- Gelsinger's - Intel's former CEO delivers harsh criticism of the company's performance

- Criticism of CHIPS Act Implementation

- Gelsinger pointed out long-standing delays by the U.S. Department of Commerce

- Gelsinger admitted Intel's strategic errors

- Market Reaction and Analyst Downgrade

- Gelsinger's - Intel's former CEO delivers harsh criticism of the company's performance

- Criticism of CHIPS Act Implementation

- Gelsinger pointed out long-standing delays by the U.S. Department of Commerce

- Gelsinger admitted Intel's strategic errors

- Market Reaction and Analyst Downgrade

Former Intel CEO, Pat Gelsinger, sharply criticized the implementation of the U.S. "CHIPS Act," emphasizing that despite billions in government investments, the actual impact of the program on the development of semiconductor production in the U.S. is negligible. His remarks during the program sparked a lively discussion in the market and led to a temporary shift in sentiment towards the company's stock.

Gelsinger also criticized the U.S. Department of Commerce for long-standing delays in the program's execution. He noted that for over two and a half years, "nothing happened," despite the CHIPS Act being intended to accelerate the construction of domestic semiconductor factories and make the U.S. industry independent of Asian suppliers.

The former Intel chief stated that the U.S. government's stake in the company, valued at approximately $11.1 billion, only makes sense if it actually translates into the creation and filling of new chip factories.

Although Intel's shares have risen by roughly 58% over the past 12 months, the five-year view still shows the stock price is over 30% lower. Gelsinger admitted that the company made a series of strategic mistakes over the past 15 years, losing technological advantage and being late to the AI revolution. Meanwhile, Nvidia has dominated the data center market, and AMD has taken a significant portion of the processor market from Intel. Gelsinger did, however, carefully avoided acknowledging his direct input into those "strategic mistakes".

Simultaneously, Bank of America analysts downgraded Intel's recommendation to "Underperform" and lowered its target price. They pointed out that the company still lacks a competitive AI product portfolio and has limited restructuring capabilities, despite a solid balance sheet.

In response to Gelsinger's comments, investors reacted nervously. The company depreciated by about 4% in the current session with high transaction volume. Negative comments reminded investors of Intel's structural problems, which remain unaddressed by the current management.

The former CEO's words served as a reminder to the market that without real reforms in the company, short-term stock price increases may quickly give way to further declines.

Source: xstation5

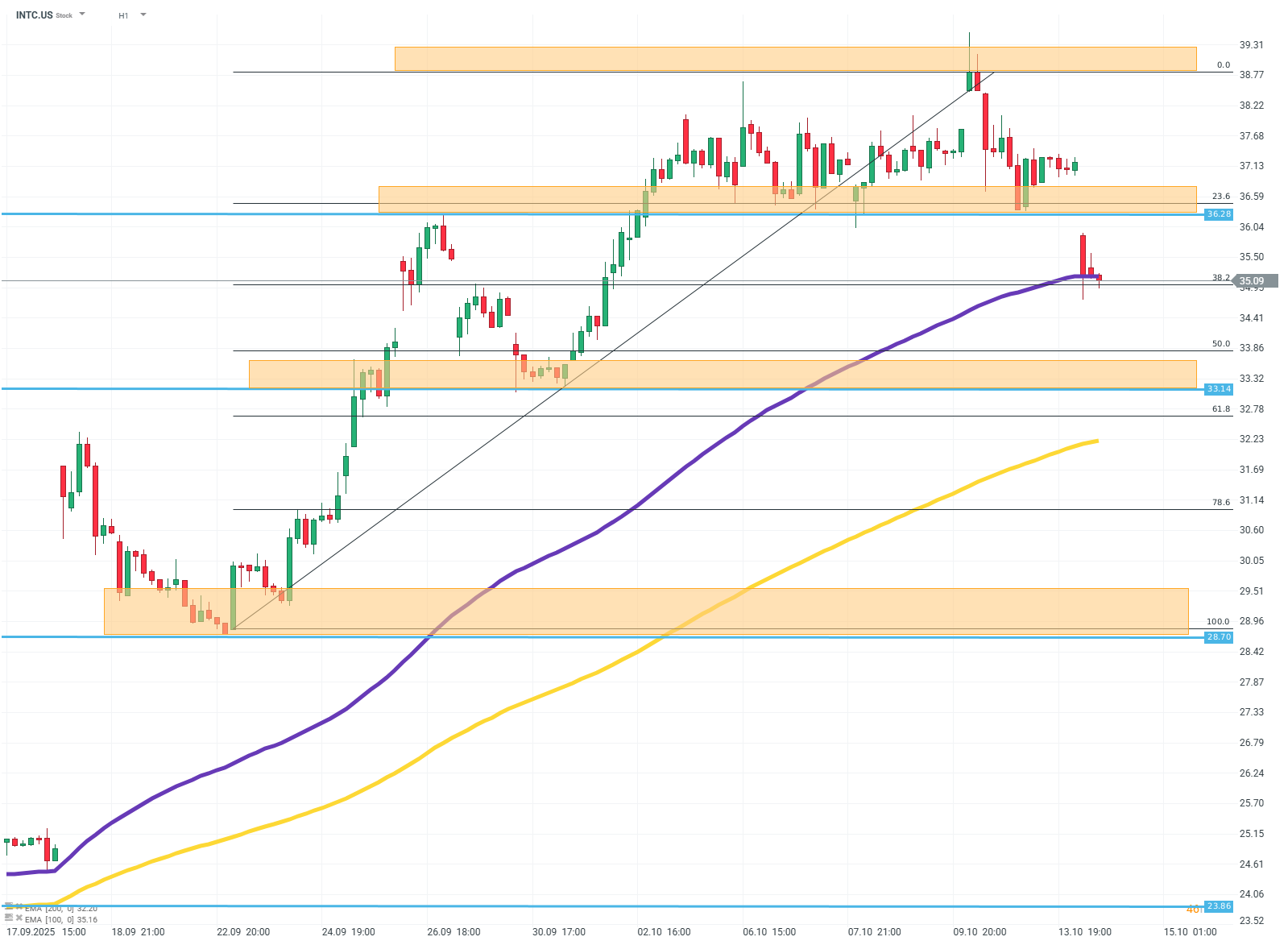

The price halted after recent declines at the EMA100 average and the FIBO 38.2 level. If buyers want to prevent further declines, defending this support will be necessary. If unsuccessful, the price is likely to depreciate to around $33 and another broad resistance zone between FIBO levels 50 and 61.8, below which lies the EMA200 average.

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.