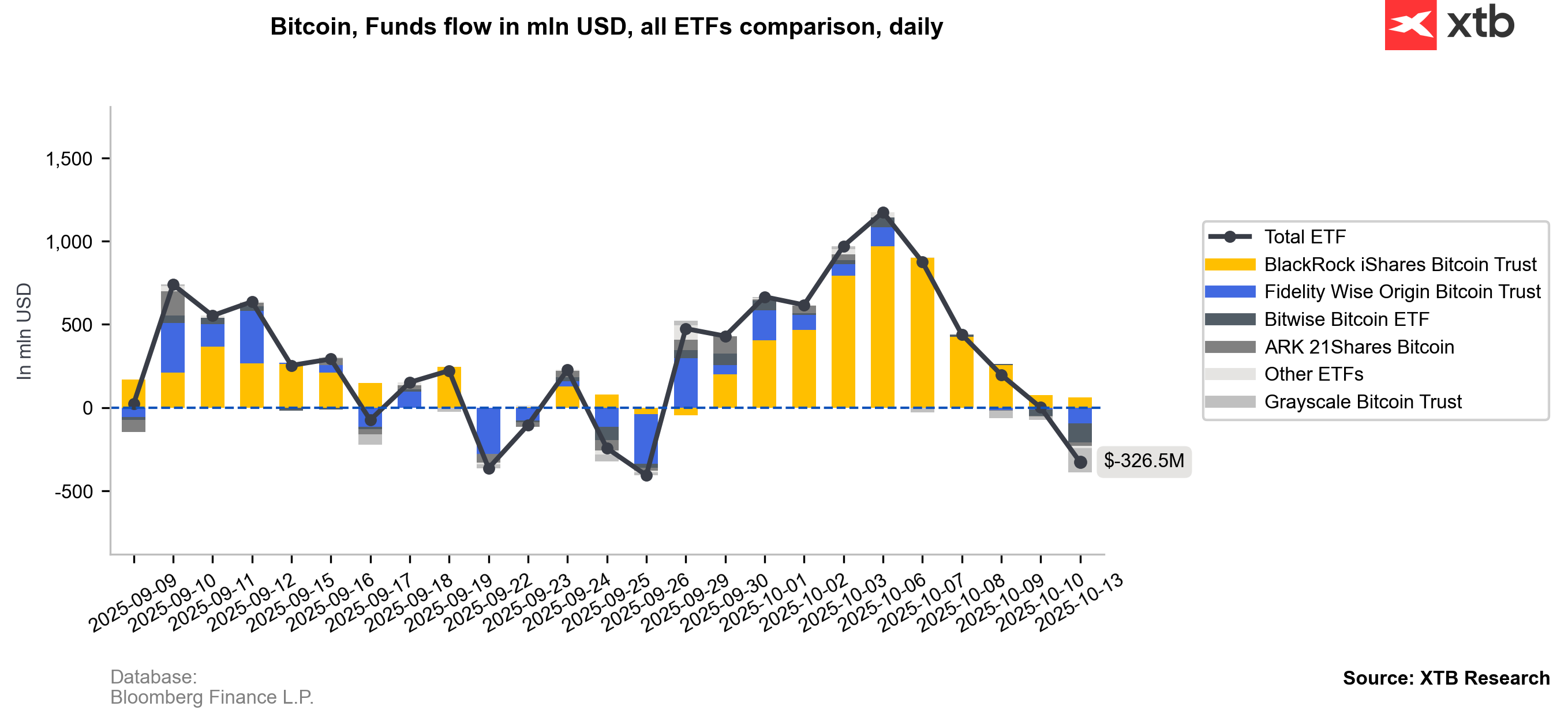

ETF inflows to Bitcoin were negative on Friday, and Monday (-326M).

Source: Bloomberg Finance L.P., XTB Research

EURUSD higher after Powell's speech! 💶📈

JPMorgan, Goldman Sachs, and Citigroup: Sector Overview and Challenges

US OPEN: Wall street extends declines! 📉

WTI Crude Plunges Over 2% to Lowest Level Since May

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.