Western European stock exchanges started today's session with gains, following the positive sentiment from Wall Street. Investors are reacting to weaker data from the U.S. labor market, which has increased expectations for imminent interest rate cuts by the Federal Reserve. However, in the following hours, the mood changed — indices recorded declines. This is particularly noticeable in Germany, where after an initial rebound, the DE40 index turned downward, signaling increased caution among investors. It currently remains around the opening level.

The French government of Prime Minister François Bayrou lost a vote of confidence yesterday, leading to its downfall and deepening the political crisis in France. In response, President Emmanuel Macron appointed Sébastien Lecornu, a former defense minister and loyal ally, as the new prime minister, tasked with attempting to maintain pro-business reforms amid political deadlock.

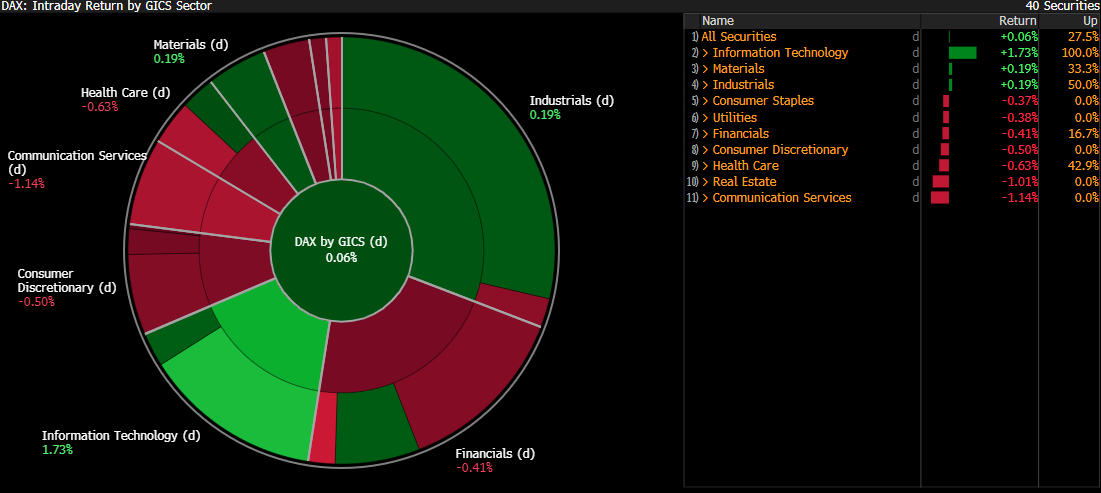

Source: Bloomberg Finance LP

The index is mainly supported by IT companies, undoubtedly buoyed by positive sentiment towards the sector from across the ocean. Consumer goods are losing the most, amid concerns about consumer conditions in the face of deteriorating data.

DE40 (D1)

The price on the German index is at a very important point from a technical perspective. The price is holding below the upward trend line. In the event of breaking the resistance zone around 23,580 points, it is difficult to determine how low the declines may stop. If buyers want to regain initiative, their task is becoming increasingly difficult due to the fact that the trend line will soon intersect with the resistance zone and the EMA50 average.

Company News:

- Rheinmetall (RHM.DE) - being one of the leaders in the European defense sector, is recovering losses after yesterday's correction in the upward trend. The CEO said in an interview yesterday that the company intends to become a one-stop provider of all solutions.Barclays analysts stated that the sector, underinvested for over two decades after the end of the Cold War, is now facing a potential supercycle of defense spending that could last until the 2030s. The company is up about 1%.

- Inditex (ITX.ES) – shares are up 6–7% after the company announced accelerated sales at the turn of August and September.

- Novo Nordisk (NOVOB.DK) – the stock is up about 2% following the announcement of restructuring and a plan to reduce employment by over 11%.

- SAP (SAP.DE) – up about 2%, supported by demand for cloud solutions and AI technologies.

- ASML (ASML.NL) – the company is up about 1%, benefiting from positive Oracle forecasts regarding orders in the cloud sector and TSMC's sales results.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.