Mass profit-taking and mounting pressure on leveraged long positions are weighing on precious metals today. Gold is down nearly 5%, and the pullback from its all-time high is now around 10%. Silver is also sliding sharply, down almost 8%. Palladium is off nearly 9%, while platinum is retreating by as much as 10%.

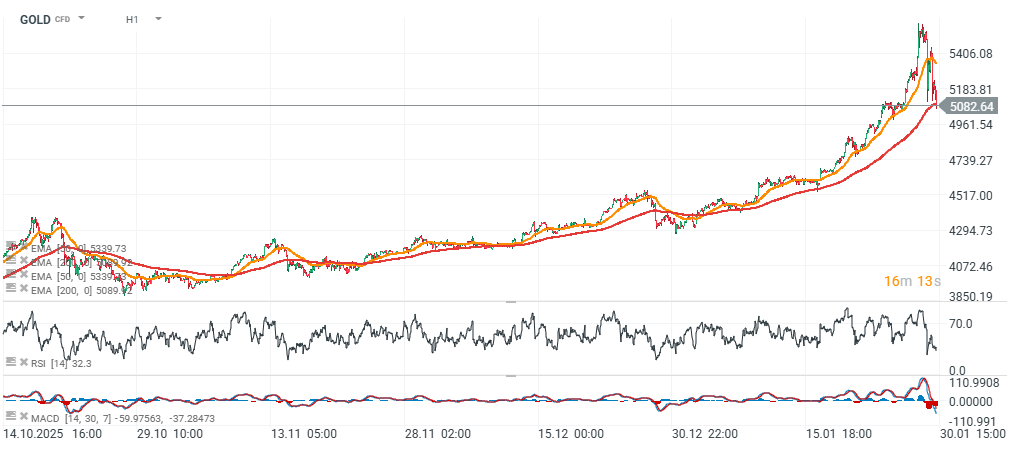

The move comes despite major banks such as JPMorgan and UBS raising their forecasts, suggesting that short-term momentum has turned against precious metals. Gold’s RSI plunged yesterday from around 89 to just under 28, during one of the largest precious-metals sell-offs in modern market history.

Gold is currently testing the EMA200 (red line) near $5,100 per ounce. Volatility remains elevated and bulls may attempt to reverse the move quickly. A potentially solid support zone appears around $4,600–$4,700 per ounce (one standard deviation).

GOLD (H1)

Source: xStation5

On the daily timeframe, the current correction range looks roughly 1:1 compared with the October decline, although it’s worth noting that the latest pullback followed a much stronger prior upswing, which naturally increases the likelihood of a larger deviation.

Source: xStation5

Daily Summary: Precious metals are bleeding, and the US government is shut down again!🔒

Palantir Preview: Perfection already priced in?

Another US Gov. Shutdown: What can it mean this time?

US Open: America rises, precious metals fall!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.