- Acceleration in software driven by artificial intelligence and cloud is key for investors, along with hard data on contract value and monetization.

- Investors want improvements in margins and cash flows, as well as clear commentary on the impact of contract schedules.

- Traditional services, such as system maintenance and modernization, remain the foundation of recurring revenues

- The renewal cycle of Z series seventeen mainframe computers is expected to increase orders and drive sales

- Technological partnerships and integration of acquisitions should strengthen the offering and reach

- The tone of management and specific indicators of AI adoption will be crucial for evaluating the report

- Acceleration in software driven by artificial intelligence and cloud is key for investors, along with hard data on contract value and monetization.

- Investors want improvements in margins and cash flows, as well as clear commentary on the impact of contract schedules.

- Traditional services, such as system maintenance and modernization, remain the foundation of recurring revenues

- The renewal cycle of Z series seventeen mainframe computers is expected to increase orders and drive sales

- Technological partnerships and integration of acquisitions should strengthen the offering and reach

- The tone of management and specific indicators of AI adoption will be crucial for evaluating the report

IBM is one of the oldest and most recognizable technology corporations in the world. The company grew on hardware and transactional systems for large organizations, and today it combines software, services, and cloud with a broad ecosystem of partners. Its clients are primarily institutions with very high demands for reliability and security.

Today, the company is publishing its results. The two previous reports disappointed, mostly with earnings per share. Investors will be paying attention primarily to the pace of adoption of AI-based solutions, the credibility of margins and cash after recent setbacks, the condition of so-called traditional services, the significance of the patent portfolio, and the contribution of the new Z series seventeen infrastructure cycle.

- The most important expectation from investors is acceleration in the segment of software driven by artificial intelligence and cloud. The company is entering artificial intelligence cautiously, expanding its portfolio and integrating new features with existing platforms. The market will be listening to hard data on the value of contracts signed, the effects of implementations with large clients, as well as the monetization plan and the role of technological partnerships.

- The second challenge for the company is to meet conservative investor expectations regarding results after two relatively weak quarters. Attention is shifting from revenues to the quality of margins and cash flows. Investors are also looking for signs of greater cost discipline, stabilization of general and sales costs, as well as confirmation of full-year cash targets, with clear commentary on the contract execution schedule.

- The third pillar of expectations is services. Besides, projects related to artificial intelligence, so-called traditional services, such as maintenance, development, and modernization of existing systems, are of key importance. They ensure revenue repeatability but are subject to rate pressure and contract rotation. A strong patent portfolio remains an important asset, helping to defend margins, support licensing, and provide a protective umbrella for new features in software and infrastructure.

- The fourth significant area is infrastructure. It is expected that the renewal cycle of the Z series seventeen mainframe computers will bring an increase in orders and drive demand for software and services around this platform. Important will be information about the length of the cycle, the pace of implementations, and the extent to which the new generation supports applications related to artificial intelligence.

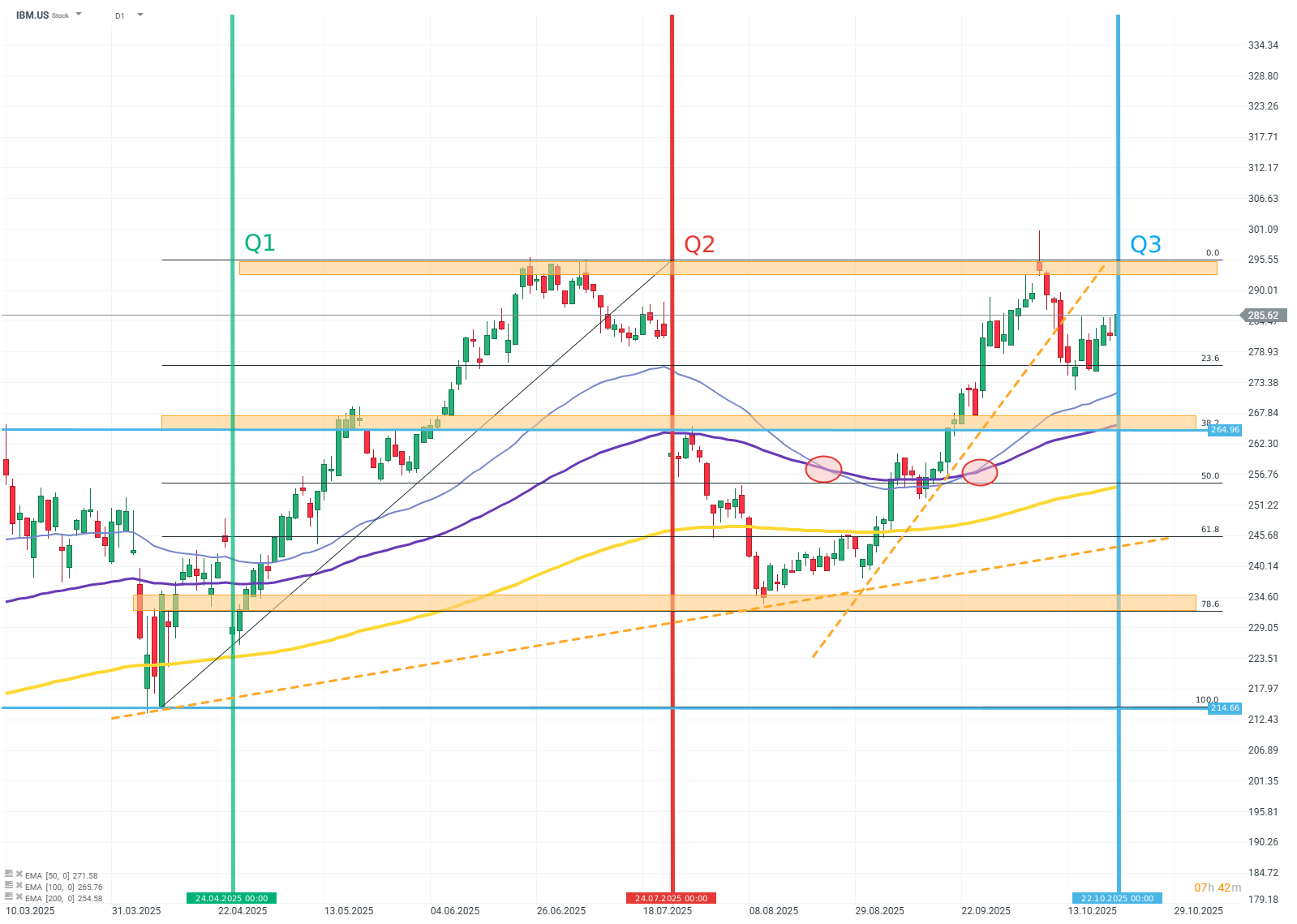

IBM.US (D1)

Source: xStation5

Google Quantum Echoes – A Quantum Computing Breakthrough

US OPEN: Is the 'Meme Stock' Season Kicking Off?

Waymo: Race against the regulators

TSMC Earnings Preview: Will the Key Semiconductor Supplier Surprise the Market?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.