Zscaler (-8.0%), Palo Alto Networks (-7.0%), and Cloudflare (5.9%) shares dips following Microsoft's (+1.8%) announcement of their new security services, a move that analysts believe could pose a competitive threat to these established players. While Microsoft's new services are still in their early stages, the company's broad portfolio and substantial distribution capabilities make the announcement a considerable concern for cybersecurity firms. However, despite today's dramatic decrease in shares value, the largest investment banks have a different opinion:

-

Goldman Sachs suggests that Microsoft's expansion in the security sector will have minimal impact over the next year and network security vendors are likely to maintain their technology lead over Microsoft.

-

Morgan Stanley warns that while Microsoft's massive network and capacity to invest are advantages, gaining meaningful market share in this part of the security market may be more difficult due to the lack of synergy with Microsoft's existing estate.

Microsoft's latest security service expansion involves the development of their Entra suite, starting with the introduction of Microsoft Entra in May 2022, featuring Azure Active Directory (Azure AD), Microsoft Entra Permissions Management, and Microsoft Entra Verified ID.

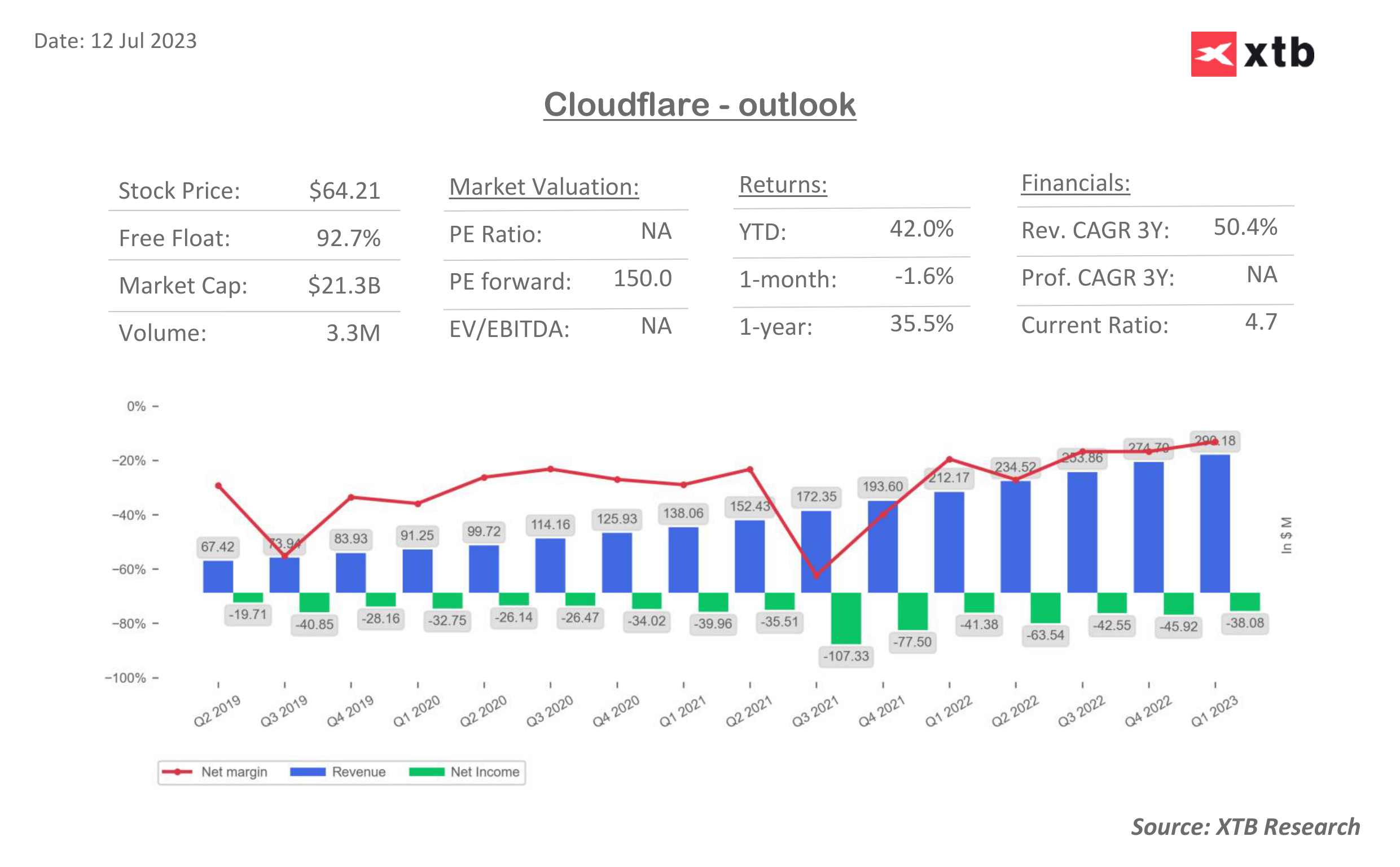

Cloudflare (NET.US) financial outlook

Cloudflare (NET.US) financial outlook

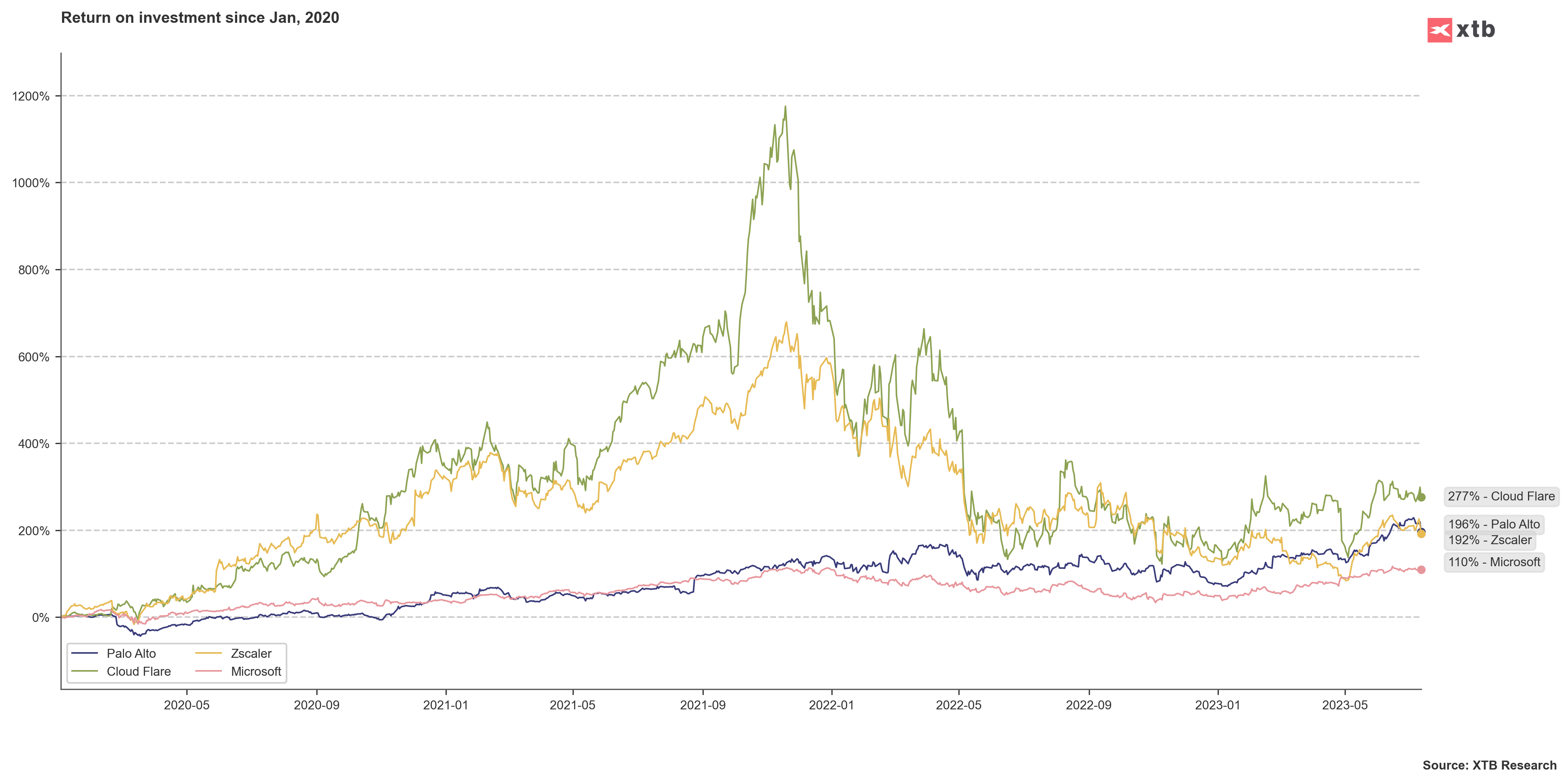

Return on investment in stocks at the beginning of 2020, Microsoft achieved the lowest return, but being the largest company a 110% return is still impressive. The opposite could be noticed recently, when stocks of the remaining companies decrease while Microsoft's are gaining. What's more, Palo Alto, Zscaler, and Cloudflare are far from their ATH reached during the post-Covid bullish market, source XTB Research, bloomberg.

Return on investment in stocks at the beginning of 2020, Microsoft achieved the lowest return, but being the largest company a 110% return is still impressive. The opposite could be noticed recently, when stocks of the remaining companies decrease while Microsoft's are gaining. What's more, Palo Alto, Zscaler, and Cloudflare are far from their ATH reached during the post-Covid bullish market, source XTB Research, bloomberg.

Beyond Meat after the sell-off📉Is short squeeze still possible?

Banco Macro gains 5% amid US Treasury help to Argentine peso 🗽

US Open: Mixed sentiments on Wall Street 📊IBM loses, Honeywell surges 7%

Highlights From The S&P 500 Earnings Season 🗽What's up on Wall Street?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.