-

Gold is surging dynamically, reaching new historic highs above $4,078 per ounce and increasing by over 1.7% today, even after a brief rebound in equity indexes following reassuring remarks from Trump.

-

Persistent demand for gold stems from ongoing uncertainty regarding a lasting resolution to the US–China trade dispute, growing expectations for interest rate cuts, and continued inflows into gold ETFs.

-

Actions by both Trump and Beijing are escalating global risks, and gold continues to serve as a key safe haven, even when there are fleeting signs of stabilization in equity markets.

-

Gold is surging dynamically, reaching new historic highs above $4,078 per ounce and increasing by over 1.7% today, even after a brief rebound in equity indexes following reassuring remarks from Trump.

-

Persistent demand for gold stems from ongoing uncertainty regarding a lasting resolution to the US–China trade dispute, growing expectations for interest rate cuts, and continued inflows into gold ETFs.

-

Actions by both Trump and Beijing are escalating global risks, and gold continues to serve as a key safe haven, even when there are fleeting signs of stabilization in equity markets.

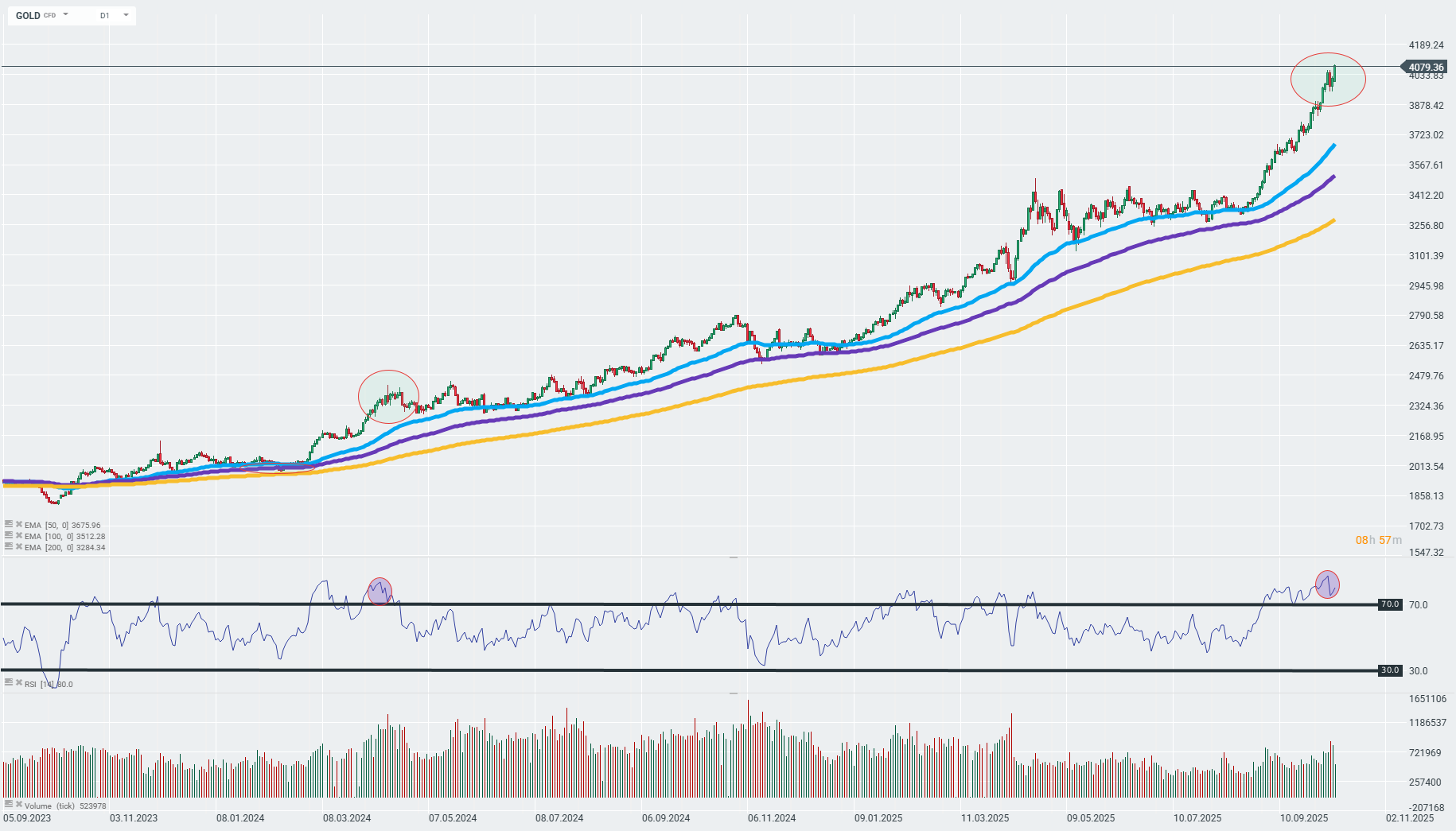

GOLD continues its rapid upward movement, gaining over 1.7% today even after President Trump slightly softened his rhetoric regarding possible tariff escalation with China, expressing hope for a trade agreement on the Truth platform. Despite a robust rebound in Wall Street index futures following the biggest sell-off since April, gold keeps setting new price records – today the ounce surpassed $4,078. Investors remain cautious, treating gold as a key hedge in times of uncertainty and global economic-political turbulence, and even a temporary calm in equity markets does not weaken demand for the metal.

Such momentum may be driven by rising expectations for further interest rate cuts in the US and ongoing inflows into gold-focused ETFs and central banks. Trump's announcement of potential 100% tariffs on Chinese goods and export restrictions on key software have heightened market anxiety. This is further confirmed by China’s intensifying export restrictions on rare earth metals, elevating risks for global supply chains. The rebound in indexes proves short-lived, while gold sustains its rally as a safe haven. The situation demonstrates that the market remains unconvinced about lasting de-escalation—hence, gold continues to benefit from global uncertainty.

GOLD is extending its most dynamic upward streak since February and March 2024, considering the 14-day RSI indicator. From a technical perspective, GOLD remains clearly above its 50-day EMA, further highlighting the impressive dynamic of recent gains. However, it is worth noting that this condition has persisted for a long time, theoretically pointing to the possibility of downward corrections. On the chart, a key support area might be at $3,970 per ounce, which marked a local low on October 10. A break below that zone could theoretically open the way for deeper declines toward the 50-day EMA. On the other hand, persistent uncertainty around trade/the US government shutdown and the dynamic trend in gold may continue to support the protracted buying pressure in GOLD. Source: xStation

Michelin cuts its 2025 forecasts, shares plunge!

Chart of the Day – Silver (14.10.2025)

BREAKING: Higher Unemployment Rate in the UK

Morning wrap (14.10.2025)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.