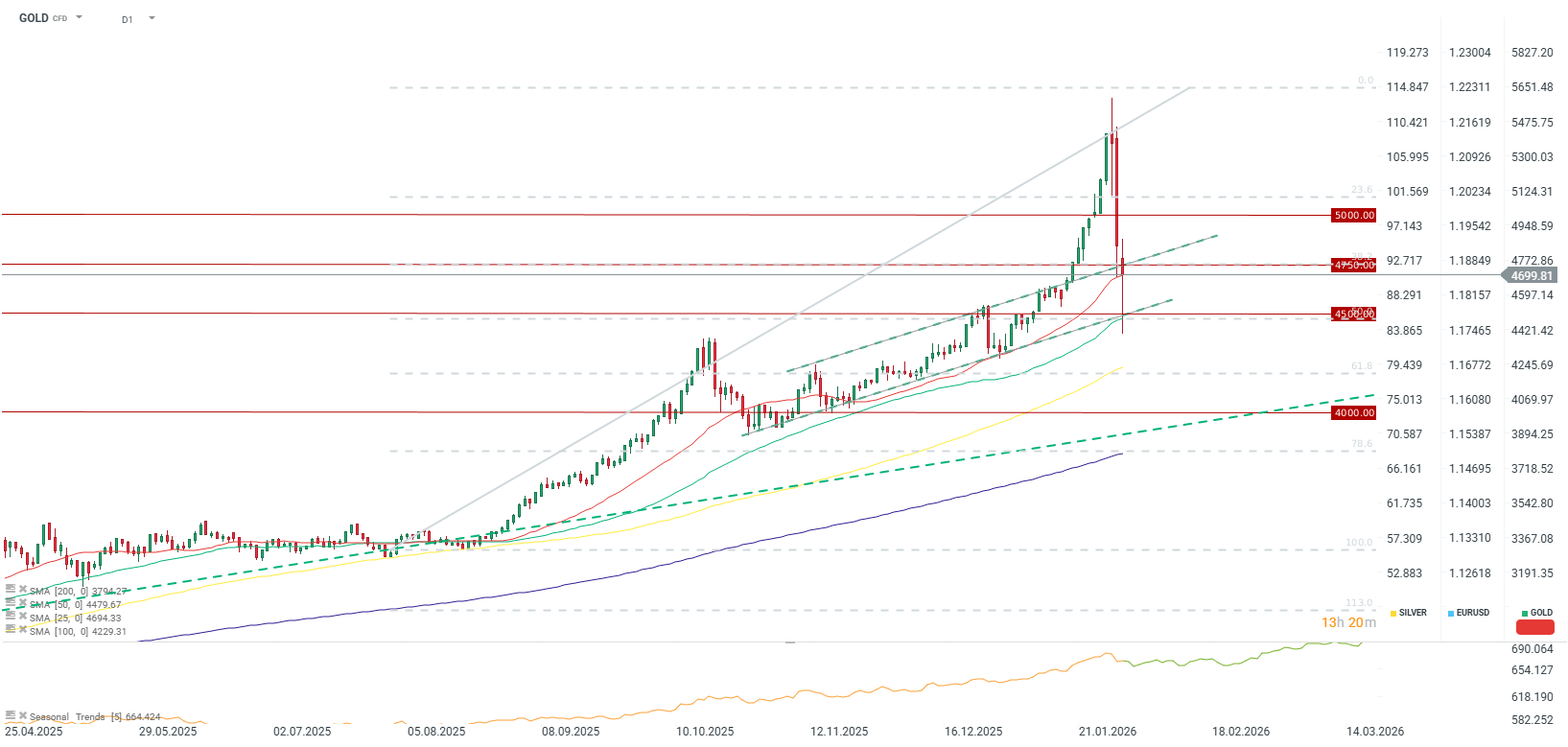

The gold price is significantly paring its losses, rebounding from near $4,400 per ounce to a level of almost $4,700. Notably, this bounce occurred around the 50.0 Fibonacci retracement level of the bull run that began in August 2025. Furthermore, the buffer zone between the 25 and 50-day Simple Moving Averages (SMA) remains intact for the time being.

