-

Gold continues to climb above $4,200 per ounce, driven by expectations of a shift in Federal Reserve policy.

-

Silver has surged past $52 per ounce, extending its strong upward momentum.

-

The U.S. labor market is showing increasing signs of weakness.

-

Fed officials are signaling the possibility of interest rate cuts in the near future

-

Gold continues to climb above $4,200 per ounce, driven by expectations of a shift in Federal Reserve policy.

-

Silver has surged past $52 per ounce, extending its strong upward momentum.

-

The U.S. labor market is showing increasing signs of weakness.

-

Fed officials are signaling the possibility of interest rate cuts in the near future

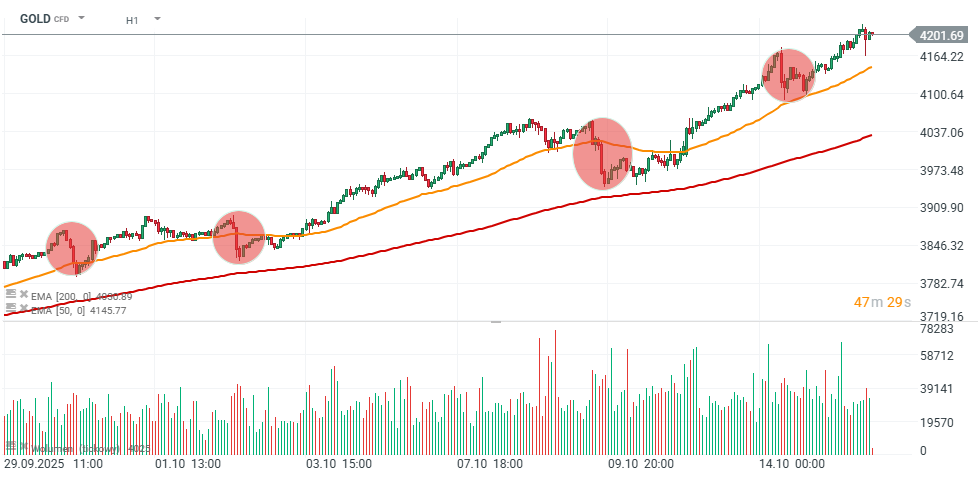

Precious metals, including gold, are rising sharply today, extending the ongoing rally. Gold is climbing above $4,200, rebounding relatively quickly after a brief correction that tested the $4,100 level. Currently, the key support levels are $4,100 and $4,160 per ounce, as defined by price action. In October, the Fed is expected to cut rates by another 25 basis points. Metal availability in the London market remains tight, while spot demand is very strong.

Investors are increasingly viewing precious metals as a hedge against currency devaluation and the consequences of growing budget deficits — a phenomenon referred to as the “debasement trade.”

- In the case of silver as well, the market has been gripped by a liquidity squeeze in London, which has driven up benchmark prices that now exceed New York futures. The gap between the two markets is about $1 per ounce, while the annualized cost of borrowing silver (on a monthly basis) stood at approximately 17% on Tuesday — both historically elevated levels.

- Traders are also awaiting the results of the U.S. administration’s so-called Section 232 investigation into critical minerals, which includes silver, platinum, and palladium. This inquiry has raised concerns that these metals could be subjected to new tariffs, even though they were officially exempted in April.

The four major precious metals have posted impressive gains this year — ranging from 60% to 82% — becoming the leaders of the commodity market rally. The key drivers behind gold’s price surge include central bank purchases, rising investor exposure to ETFs, and interest rate cuts by the Federal Reserve.

Spot demand for so-called “safe haven” assets has been further fuelled by:

-

escalating trade tensions between the U.S. and China,

-

concerns over the Federal Reserve’s independence,

-

and the risk of another U.S. government shutdown.

A major driving force behind the rally remains aggressive gold buying by central banks, which are acquiring large volumes of the metal amid a weakening U.S. dollar and falling bond yields. Concerns about rising debt, lower interest rates from the Fed and ECB, and geopolitical risks are prompting investors to treat gold as a reliable store of value. The Fed is set to decide on interest rates on October 29 and is likely to cut them by 25 basis points — as also hinted by recent comments from Federal Reserve official Susan Collins.

GOLD (H1 Timeframe)

Gold has experienced a few minor corrections, but the uptrend that began in early October remains dominant.

