‘Meme stocks’ have once again taken over Wall Street, as can be seen from the strong gains of companies such as AMC, GameStop and AMC. For companies related to photovoltaics and renewable energy in the broader sense, we also have news of new tariffs on Chinese photovoltaic manufacturers announced by the US President Joe Biden. This is why a large proportion of the growth leaders in the Russell 3000 index, which brings together 95% of US companies by capitalisation, are PV-related companies.

Companies considered to be meme companies are growth leaders in the broad Russell 3000 index. These companies are mostly characterised by very high short-interest, which is the proportion of stocks that are used for short selling. Source: Bloomberg

Of particular note is SunPower, where short-interest is over 95% and the number of days needed for funds to cover short positions is about 8 according to Bloomberg estimates! It is the short-interest that is the key factor in the strong growth of the meme companies. In 2021, individual investors targeted heavily sold companies by funds, leading to multi-billion dollar losses. GameStop, which started the whole meme company movement, has a lower short-interest of 24%. However, this company has a significantly larger capitalisation and the number of days needed to cover short positions is as high as 17. Among the growth leaders we also have AMC, with a short-interest of 18%, PlugPower 26%, Maxeon 43%, or BigLots 30%. Riding the wave of growth in smaller companies, the Russell 2000 index is gaining quite strongly.

GME shares have been at the forefront of increases over the past few sessions. It can be seen that AMC and SunPower shares have lost more heavily since the holiday period last year. Source: xStation5

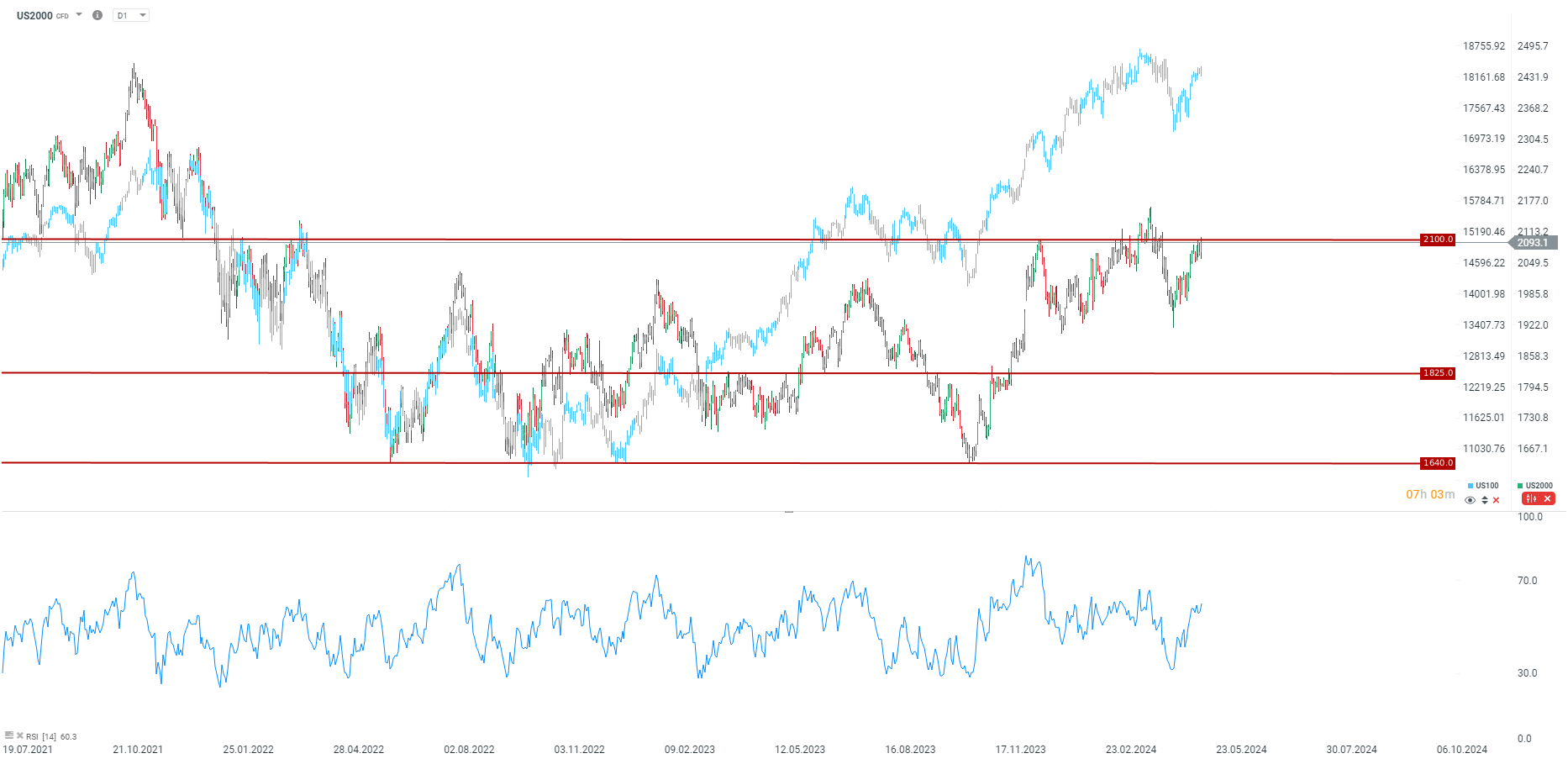

US2000 is trying to knock out recent local peaks, while it is more than 15% short of its historic highs. The situation on the US100 is completely different. The big difference in the indices is precisely the result of the over-selling of smaller companies from the holiday season last year. Seasonality suggests that we may be behind a local low, with seasonal peaks likely in late May and then late July. Of course, further movements will depend largely on the health of companies and the outlook for monetary policy in the US, although of course the frenzied demand for meme stocks could lead to increased interest in smaller companies. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.