Despite decades of stagnation, the Japanese economy remains one of the largest in the world, and the Japanese yen remains one of the most important currencies. An indispensable element of this financial landscape is the so-called "Carry Trade." What is it, why is it so important, and why is it threatened?

"Carry Trade" is a method used by institutional investors to profit from interest rate differentials. In this case — between the USA and Japan. By taking advantage of ultra-low interest rates in Japan, investors borrow yen, buy dollars with them, and then purchase U.S. bonds, whose interest rates are higher than the cost of borrowing in Japan. This strategy is burdened with significant interest rate and currency risk.

"Carry trade" works as long as there is a significant difference in interest rates and bond yields — this difference between the USA and Japan is systematically decreasing. Mounting negative phenomena and pressure on the Bank of Japan (BoJ) have forced the end of the yield control program and the start of unprecedented interest rate hikes.

The yen is trapped in the structural problems of the Japanese economy. The yen cannot weaken too much, as the country will no longer be able to afford imports, on which it is critically dependent — however, even a small interest rate hike by developed country standards could lead to the collapse of the Japanese financial system due to Japan's gigantic debt — which is mostly held by Japanese banks.

What does this mean for the currency market, and what is the most likely scenario? The interest rate difference between the USA and Japan is still as much as 3.5%, which makes profits from "carry trade" easier, but exerts continuous pressure on the yen, which has already lost half of its value since 2020.

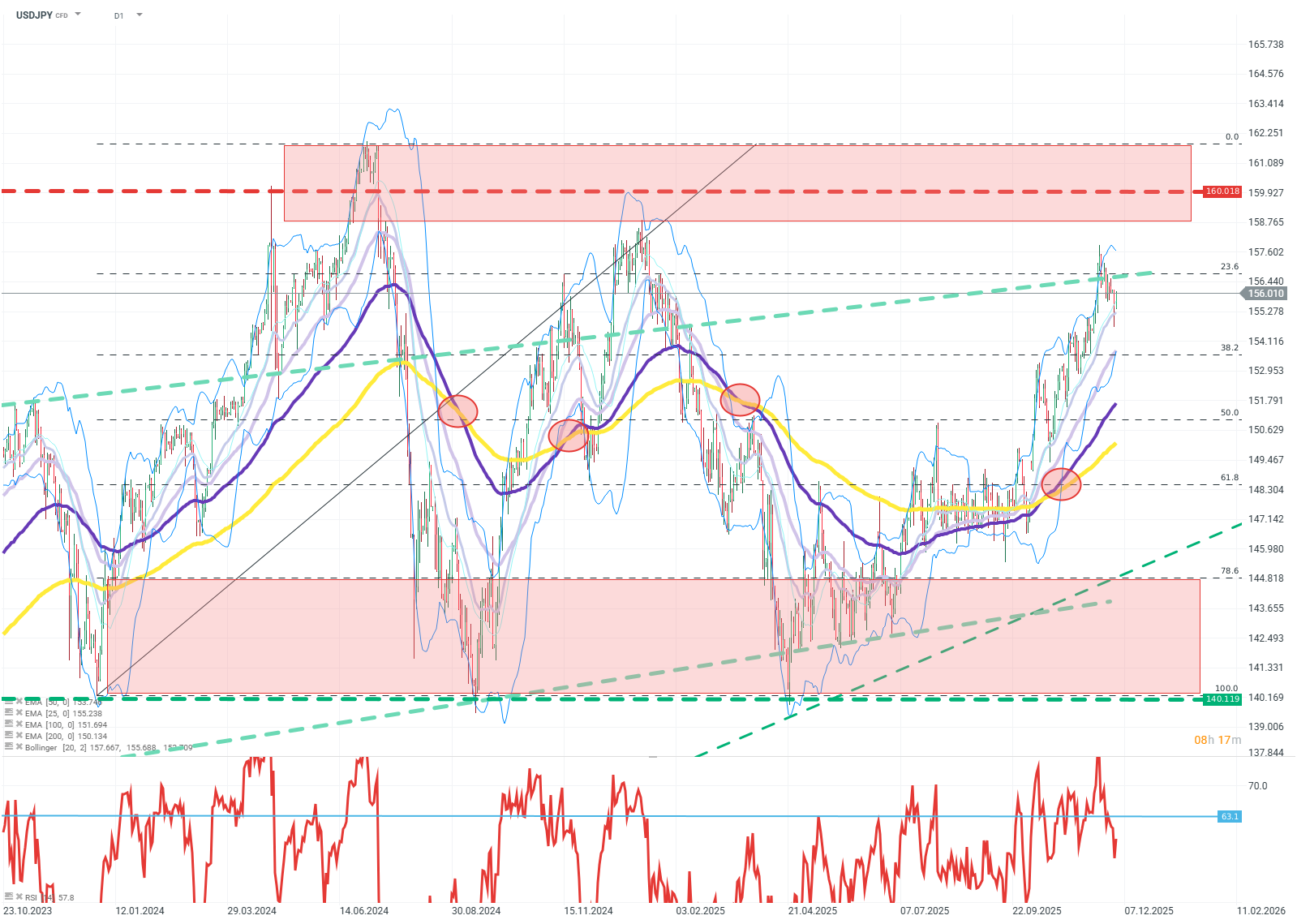

An unacceptable level for Japan is above 160 yen per dollar, due to unacceptable increases in fuel and food prices.

Why did the yen break the upward trend at 160 and has been consolidating for a year? The Bank of Japan is a heavyweight champion in the field of currency interventions, even verbal intervention by the bank can bring the rate down by several yen within minutes. The Bank of Japan has the largest foreign exchange reserves in the world and will not hesitate to use them; any speculative attack on the yen is doomed to failure. However, the BoJ cannot maintain the yen's rate so high with such low interest rates; sooner or later, the bank will be forced to raise them.

The market currently prices a 0.75-1% interest rate hike by the BoJ by March next year, while at the same time, the market expects the FED to cut rates by over 1.5%. This means a reduction in the interest rate differential from 3.5% to even 1%. This is too little to compensate investors for transaction costs and risk, and this scenario will lead to massive position closures and significant yen appreciation.

USDJPY (D1)

Source: xStation5

Daily Summary: Tech sector fears send markets lower

End of Zillow? Google enters another market.

US OPEN: Mild optimism at the start of the week

🍫Cocoa Retreats from Monthly High

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.