Why is this reading important?

Retail sales are one of the key indicators of consumer health in the US, which accounts for most of the economic growth. The data, especially when excluding cars and fuel, allows for an assessment of the real strength of demand and the current pace of economic activity. Continued sales growth indicates consumer resilience despite high interest rates. From the Federal Reserve's perspective, this reading influences the assessment of demand pressure and expectations for future rate cuts, and for financial markets, it shapes the valuation of the dollar, bonds, and stocks and reduces concerns about a sharp economic slowdown.

Retail sales results for December

- Retail sales (m/m): actual 0% (forecast 0.4%; previous: 0.6%)

- Sales excluding cars (m/m): actual 0% (forecast 0.3%; previous: 0.5%)

- Sales excluding cars and fuel (m/m): actual 0% (previous: 0.4%)

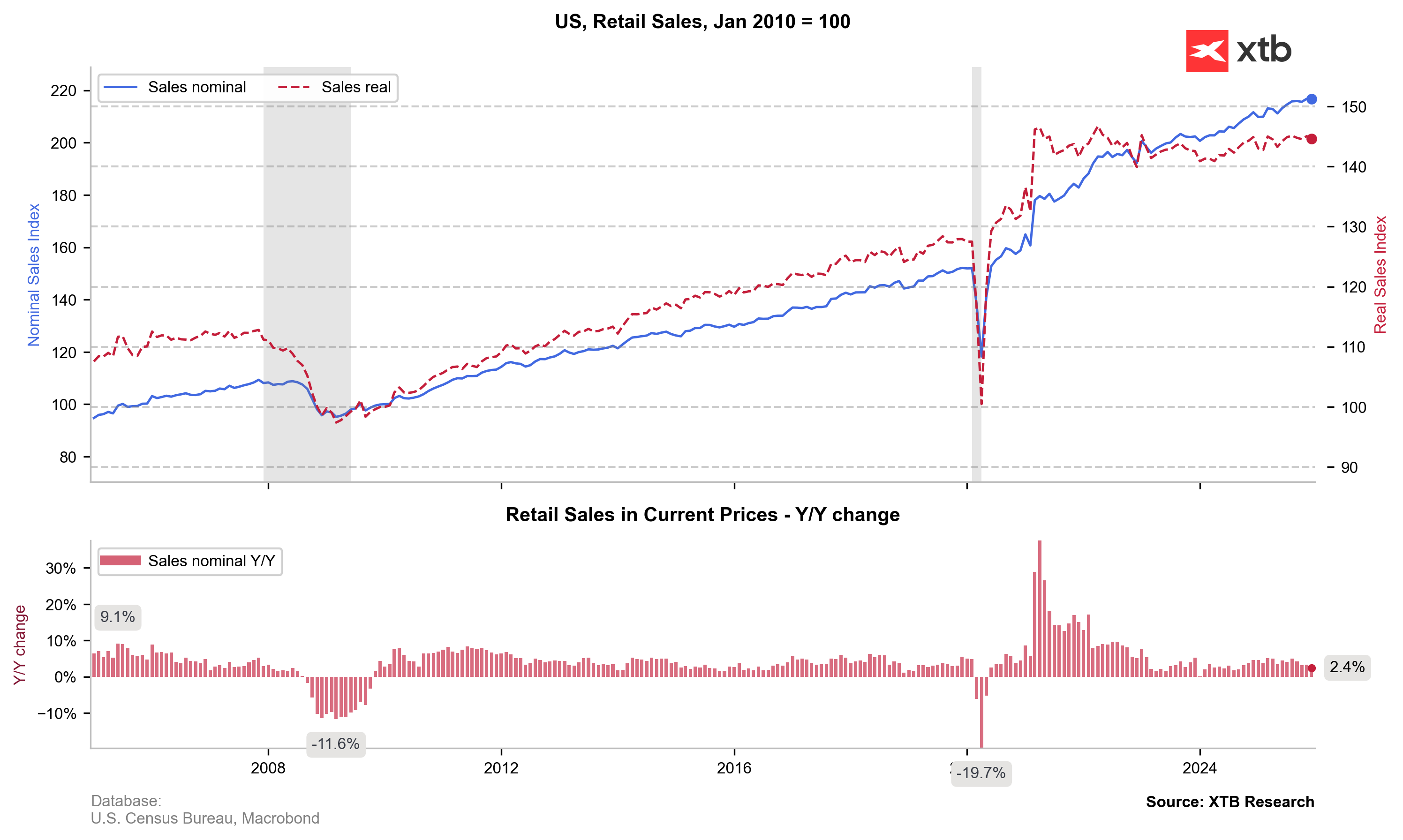

- Retail sales (y/y): actual 2,4% (previous 3.3%)

Source: XTB Research

Actual results

December US retail sales came in clearly weaker than market expectations. Headline retail sales were flat on a month-over-month basis, missing the 0.4% consensus forecast and slowing sharply from the previous 0.6% increase. Sales excluding autos also showed no growth, disappointing relative to expectations of a 0.3% rise and the prior 0.5% reading. More importantly, sales excluding autos and fuel stalled after a 0.4% increase in the previous month, pointing to a slowdown in underlying consumer demand. On a year-over-year basis, retail sales growth decelerated to 2.4% from 3.3%, confirming a loss of momentum in consumption toward year-end. Overall, the data suggest that tighter financial conditions are increasingly weighing on household spending and may reinforce market expectations for a more accommodative Fed policy stance in the coming months. As a result of this release, the US dollar weakened significantly, with falling Treasury yields and a clear reduction in the dollar’s rate advantage providing strong support for EUR/USD.

Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.