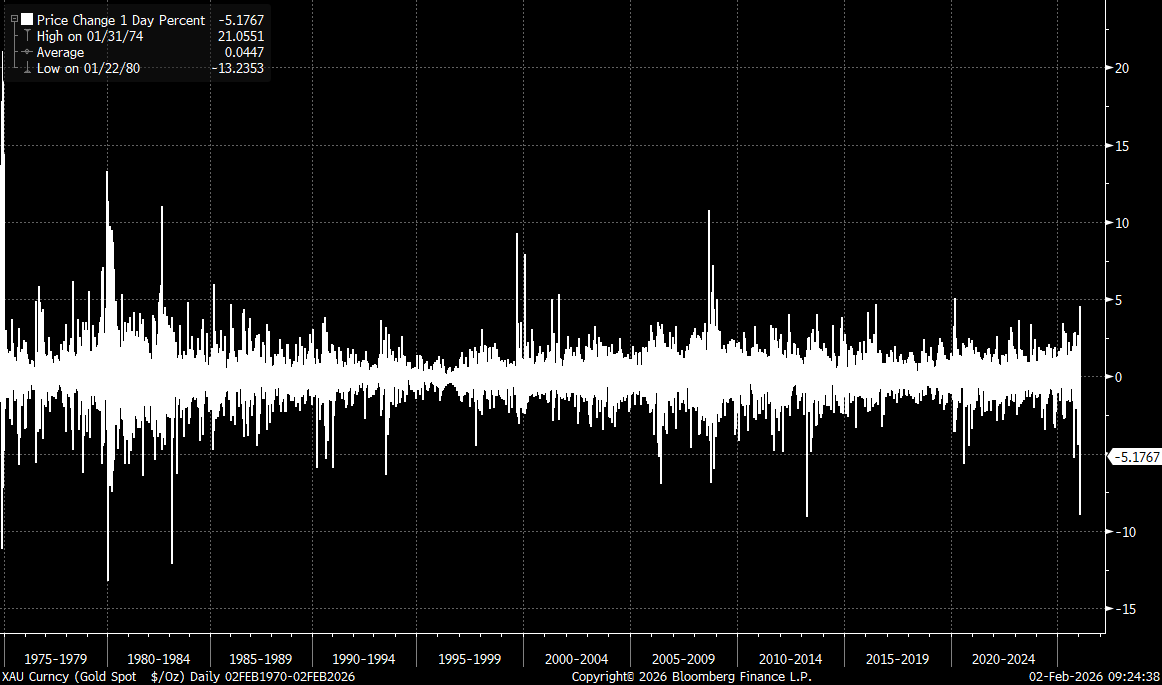

Friday’s price drop in the gold market was among the largest in history, yet it did not exceed 10%. By contrast, silver’s decline at one stage surpassed 30%. Source: Bloomberg Finance LP