Source: xStation5

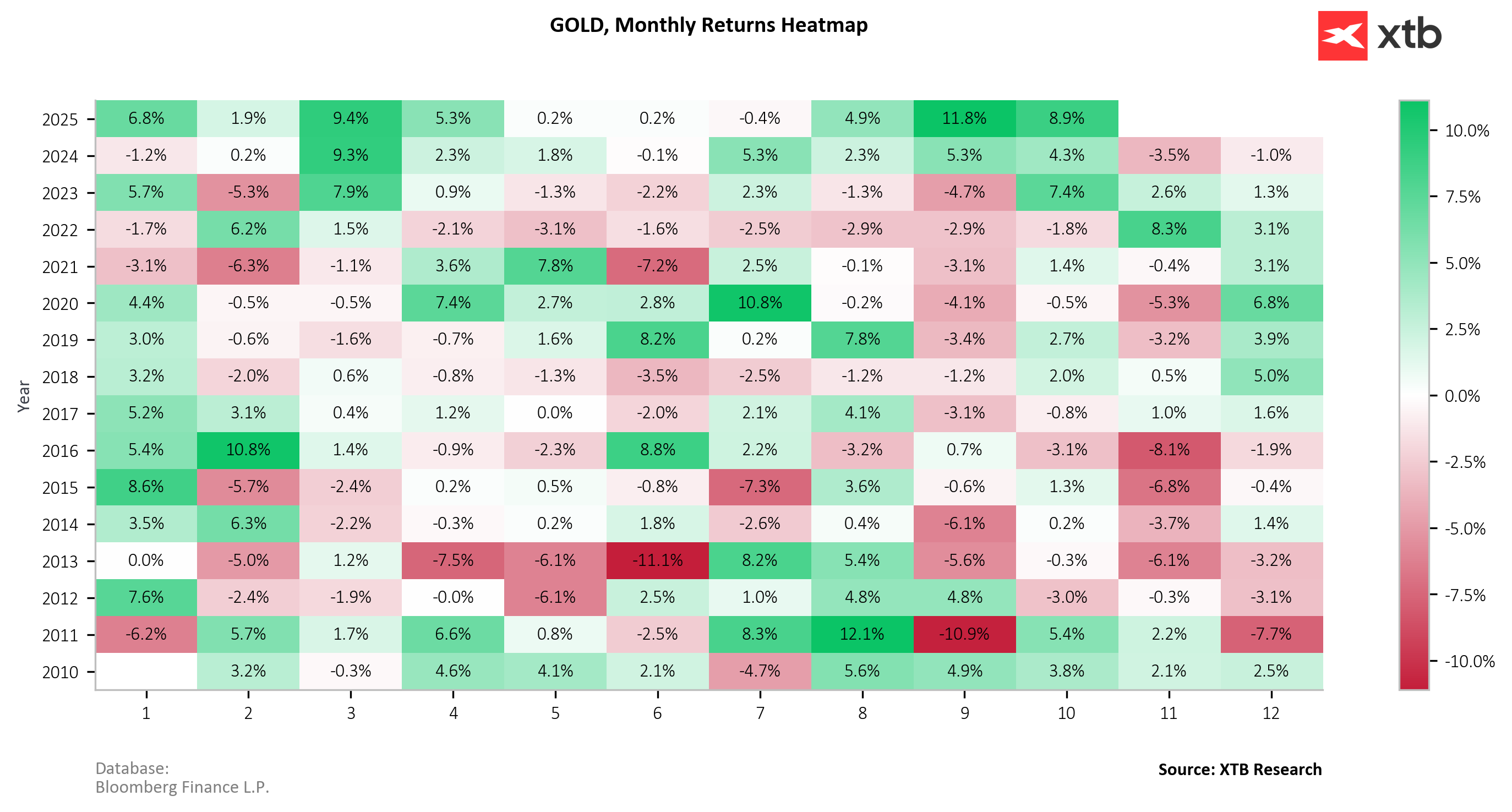

Gold's Performance Over Time

Historically, October hasn’t been particularly favorable for gold prices. However, in 2022, the metal’s price rose by over 8%. So far, since October 1, gold has gained around 9%, climbing from $3,850 to its current level per ounce.

Source: XTB Research, Bloomberg Finance

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.