أظهرت بيانات لجنة الأوراق المالية والبورصات الأمريكية أن وارن بافيت وشركته بيركشاير هاثاواي يقللان من تعرضهما لأسهم بنك أوف أمريكا (BAC.US) قبيل بدء دورة خفض أسعار الفائدة من جانب بنك الاحتياطي الفيدرالي.

تبيع بيركشاير هاثاواي أسهم بنك أوف أمريكا منذ ستة أسابيع، مما أدى إلى تقليص حصتها بالكامل بنحو 13%. ويُظهر أحدث تقرير لشركة بيركشاير أن أسهمًا أخرى بقيمة 982 مليون دولار (129 مليون سهم من البنك) قد بيعت منذ يوم الاثنين الماضي.

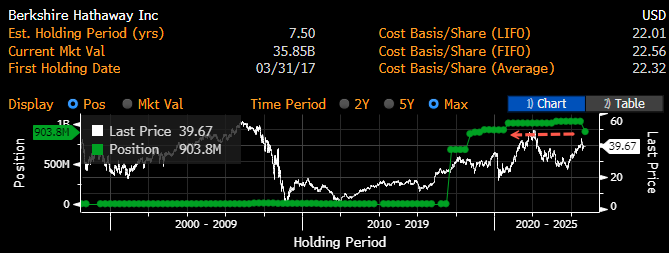

تظل بيركشاير أكبر مساهم في البنك في جميع الأوقات، حيث تمتلك 903.8 مليون سهم بقيمة حوالي 36 مليار دولار بسعر إغلاق يوم الثلاثاء. المصدر: Bloomberg Financial LP

من الجدير بالذكر أنه إذا تحقق سيناريو خفض أسعار الفائدة ثلاث مرات بمقدار 25 نقطة أساس لكل منها بحلول نهاية العام، فقد يكون صافي دخل الفائدة لبنك أوف أميركا أقل بنحو 225 مليون دولار في الربع الرابع مقارنة بالربع الثاني.

انخفضت أسهم BAC.US بنسبة 0.75% قبل افتتاح جلسة التداول في وول ستريت بعد أنباء عن تقليص حصة شركة Berkshire في أسهم البنك. المصدر: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.