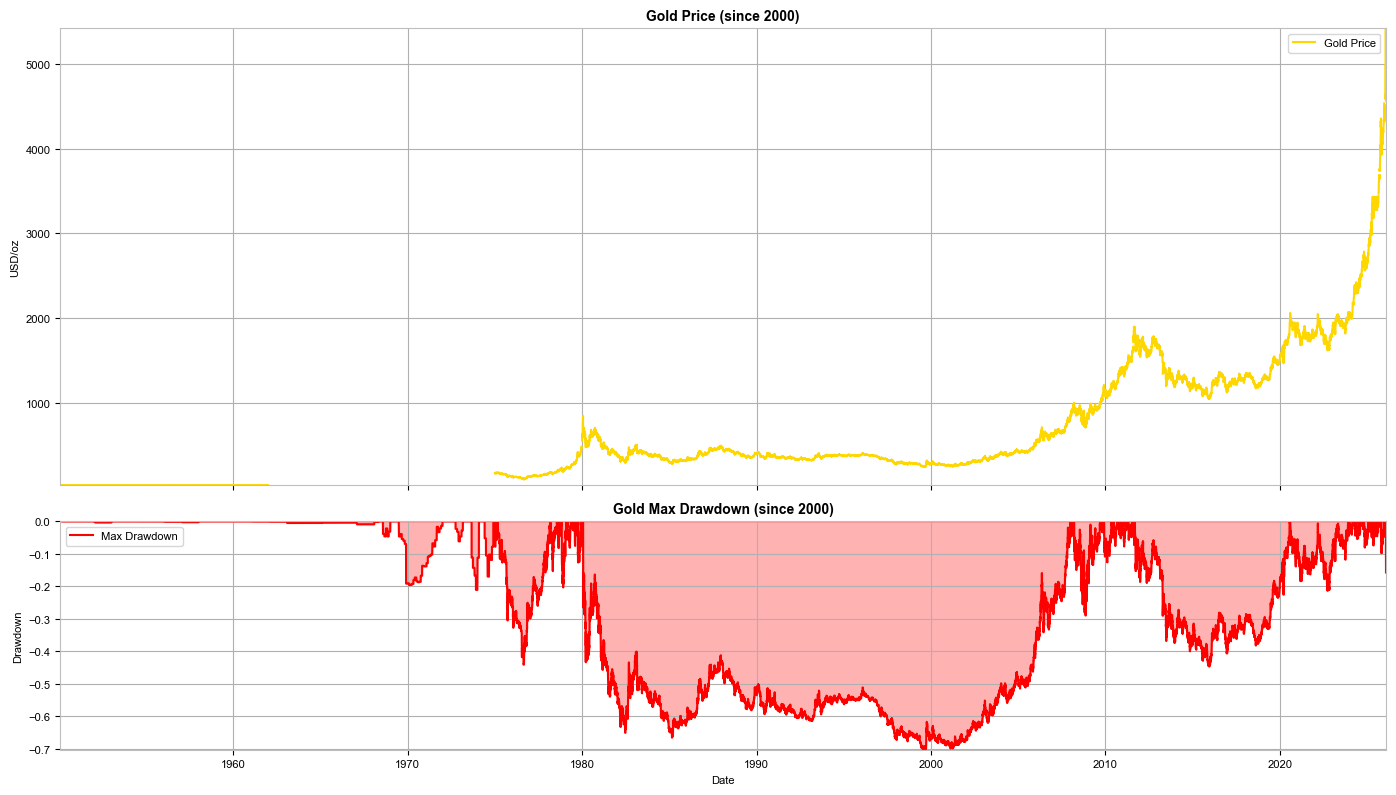

It is important to highlight that the demand structure for gold differs fundamentally from that of silver. In the gold market, we have not observed the same extreme signals from the options market, nor were there acute concerns regarding physical bullion delivery. Nevertheless, historical context is vital: in the past, gold corrections from all-time highs have reached as much as 40%, although the largest correction since 2020 has been limited to 20%.

Analyzing the period from 2020 onwards, the maximum correction reached 20%. Source: Bloomberg Finance LP

A daily close above $4,750 per ounce could signal that the correction in the gold market has run its course. In such a scenario, the objective would be a swift return toward the $5,000 psychological barrier. Conversely, should gold end the session closer to $4,500, the prospect of a deeper correction remains on the table. This could see prices retreat toward the long-term trend line, situated in the $4,000–$4,200 per ounce range.

Daily Summary: Precious metals are bleeding, and the US government is shut down again!🔒

Palantir Preview: Perfection already priced in?

Another US Gov. Shutdown: What can it mean this time?

US Open: America rises, precious metals fall!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.