Shares of rare earth miner and processor MP Materials (MP.US) have rebounded by nearly 40% from a local low and started 2026 with gains. The move appears driven by several factors, largely geopolitical in nature.

- Donald Trump warned that tariffs could rise to 25% for any country conducting trade with Iran, implying that China could come under pressure if it continues importing Iranian oil on a large scale. This, in turn, could trigger retaliation and further restrictions in the rare earth processing ecosystem, where China remains the dominant player.

- Expanding processing capacity at Mountain Pass is therefore in the strategic interest of the United States even under mild tensions, and today that objective increasingly looks like a national priority. For MP Materials, this could translate into a step-change in orders and business scale.

- MP Materials owns the largest rare earth mine in the U.S. and operates the only large-scale U.S. facility for rare earth production and processing (Mountain Pass), giving it a near-monopoly position in a strategically important market.

- In 2025, the company benefited from contracts with Apple and the U.S. Department of Defense worth a combined over $900 million. MP Materials supplies materials central to the energy transition, including neodymium-praseodymium (NdPr) magnets. By 2033, NdPr demand could increase by as much as fivefold. Between 2020 and 2024, Mountain Pass rare earth output (around 40,000 to 45,000 tons) was sufficient to cover total U.S. rare earth requirements. The key bottleneck, however, remains early-stage domestic processing infrastructure, which still forces the U.S. to export mined material to China for downstream processing.

- MP Materials has been building out that missing link. It launched the first U.S. separation and refining line for NdPr oxide and produced 1,294 tons in 2024, while also starting construction of a permanent magnet factory in Texas (expected to supply, among others, General Motors). The company plans that by 2026, the full value chain, from mining to finished products, will operate within the United States.

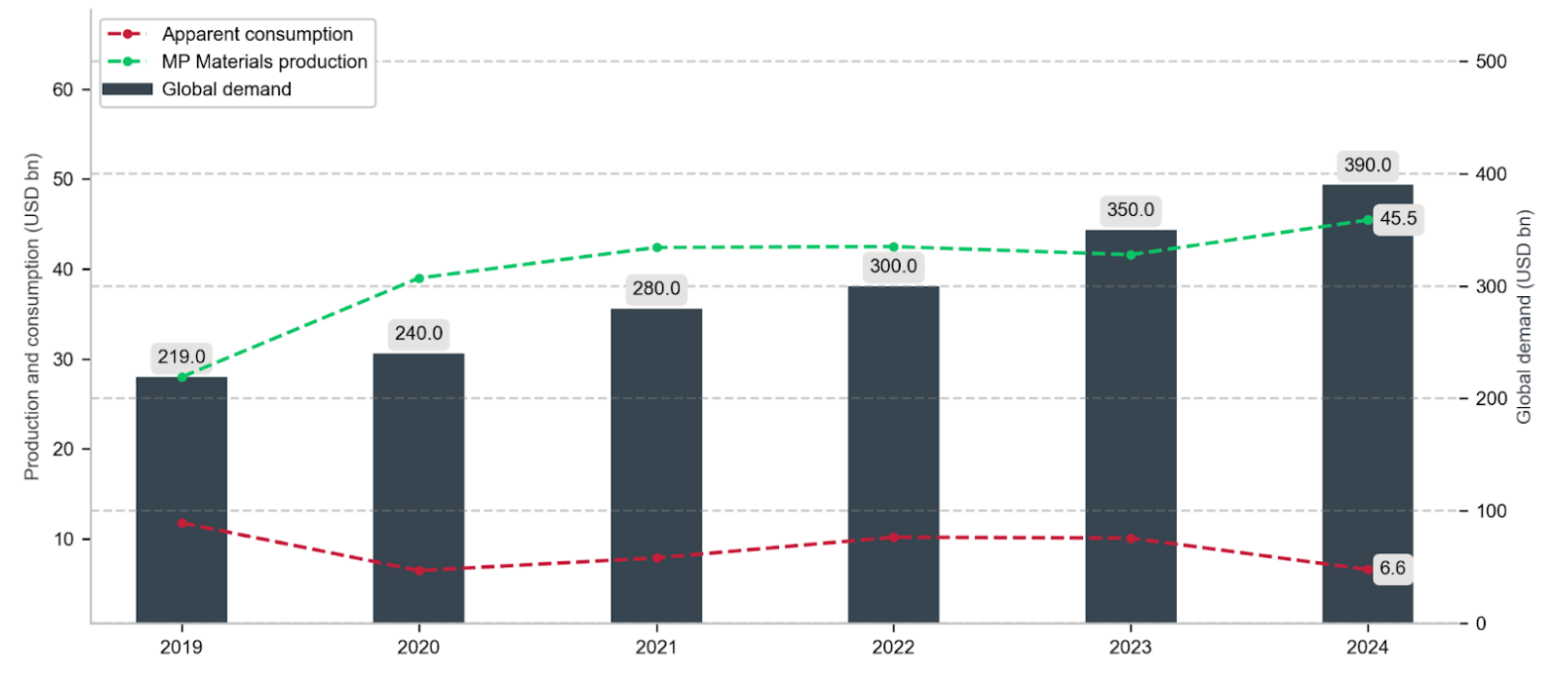

A referenced chart illustrates global rare earth demand (yellow line), MP Materials production (green), and so-called “apparent consumption” in the U.S. (blue) for 2019–2020. The decline in apparent consumption does not reflect weaker real demand, but rather the export of concentrate to China for processing and the accounting methodology used by the United States Geological Survey (USGS). In practice, U.S. demand is rising, and the gap between domestic production and real demand should narrow as domestic processing capacity expands. Global demand continues to trend higher.

Source: USGS, MP Materials

Source: USGS, MP Materials

MP Materials shares (D1 timeframe)

The stock resumed its uptrend after a difficult end to 2025, when hopes of peace in Ukraine rose and headlines turned more optimistic about future U.S.–China economic cooperation despite strategic disagreements and a broader division of influence. MP Materials rallied from just under $48 per share to around $65 and now trades above two key long-term moving averages (EMA50 and EMA200). The decline was halted near the 200-day exponential moving average (EMA200), while price action also formed a potential double-bottom around $50. The current impulse could push the stock toward prior highs. On the other hand, a corrective move could pull the price back toward the $50 area and potentially close the upside gap created during the summer rally.

Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.