Gold is performing exceptionally well today, up nearly 3% and continuing its climb toward record levels near $5100 per ounce. Prices recently posted their strongest single-day gain since 2008, rising more than 5.2% in one session, highlighting both the strength of buyers and the scale of inflows into the market. Data from China suggests investors are still accumulating physical bullion ahead of the Chinese New Year holiday, scheduled for February 16.

Interestingly, gold buying has continued despite weak sentiment in U.S. equities and appears to be breaking through many traditional correlations, indicating that the fundamental backdrop for precious metals has not materially changed despite last week’s panic. Global capital continues to flow into bullion, with additional upside support coming from the U.S. dollar index, which is posting a second consecutive day of moderate declines.

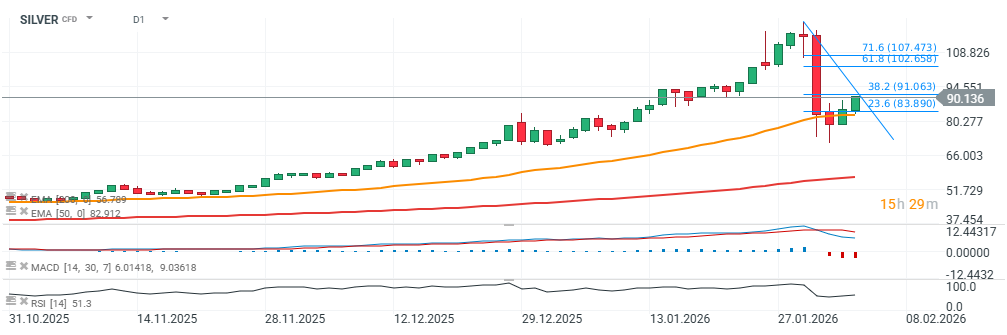

(GOLD, SILVER charts, D1 timeframe)

From a technical perspective, gold has moved above the 38.2% Fibonacci retracement of Friday’s sell-off and is now heading toward the 61.8% level near $5,150 per ounce. Key momentum support has held at the EMA50 (orange moving average). Friday’s bearish candle also left a long lower wick, as price ultimately closed above the moving average, and on Monday it successfully defended the $4,700 area as a key support zone.

Source: xStation5

Silver has joined the rebound as well, recovering toward $90 per ounce. The price held its key momentum support at the EMA50 (orange line) and is now approaching an important resistance level: the 38.2% Fibonacci retracement of Friday’s decline, located near $91 per ounce.

Source: xStation5

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.